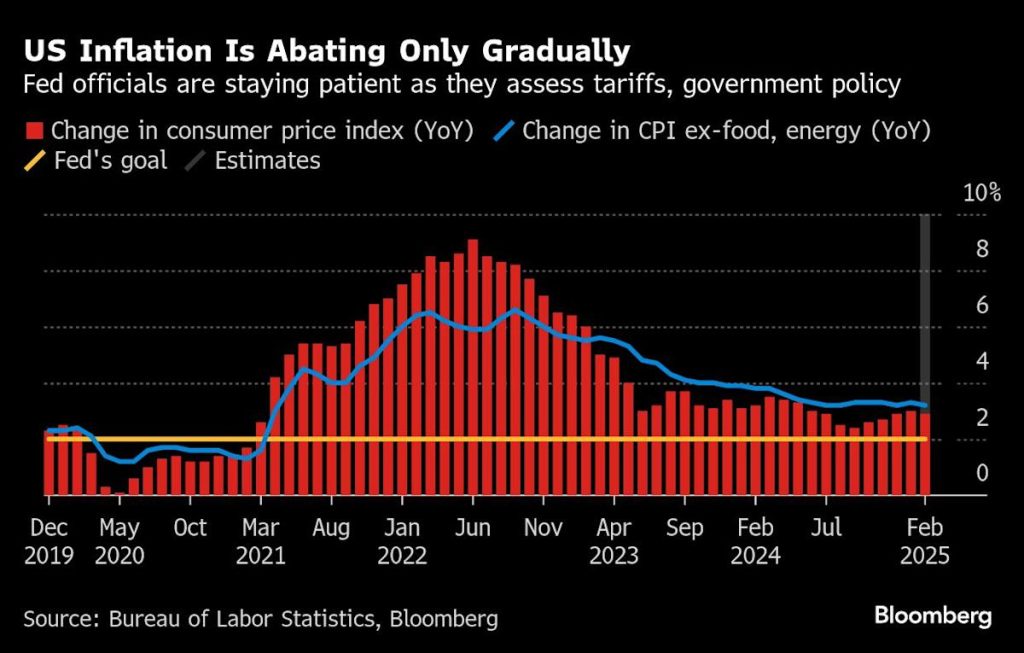

(Bloomberg) — Cooler-than-forecast February inflation pushed stocks higher after two days of heavy losses. A kneejerk rally in bonds quickly reversed and yields rose across the curve amid concerns over an escalating trade war.

Most Read from Bloomberg

Equities advanced after a selloff that put the S&P 500 on the verge of a technical correction. The bounce was led by tech megacaps, which got heavily hit during the recent market rout. While the surprise slowdown in consumer prices brought a degree of relief to traders, several voices on Wall Street saw the data as the “calm before the storm” given the uncertainties around the potential impacts of tariffs on the economy.

Follow The Big Take daily podcast wherever you listen.

In fact, all the anxiety around President Donald Trump’s trade war continued to influence sentiment, with the US equity benchmark briefly erasing a 1.3% rally before moving higher again.

“For the last three weeks, traders have felt like buying this market is like trying to catch a falling knife,” said Mark Hackett at Nationwide. “But extreme oversold conditions and near-universal pessimism suggest a relief rally is likely.”

Despite the improvement provided by the latest consumer price index, uncertainty remains in the air as the outlook for inflation remains hazy due to trade policy developments, according to Oscar Munoz and Gennadiy Goldberg at TD Securities.

“In this context, the Fed is unlikely to change its policy guidance anytime soon,” they said.

The S&P 500 rose 0.5%. The Nasdaq 100 climbed 1.1%. The Dow Jones Industrial Average lost 0.2%. Tesla Inc. extended a two-day surge to 12%. In late hours, Intel Corp. said it named industry veteran Lip-Bu Tan as its next chief executive officer. Adobe Inc. gave a tepid outlook.

The yield on 10-year Treasuries advanced three basis points to 4.31%. A dollar gauge was little changed.

Today’s inflation release is unambiguously positive for risk assets as there is greater confidence that inflation is not re-accelerating like January’s data showed, which gives policymakers a bit of breathing room and should allow the Fed to loosen policy should signs of labor market weakness emerge, according to Jeff Schulze at ClearBridge Investments.

“However, the Fed will also need to see that inflation expectations are recovering from their recent rise before cutting rates, as a de-anchoring of inflation expectations is what keeps most central bankers up at night, given the challenge it represents to restoring price stability in the future,” he said.