(Bloomberg) — Risks to euro-zone economic forecasts are more to the downside than the upside, according to European Central Bank Governing Council member Jose Luis Escriva.

Most Read from Bloomberg

“The more disruptive scenarios aren’t materializing,” the Spanish central bank chief said. “That doesn’t mean they couldn’t take us by surprise. We need to be readier than ever to revise our forecasts, therefore the relevant caution.”

Speaking Monday evening in Madrid, Escriva said that “growth risks are more downside than upside.”

“There are some upside risks, like fiscal policy, as long as it might last, and others,” he said. “But downside risks are more obvious than the upside risks.”

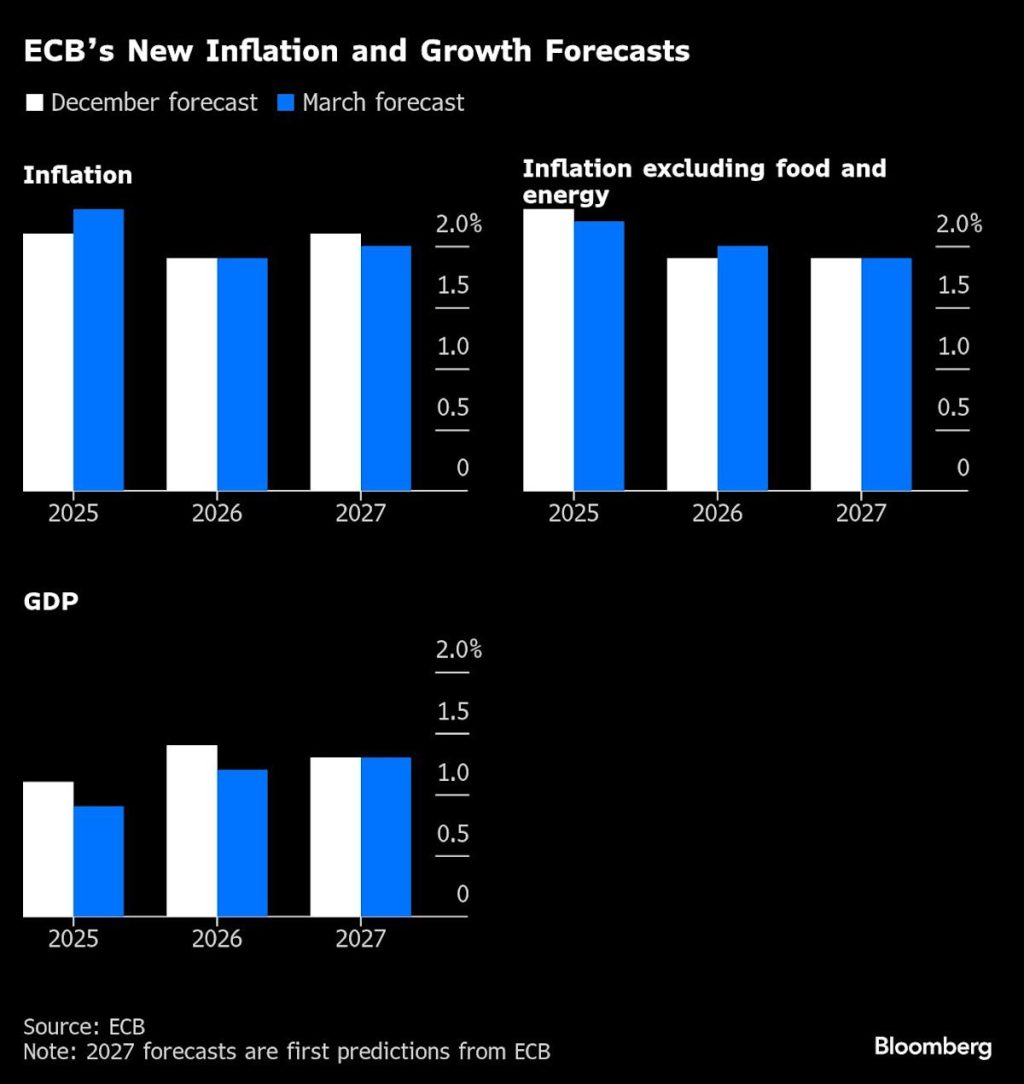

The ECB earlier this month cut its growth forecasts for this year and next, predicting that the economy will expand just 0.9% in 2024 and 1.2% in 2025.

Escriva, who has led the Bank of Spain for half a year and headed the ECB’s monetary-policy division in the early 2000s, seared clear of the topic of interest rates, which the ECB has cut six times since June.

While some policymakers have pushed for another quarter-point move at the next meeting in April, markets consider another such step a coin-toss. That’s partly because of US President Donald Trump’s planned April 2 announcement on reciprocal tariffs and their still unpredictable global fallout.

The current environment is “extremely uncertain,” Escriva said, adding that the US administration is the primary reason for this.

“If we take an uncertainty global index to put a number to uncertainty, then we’re at the highest level since records started,” he said. “Higher than Covid, of course than the war in Ukraine, higher occasionally than 9/11, higher than the very intense Lehman Brothers episode during the Great Financial Crisis.”

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.