With the stock market experiencing gyrations that haven’t been seen in, well, months, investors are fretting about the future of their portfolios and the prospects of a recession triggered by Donald Trump’s will-he-or-won’t-he follow through with his tariff threats.

This isn’t the place to come for advice on how to trade the stock market. When I scan the market prognostications coming to me via email and the investment websites I regularly visit, I find that they fall into two equally balanced categories: Those counseling, “Don’t worry, be happy”; and those forecasting a cataclysmic crash, or at least a recession bulking large on the horizon.

Since that’s what I usually hear whether the market is on a bull tear or a slump, I am reminded of the observation that William Goldman, the Oscar-winning screenwriter of “The Princess Bride” and “Butch Cassidy and the Sundance Kid,” made about Hollywood: “Nobody knows anything.”

Sell down to the sleeping point.

J.P. Morgan’s advice to a friend who said he was so nervous about his stocks that he couldn’t sleep at night

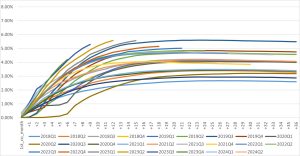

That said, it may be useful to place the most recent stock market action in perspective. We can start with volatility of recent days and weeks.

On Monday, Mar. 10, the Dow Jones industrial average fell 890 points, or 2.8%; the broader Standard & Poor’s 500 index fell by 2.7% and the Nasdaq composite index, which tracks tech stocks, fell 4%. The day before, Trump had refused to rule out that his economic policies might produce a recession.

The market’s sentiment was sour all week. On Thursday, the S&P 500 entered “correction” territory — a 10% drop from its recent high, which in this case had been recorded Feb. 19. The pullback inspired some market commentators to dust off an antique market indicator known as the Dow Theory. That indicator posits that any move in the Dow Industrials must be matched by a similar move in the Dow transportation index.

Both were falling last week, “deepening fears of a broader market correction,” wrote James Gordon of the Daily Mail.

Yet whether the Dow Theory is relevant to today’s economy is questionable. It was coined at the turn of the last century, when industrial output was in heavy machinery and physical goods that had to be shipped by the railroad companies dominating the transportation sector.

Today, more than one-third of the 30 companies in the Dow industrials deal in finance, insurance or high-tech and don’t make products that need to be physically transported.