Lovesac LOVE is gearing up to announce its quarterly earnings on Thursday, 2025-04-10. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Lovesac will report an earnings per share (EPS) of $1.85.

The market awaits Lovesac’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

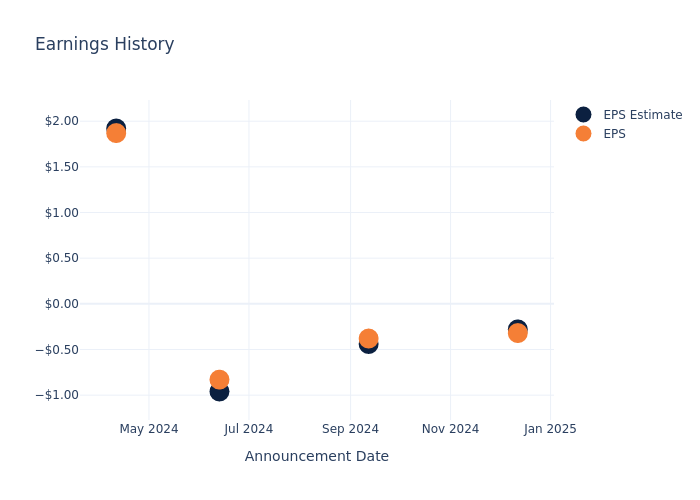

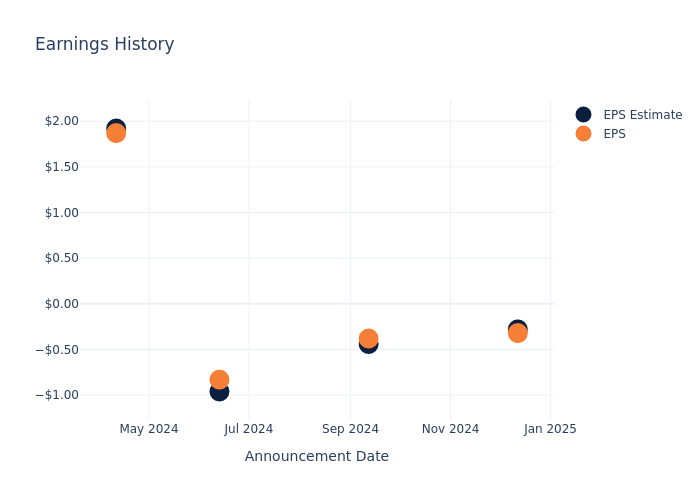

Historical Earnings Performance

Last quarter the company missed EPS by $0.04, which was followed by a 2.33% increase in the share price the next day.

Here’s a look at Lovesac’s past performance and the resulting price change:

| Quarter | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.28 | -0.44 | -0.96 | 1.92 |

| EPS Actual | -0.32 | -0.38 | -0.83 | 1.87 |

| Price Change % | 2.0% | 3.0% | -8.0% | -6.0% |

Market Performance of Lovesac’s Stock

Shares of Lovesac were trading at $12.47 as of April 08. Over the last 52-week period, shares are down 40.76%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts’ Perspectives on Lovesac

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Lovesac.

With 1 analyst ratings, Lovesac has a consensus rating of Buy. The average one-year price target is $35.0, indicating a potential 180.67% upside.

Peer Ratings Overview

This comparison focuses on the analyst ratings and average 1-year price targets of and Purple Innovation, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Purple Innovation, with an average 1-year price target of $1.0, suggesting a potential 91.98% downside.

Peer Metrics Summary

The peer analysis summary provides a snapshot of key metrics for and Purple Innovation, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Lovesac | Buy | -2.68% | $87.64M | -2.47% |

| Purple Innovation | Neutral | -11.62% | $55.28M | -35.21% |

Key Takeaway:

Lovesac is positioned better than its peer in terms of Revenue Growth and Gross Profit. However, its Return on Equity is lower compared to the peer. Overall, Lovesac is performing relatively well compared to its peer in the analysis.

Discovering Lovesac: A Closer Look

The Lovesac Co designs, manufactures and sells alternative furniture which is comprised of modular couches called sactionals and premium foam beanbag chairs called sacs. It also offers other accessories such as sactional-specific drink holders, Footsac blankets, decorative pillows, fitted seat tables, and ottomans. Its products are sold across the United States through its website or company-owned retail stores which are used in homes and offices. The majority of the firm’s revenue is derived from the sale of Sactionals.

Breaking Down Lovesac’s Financial Performance

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Challenges: Lovesac’s revenue growth over 3 months faced difficulties. As of 31 October, 2024, the company experienced a decline of approximately -2.68%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Lovesac’s net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -3.29%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Lovesac’s ROE stands out, surpassing industry averages. With an impressive ROE of -2.47%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Lovesac’s ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -1.01%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 0.93, Lovesac adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Lovesac visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.