High-rolling investors have positioned themselves bullish on Snap SNAP, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in SNAP often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 9 options trades for Snap. This is not a typical pattern.

The sentiment among these major traders is split, with 66% bullish and 33% bearish. Among all the options we identified, there was one put, amounting to $29,160, and 8 calls, totaling $469,700.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $11.0 for Snap during the past quarter.

Insights into Volume & Open Interest

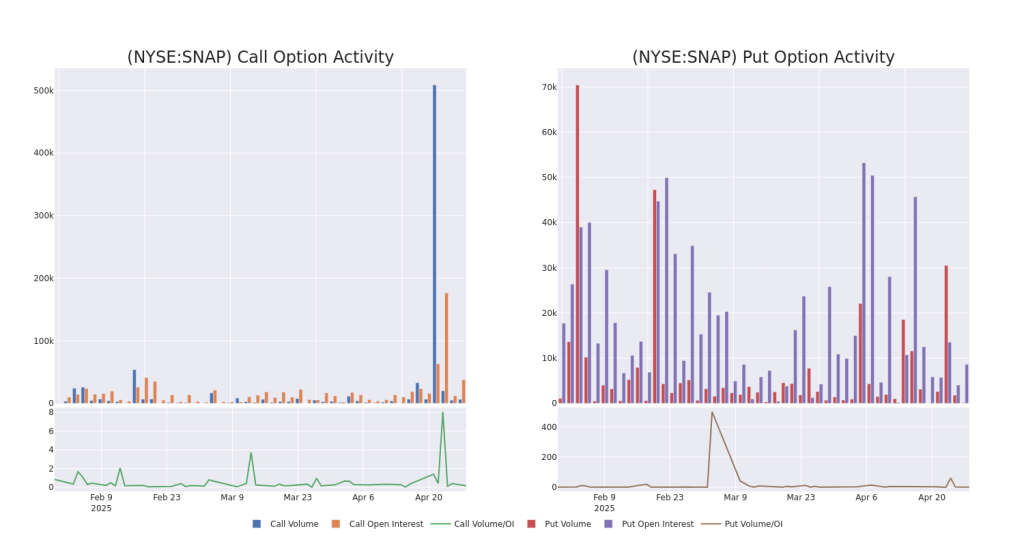

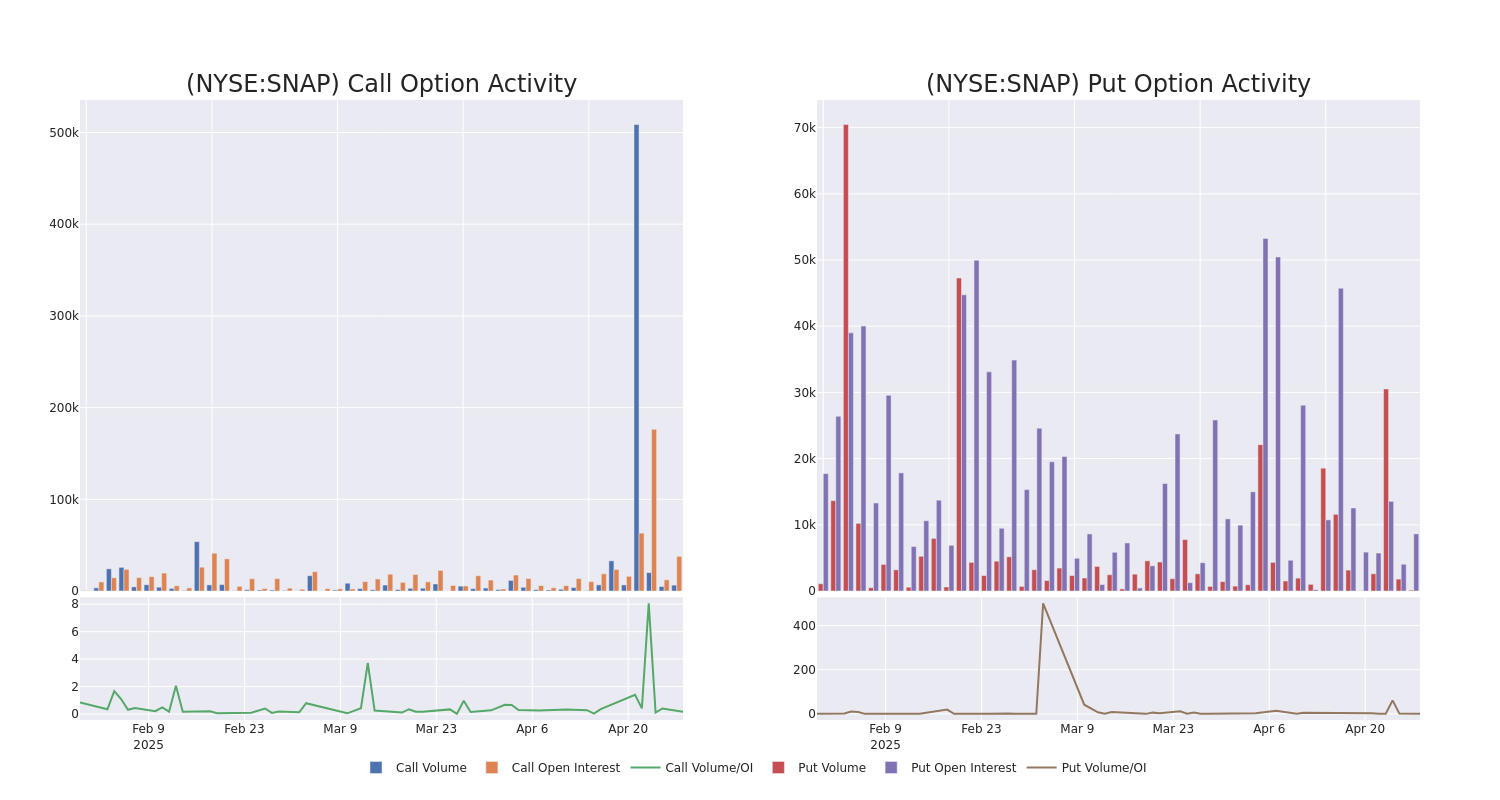

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Snap’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Snap’s substantial trades, within a strike price spectrum from $5.0 to $11.0 over the preceding 30 days.

Snap 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | CALL | SWEEP | BULLISH | 01/15/27 | $4.9 | $4.8 | $4.9 | $5.00 | $98.0K | 1.6K | 0 |

| SNAP | CALL | TRADE | BEARISH | 05/02/25 | $1.69 | $1.65 | $1.65 | $7.50 | $82.5K | 1.5K | 620 |

| SNAP | CALL | SWEEP | BULLISH | 01/15/27 | $4.95 | $4.7 | $4.95 | $5.00 | $74.2K | 1.6K | 351 |

| SNAP | CALL | SWEEP | BULLISH | 01/16/26 | $1.66 | $1.61 | $1.66 | $10.00 | $66.4K | 10.0K | 422 |

| SNAP | CALL | SWEEP | BEARISH | 05/02/25 | $0.74 | $0.73 | $0.73 | $9.00 | $54.7K | 9.3K | 3.6K |

About Snap

Snap is a technology company best known for its marquis social media application Snapchat, a visual messaging application that has amassed hundreds of millions of users. The app was initially only used to communicate with family and friends through photographs and short videos (known as “Snaps”). Users can now enjoy augmented reality, or AR, lenses, content from famous creators and celebrities, updates about local events, and more. Although the app offers a paid subscription option with premium features, advertising sales produce most of the app’s revenue. The firm also sells wearable devices called AR Spectacles, which can capture photos and videos overlayed with AR lenses, but these make up a small portion of Snap’s overall sales.

Present Market Standing of Snap

- With a volume of 27,791,618, the price of SNAP is up 3.34% at $8.82.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 1 days.

Professional Analyst Ratings for Snap

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $9.3.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on Snap, which currently sits at a price target of $9.

* An analyst from Goldman Sachs has decided to maintain their Neutral rating on Snap, which currently sits at a price target of $9.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Snap, maintaining a target price of $8.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Neutral rating for Snap, targeting a price of $10.

* An analyst from Canaccord Genuity has decided to maintain their Hold rating on Snap, which currently sits at a price target of $10.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Snap options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.