(Bloomberg) — The stock market is on a heater. After rising for nine straight sessions and gaining 10% in that time, the S&P 500 Index closed out the week on its longest winning streak in more than 20 years, recouping all of its losses since April 2, when President Donald Trump launched his global trade war.

Most Read from Bloomberg

The question is why. And the answer appears to be, with so much of Wall Street’s institutional money staying on the sidelines, bullish individual investors are driving the gains. History says there’s little sense in fighting this enthusiasm. To paraphrase the famous statement from former Citigroup CEO Chuck Prince in 2007 right before the global financial crisis hit, for now the music is still playing, so you have to dance.

“There are so many smart people in our industry that just don’t get the simplicity of how this market works over longer periods of time, and I think it actually creates an opportunity,” said David Wagner, portfolio manager at Aptus Capital Advisors LLC. “Am I siding with the retail investors here right now? I might be.”

The fundamentals behind the enthusiasm, however, are less than promising.

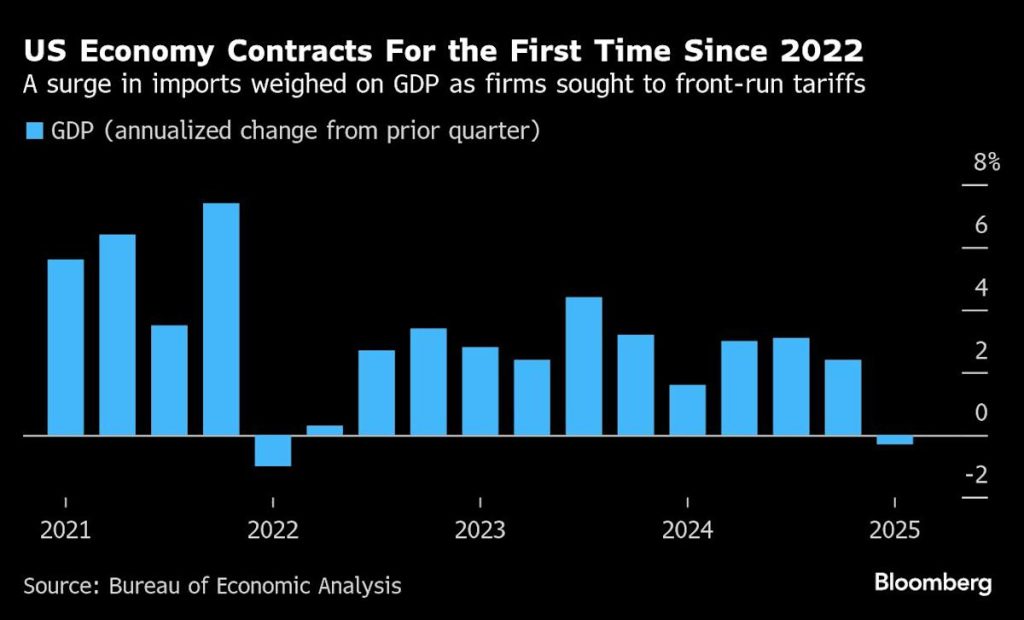

Economic data has been uneven, as the impact of Trump’s sweeping tariffs is only starting to hit. This week, the US Bureau of Economic Analysis reported that inflation-adjusted gross domestic product contracted in the first quarter for the first time since 2022, while figures from the Bureau of Labor Statistics indicated that jobs growth was robust in April, although the labor market is showing signs of cooling. And the so-called soft data, which measures how consumers and households are feeling, also has been concerning.

Earnings have been solid, but far from great. For the most part, companies are reluctant to give hard outlooks for the rest of the year with so much uncertainty in the global economy. Big tech stalwarts Microsoft Corp. and Meta Platforms Inc. put up strong numbers this week, but Amazon.com Inc. and Apple Inc. indicated that trade pressures are starting to hit. And although the Trump administration has talked about upcoming tariff agreements with some trade partners, the reality is nothing has happened and any concrete deals with terms nailed down are a ways off.