About 11 years after Moody’s first placed a Baa1 rating on J.B. Hunt’s publicly traded debt, the ratings agency this week affirmed that rating.

It’s been a remarkable run of stability for the trucking and intermodal giant (NASDAQ: JBHT). The Baa1 rating – three notches above the dividing line between investment-grade and non-investment-grade debt – dates back to 2014.

Baa1 is equivalent to the BBB rating of S&P Global Ratings. S&P has had a BBB rating on J.B. Hunt since 2012, though last summer it changed the outlook on the company to “stable” from “positive.”

Moody’s already had a stable outlook on J.B. Hunt, and it retained that outlook in the affirmation of the Baa1 rating. A stable outlook at both ratings agencies means conditions are not likely to result in an upgrade or downgrade of the company anytime in the near future.

Moody’s undertook the review of J.B. Hunt’s debt because the Arkansas-based company is issuing $500 million in senior unsecured debt to replace an existing $500 million term loan that is due in September. Moody’s said that loan is not rated.

Unlike privately held companies with publicly traded debt, the reports of rating agencies on a publicly traded company like J.B. Hunt do not offer as many insights into a company’s fiscal situation. Earnings are released every quarter, and equity markets provide a verdict on their view of the company every day.

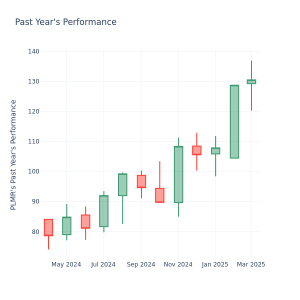

Ironically, J.B. Hunt, along with numerous other trucking companies, hit a 52-week low in equity trading Wednesday, reaching $151.60. It is down about 23.8% for the year and 6.8% in the past month.

“The affirmation of J.B. Hunt’s existing rating and maintenance of the stable outlook reflects the company’s favorable credit metrics, with leverage expected to remain around 1.0x and positive free cash flow, despite an ongoing slowdown in the freight sector,” Moody’s wrote in its rating report. “J.B. Hunt also benefits from its position as a leading surface transportation and logistics company with a strong national footprint and intermodal franchise arrangements with most of the major North American railroads.”