Deep-pocketed investors have adopted a bullish approach towards Five Below FIVE, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in FIVE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 34 extraordinary options activities for Five Below. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 67% leaning bullish and 23% bearish. Among these notable options, 6 are puts, totaling $349,980, and 28 are calls, amounting to $2,113,698.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $100.0 for Five Below over the last 3 months.

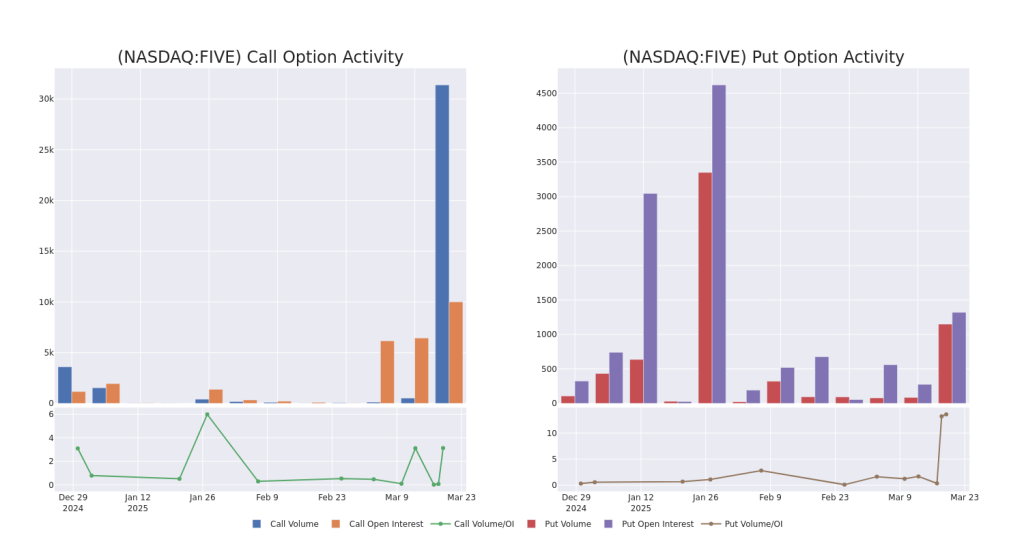

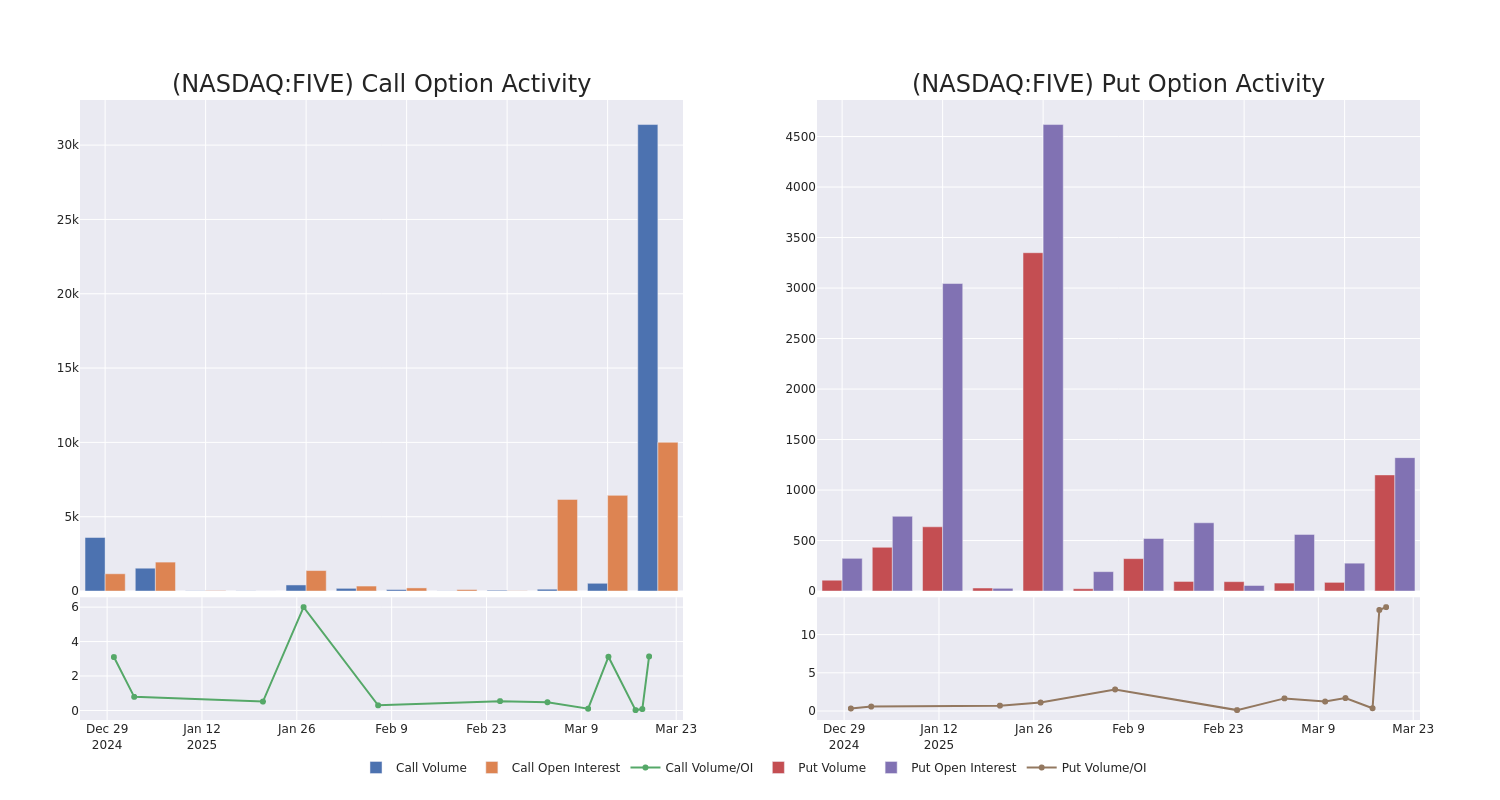

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Five Below’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Five Below’s whale trades within a strike price range from $55.0 to $100.0 in the last 30 days.

Five Below Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FIVE | CALL | TRADE | BULLISH | 05/16/25 | $6.3 | $5.9 | $6.2 | $80.00 | $868.0K | 2.0K | 1.5K |

| FIVE | CALL | TRADE | BULLISH | 03/21/25 | $2.75 | $2.6 | $2.8 | $80.00 | $126.0K | 491 | 790 |

| FIVE | PUT | SWEEP | BEARISH | 03/21/25 | $8.2 | $8.1 | $8.1 | $80.00 | $108.5K | 503 | 426 |

| FIVE | CALL | TRADE | BULLISH | 03/21/25 | $4.6 | $3.7 | $4.3 | $75.00 | $86.0K | 407 | 633 |

| FIVE | CALL | SWEEP | BULLISH | 03/21/25 | $4.9 | $4.6 | $4.9 | $75.00 | $85.2K | 407 | 178 |

About Five Below

Five Below Inc is a specialty value retailer offering merchandise targeted at the tween and teen demographic. The Company’s edited assortment of products includes select brands and licensed merchandise.

Current Position of Five Below

- Currently trading with a volume of 1,922,653, the FIVE’s price is up by 2.33%, now at $75.63.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 0 days.

Expert Opinions on Five Below

In the last month, 2 experts released ratings on this stock with an average target price of $80.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Market Perform rating for Five Below, targeting a price of $85.

* An analyst from Loop Capital persists with their Hold rating on Five Below, maintaining a target price of $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Five Below with Benzinga Pro for real-time alerts.

Momentum9.41

Growth67.41

Quality82.09

Value74.44

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.