Financial giants have made a conspicuous bearish move on Blackstone. Our analysis of options history for Blackstone BX revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $665,959, and 2 were calls, valued at $126,267.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $145.0 to $165.0 for Blackstone during the past quarter.

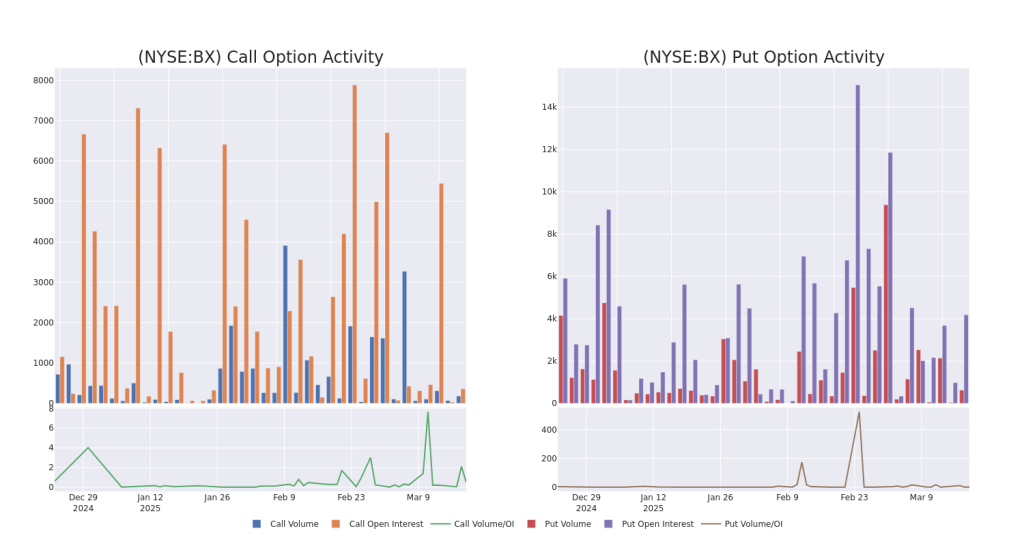

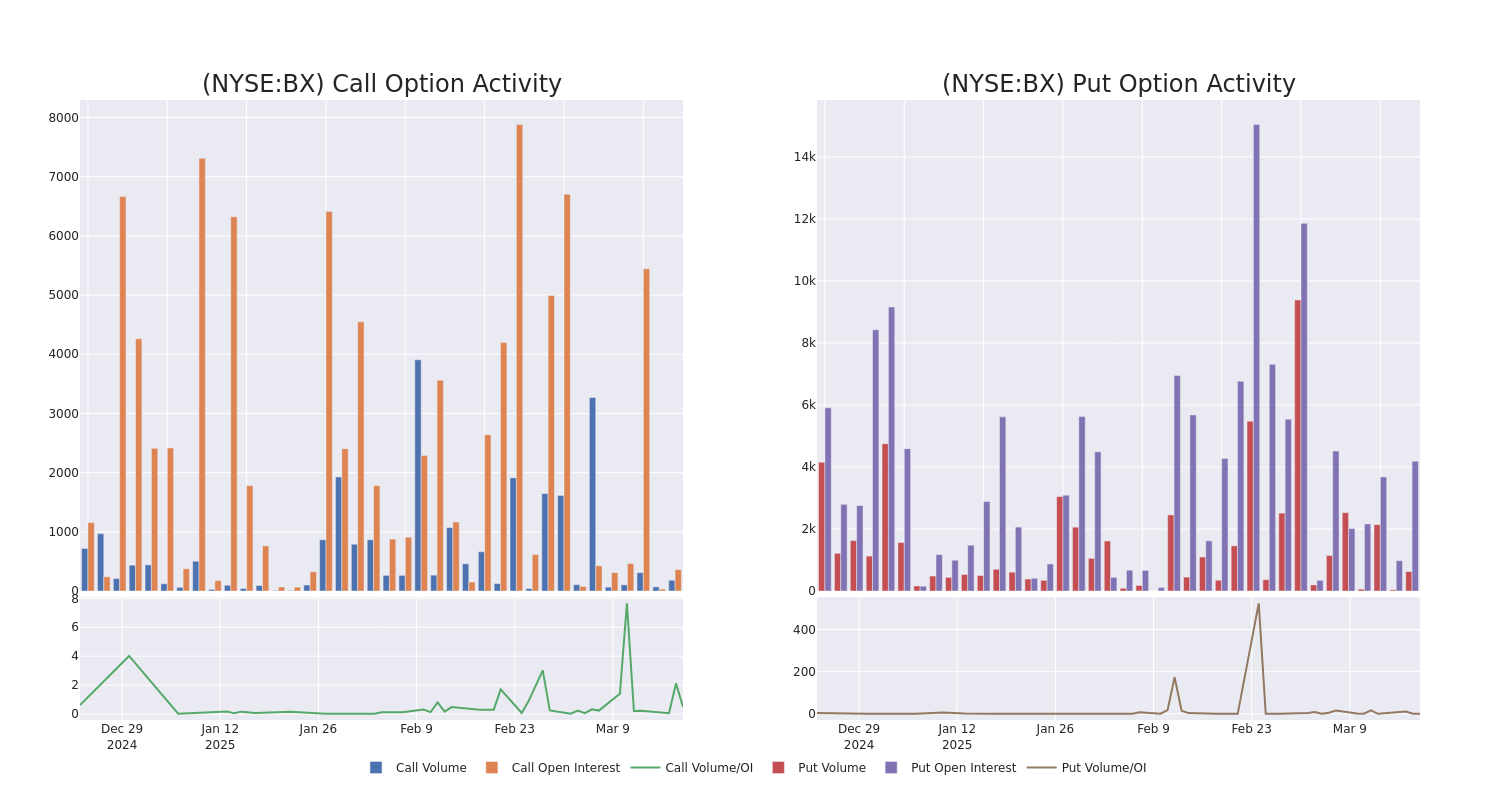

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Blackstone stands at 758.5, with a total volume reaching 810.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Blackstone, situated within the strike price corridor from $145.0 to $165.0, throughout the last 30 days.

Blackstone Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BX | PUT | TRADE | BULLISH | 06/20/25 | $9.8 | $9.2 | $9.25 | $145.00 | $277.5K | 797 | 300 |

| BX | PUT | SWEEP | BEARISH | 05/16/25 | $17.5 | $14.25 | $16.45 | $160.00 | $103.6K | 1.4K | 126 |

| BX | PUT | TRADE | BEARISH | 05/16/25 | $20.8 | $18.55 | $19.94 | $165.00 | $99.7K | 582 | 75 |

| BX | PUT | SWEEP | BEARISH | 05/16/25 | $13.7 | $10.75 | $13.04 | $155.00 | $98.5K | 638 | 73 |

| BX | CALL | SWEEP | BEARISH | 12/19/25 | $12.9 | $11.8 | $11.8 | $160.00 | $87.3K | 361 | 149 |

About Blackstone

