The International Monetary Fund has sharply downgraded its 2025 growth forecast for the United States, citing President Donald Trump‘s sweeping tariffs and a surge in economic uncertainty as major headwinds.

In its April 2025 World Economic Outlook, the IMF now projects U.S. GDP growth at just 1.8% for the year, marking a 0.9 percentage point cut from its January forecast.

Roughly 0.4 percentage points of the downgrade is directly linked to Trump’s trade actions, while the rest reflects weakening domestic momentum that began even before the tariff shock.

“The tariffs represent a supply shock for the United States,” said Pierre-Olivier Gourinchas, IMF chief economist. “They reduce productivity and output permanently, and raise price pressures temporarily.”

While the IMF still expects positive growth this year, it acknowledges that the risk of recession has risen substantially. Gourinchas said the IMF’s recession probability for the U.S. in 2025 has climbed to 40%, up from 25% in October.

A Trade Shock With Long-Term Consequences

The growth hit comes as the U.S. effective tariff rate has surged past levels last seen over a century ago.

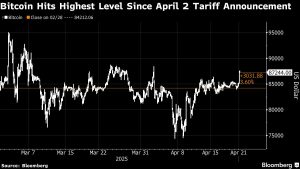

On April 2, Trump announced sweeping “reciprocal” tariffs on nearly all U.S. trading partners, triggering retaliatory measures from several countries. The IMF warns that these trade disruptions are not only curbing growth in the short term but also lowering the long-run potential of the U.S. economy.

“For trading partners tariffs act mostly as a negative external demand shock weakening activity and prices” the IMF noted.

“All countries are negatively affected by the surge in trade policy uncertainty as businesses, cut purchases and investment, while financial institutions reassess their borrowers exposure,” Gourinchas said.

Growth Slows, Inflation Pressures Mount

While growth slows, inflation is expected to remain sticky. The tariffs are seen increasing import costs, adding short-term upward pressure on prices even as consumer demand cools. The IMF raised its U.S. inflation forecast modestly, reflecting these dynamics.

The report warns that this combination of slower growth and persistent inflation puts the Federal Reserve in a difficult position, especially as it faces political pressure from the Trump administration to slash interest rates.

“Monetary policy will need to remain agile,” the IMF chief said. “But central bank independence remains a cornerstone of long-term credibility.”

Dollar Disconnect

The IMF also flagged a notable divergence from historical norms: instead of strengthening amid tariffs, the U.S. dollar has weakened. That reflects, in their view, a diminished global demand for dollar-denominated assets as policy credibility erodes.

“The tariffs could have appreciated the dollar,” Gourinchas said. “Yet, greater policy uncertainty lower U.S. growth prospects and an adjustment in the global demand for dollar assets are weighing down on the dollar.”

The U.S. dollar index – as tracked by the Invesco DB USD Index Bullish Fund ETF UUP – has weakened by about 10% since Trump’s inauguration in January.

Read now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.