Financial giants have made a conspicuous bearish move on Uber Technologies. Our analysis of options history for Uber Technologies UBER revealed 59 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 57% showed bearish tendencies. Out of all the trades we spotted, 36 were puts, with a value of $3,741,779, and 23 were calls, valued at $2,518,713.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $35.0 to $100.0 for Uber Technologies during the past quarter.

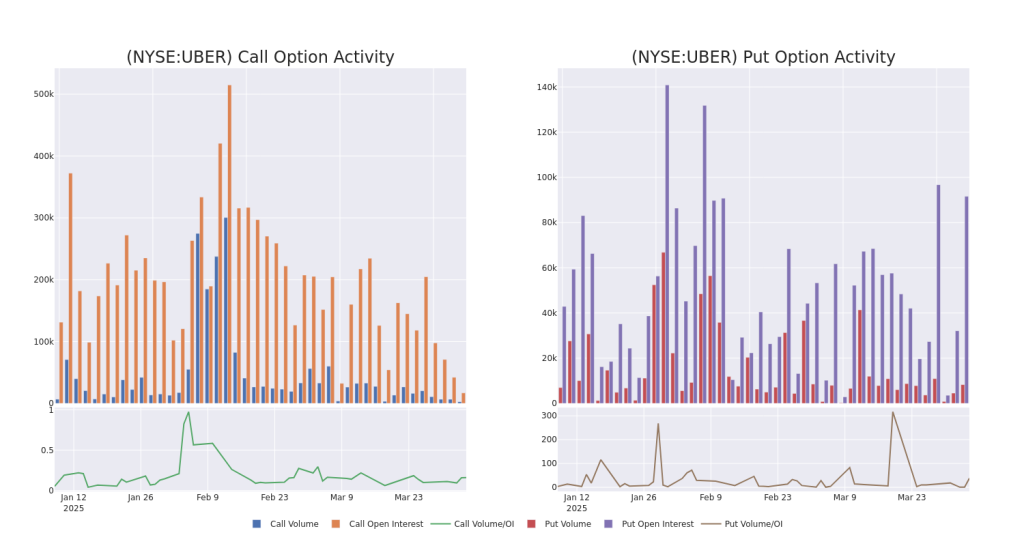

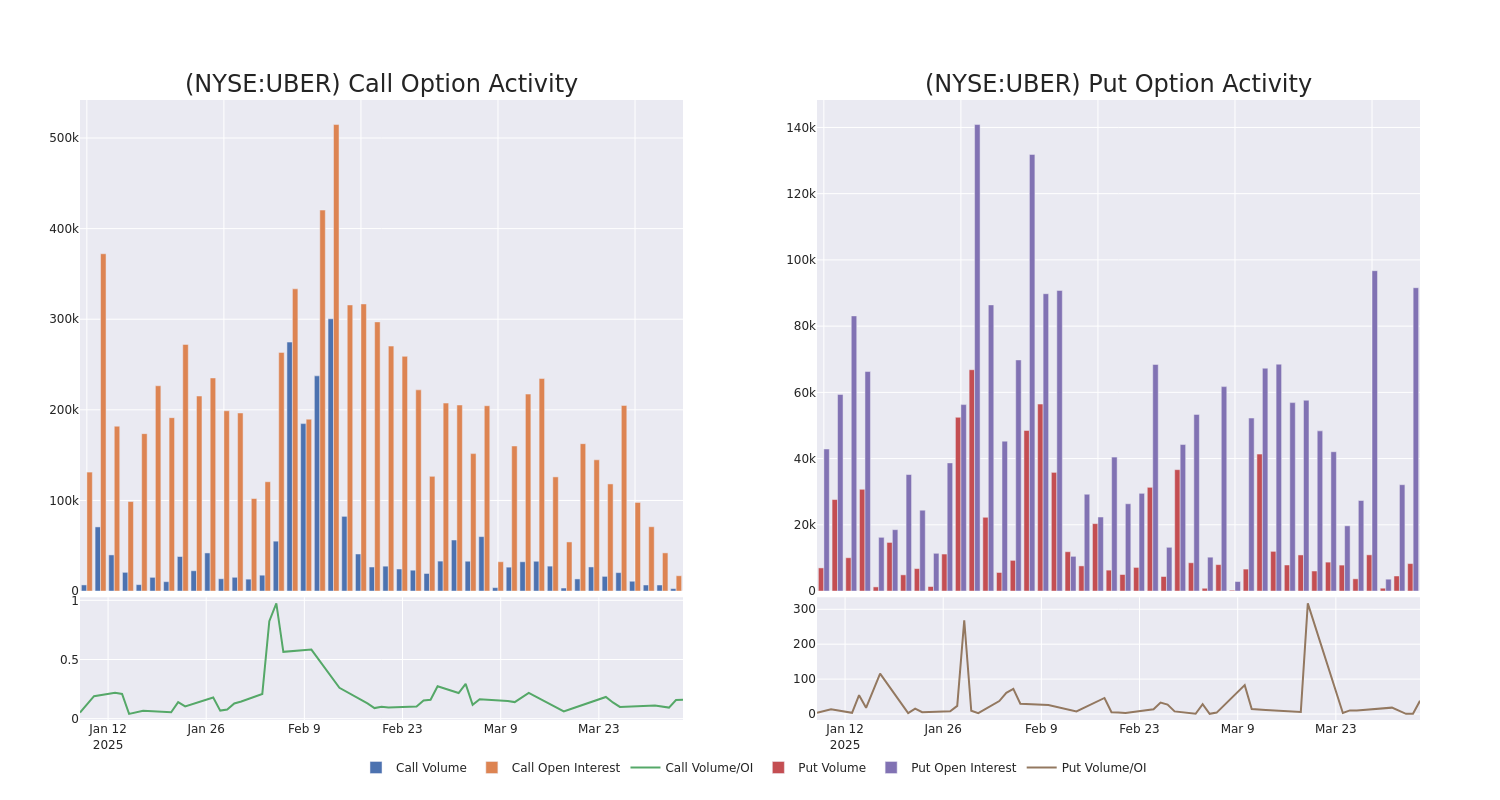

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Uber Technologies’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Uber Technologies’s whale trades within a strike price range from $35.0 to $100.0 in the last 30 days.

Uber Technologies Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UBER | PUT | SWEEP | BEARISH | 12/19/25 | $27.1 | $26.6 | $27.04 | $90.00 | $676.2K | 1.1K | 250 |

| UBER | CALL | TRADE | BEARISH | 09/19/25 | $4.75 | $4.65 | $4.65 | $75.00 | $559.3K | 3.8K | 2.2K |

| UBER | PUT | TRADE | BULLISH | 09/19/25 | $9.15 | $8.75 | $8.8 | $65.00 | $484.0K | 3.9K | 592 |

| UBER | CALL | TRADE | BEARISH | 09/19/25 | $4.75 | $4.65 | $4.65 | $75.00 | $370.6K | 3.8K | 3.0K |

| UBER | PUT | TRADE | BEARISH | 01/16/26 | $7.9 | $7.85 | $7.9 | $60.00 | $296.2K | 8.7K | 443 |

About Uber Technologies

Uber Technologies is a technology provider that matches riders with drivers, hungry people with restaurants and food couriers, and shippers with carriers. The firm’s on-demand technology platform is currently utilized by traditional cars as well as autonomous vehicles, but could eventually be used for additional products and services, such as delivery via drones or electronic vehicle take-off and landing (eVTOL) technology. Uber operates in over 70 countries, with over 171 million users who order rides or food at least once a month.

Following our analysis of the options activities associated with Uber Technologies, we pivot to a closer look at the company’s own performance.

Uber Technologies’s Current Market Status

- Trading volume stands at 16,881,109, with UBER’s price down by -0.6%, positioned at $64.23.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 30 days.

What Analysts Are Saying About Uber Technologies

2 market experts have recently issued ratings for this stock, with a consensus target price of $84.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Uber Technologies with a target price of $90.

* Reflecting concerns, an analyst from KGI Securities lowers its rating to Neutral with a new price target of $78.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Uber Technologies with Benzinga Pro for real-time alerts.

Momentum37.75

Growth6.78

Quality–

Value45.32

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.