• Inflation data, Fed FOMC minutes, Trump tariff news and the start of Q1 earnings season will be in focus this week.

• Cal-Maine Foods’ strong growth trajectory makes it a promising buy ahead of its earnings report.

• Delta Air Lines faces industry-wide challenges and economic uncertainties, potentially making it a stock to sell.

• Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The stock market sold off sharply for a second day on Friday, with the major indexes suffering their worst week since the breakout of Covid in early 2020, as investors fled riskier assets on fears that tariffs imposed by President Donald Trump could spark a trade war and tip the global economy into recession.

Source: Investing.com

For the week, the Dow Jones Industrial Average declined 7.9%, the S&P 500 tumbled 9.1%, while the tech-heavy Nasdaq Composite slumped 10% to enter a bear market.

Highlighting growing panic among investors, the CBOE Volatility Index, or Wall Street’s fear gauge, closed at its highest level since April 2020.

More volatility could be in store in the week ahead as investors continue to assess the outlook for the economy, inflation, interest rates and corporate earnings amid President Trump’s trade war.

On the economic calendar, most important will be Thursday’s U.S. consumer price inflation report for March, which could spark further turmoil if it comes in higher than expectations.

The CPI data will be accompanied by the release of the latest figures on producer prices. The University of Michigan consumer sentiment index is also important, especially the report’s readings on inflation expectations.

Source: Investing.com

Investors will also focus on the minutes of the Federal Reserve’s March FOMC meeting. This could give some insight into the future path of interest rates.

Elsewhere, a new earnings season is set to get underway, with JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), Morgan Stanley (NYSE:MS), BlackRock (NYSE:BLK), and Delta Air Lines (NYSE:DAL), some of the big names due to report. Commentary about consumer and business demand will be key.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, April 7 – Friday, April 11.

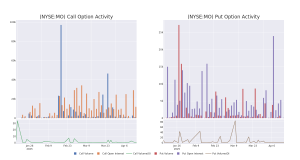

Cal-Maine Foods (NASDAQ:CALM), the nation’s largest egg producer, is gearing up to report its fiscal third-quarter earnings on Tuesday after the market closes at 4:05PM ET. According to the options market, traders are pricing in a swing of about 9% in either direction for CALM stock following the print.