Adobe Inc ADBE shares are trading lower Thursday after the company reported first-quarter results and issued soft guidance. Multiple analysts also cut price targets following the print.

- Q1 Revenue: $5.71 billion, versus estimates of $5.66 billion

- Q1 EPS: $5.08, versus estimates of $4.97

Total revenue was up 10% year-over-year as digital media revenue grew 11% year-over-year and digital experience revenue jumped 10% year-over-year. Remaining performance obligations totaled $19.69 billion at quarter’s end.

“Adobe’s success over the next decade will be driven by customer-focused innovation and new offerings for creators, marketing professionals, business professionals and consumers,” said Shantanu Narayen, chair and CEO of Adobe. “Adobe is well-positioned to capitalize on the acceleration of the creative economy driven by AI and we are reaffirming our FY2025 financial targets.”

See Also: Sam Altman’s OpenAI Urges Trump Administration For Rapid AI Advancement And Reduced Regulation

Guidance: Adobe sees second-quarter revenue of $5.77 billion to $5.82 billion versus estimates of $5.8 billion. The company expects second-quarter adjusted earnings of $4.95 to $5 per share versus estimates of $5 per share.

Adobe reaffirmed expectations for full-year 2025 revenue between $23.3 billion and $23.55 billion versus estimates of $23.5 billion. Adobe sees full-year adjusted earnings in the range of $20.20 to $20.50 per share versus estimates of $20.40 per share.

Analyst Changes:

- Morgan Stanley analyst Keith Weiss maintained an Overweight and lowered the price target from $660 to $600.

- Oppenheimer analyst Brian Schwartz maintained an Outperform and lowered the price target from $560 to $530.

- Baird analyst Rob Oliver maintained a Neutral and lowered the price target from $500 to $490.

- BofA Securities analyst Brad Sills maintained a Buy and lowered the price target from $605 to $528.

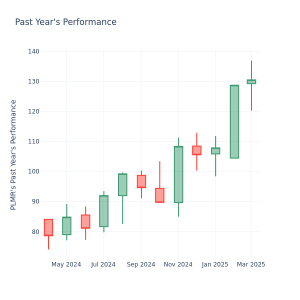

ADBE Price Action: Adobe shares were down 7.66% at $404.99 at the time of publication Thursday, according to Benzinga Pro.

Photo: Shutterstock.

Momentum18.44

Growth61.49

Quality40.07

Value2.15

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.