Blackstone is the world’s largest alternative-asset manager with $1.108 trillion in total asset under management, including $820.5 billion in fee-earning assets under management, at the end of September 2024. The company has four core business segments: private equity (25% of fee-earning AUM and 30% of base management fees), real estate (35% and 39%), credit and insurance (31% and 24%), and multi-asset investing (9% and 7%). While the firm primarily serves institutional investors (87% of AUM), it also caters to clients in the high-net-worth channel (13%). Blackstone operates through 25 offices in the Americas (8), Europe and the Middle East (9), and the Asia-Pacific region (8).

In light of the recent options history for Blackstone, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Blackstone

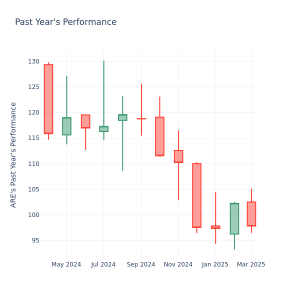

- Trading volume stands at 481,273, with BX’s price up by 2.44%, positioned at $149.75.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 29 days.

Professional Analyst Ratings for Blackstone

In the last month, 1 experts released ratings on this stock with an average target price of $180.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from UBS has elevated its stance to Buy, setting a new price target at $180.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Blackstone, Benzinga Pro gives you real-time options trades alerts.

Momentum70.03

Growth93.09

Quality68.38

Value–

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.