D-Wave Quantum Inc. QBTS shares are trading higher on Thursday.

Today, the company reported fourth-quarter adjusted earnings per share of 8 cents loss, missing the street view of 7 cents loss. Quarterly sales of $2.309 million (down 21% year over year), missing the analyst consensus estimate of $2.36 million.

Bookings for the fourth quarter were $18.3 million, an increase of 502% year over year.

Adjusted gross profit for the fourth quarter was $1.7 million, a decrease of 28% year over year. Adjusted gross margin contracted on a year-over-year basis to 73.0% from 80.2% in the year-ago period.

Also Read: Why Is G-III Apparel Stock Shooting Higher Today?

Adjusted EBITDA loss was $15.3 million, an increase of 41% year over year.

As of December 31, D-Wave’s consolidated cash balance totaled $178.0 million and as of the date of this earnings press release, exceeded $300 million.

During the fourth quarter of fiscal 2024, the company raised $161.3 million in equity through its At-The-Market and Equity Line of Credit common stock issuance programs.

“With record bookings, a record cash position and an unequivocal demonstration of our quantum system outperforming classical on a real-world problem, our progress toward achieving that mission is clear,” said Alan Baratz, CEO of D-Wave.

Outlook: The company expects first quarter fiscal 2025 revenue to exceed $10 million, with a significant portion of the first quarter revenue including revenue recognized from the sale of an Advantage annealing quantum computer (consensus: $2.606 million).

Price Action: QBTS shares are trading higher by 3.09% to $6.00 premarket at last check Thursday.

Read Next:

Image via Shutterstock.

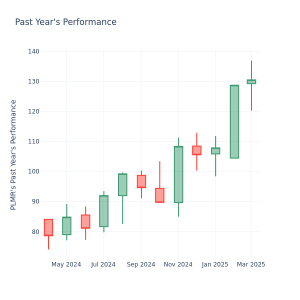

Momentum99.46

Growth–

Quality–

Value4.69

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.