Investor fear is brewing.

The market is pulling back, headlines are flashing warnings, and uncertainty is creeping in. Stocks are sliding, Bitcoin just dipped below $80,000, and Wall Street is scrambling to make sense of the latest economic signals.

On Monday, the Dow tumbled nearly 800 points, the Nasdaq shed almost 4%, and fear-driven selling hit high-growth names the hardest.

President Trump’s latest comments on a possible recession only added fuel to the fire, while concerns over tariffs and inflation have investors bracing for more volatility.

This is the kind of pullback that shakes out weak hands. It’s also the kind of moment where opportunity shows itself for those paying attention.

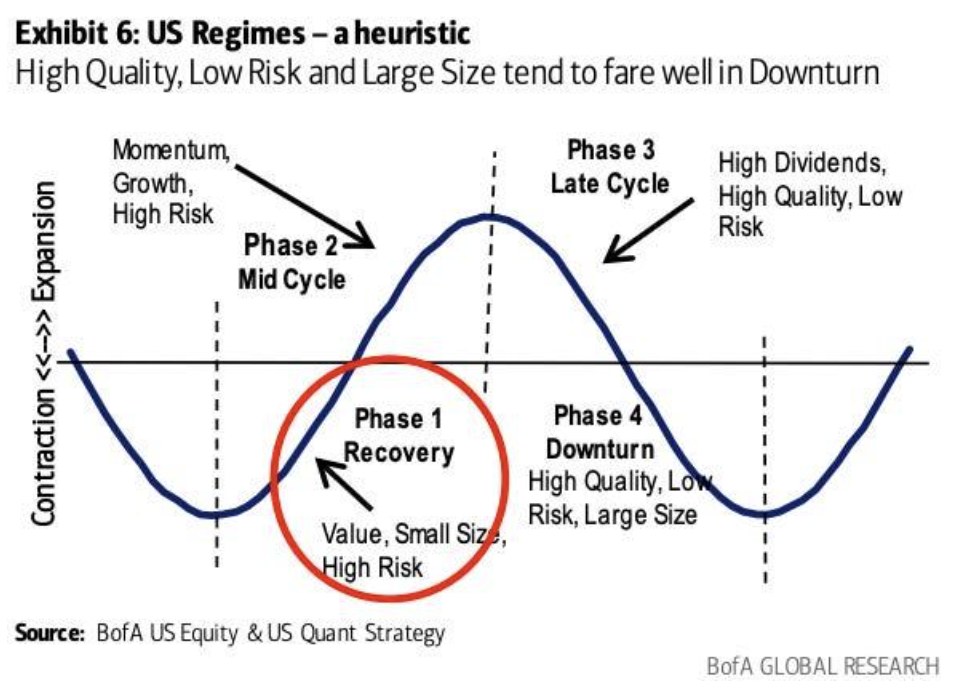

Market cycles are nothing new—investor emotions swing from euphoria to panic, creating moments where high-quality assets get caught in the crossfire.

We are in the downturn cycle on the chart above — so it’s prime time to prepare for the next wave higher.

Right now, Bitcoin isn’t the only asset flashing an accumulation window. Some of the most compelling growth companies—names with undeniable tailwinds—are trading at prices that won’t last forever.

Approaching a Market Pullback

At LikeFolio, we specialize in spotting major consumer macro trends and understanding what makes people tick – likes, dislikes, pain-points, and products/services they can’t get enough of.

We do this by leveraging powerful data in real-time, including digital traffic patterns, app usage, comments on X, posts on Reddit, and even commentary from executives during earnings calls.

This approach helps us to anticipate future demand, and thus, growth prospects for publicly traded companies.

Our client base spans from major hedge funds and institutions to individual traders, like you (and like us!).

We’ve identified eight under-the-radar plays that could deliver outsized returns as the cycle turns.

The full report breaks down the names highest on our Watch List for a rebound.

Let’s get started.

8. Bitcoin

Bitcoin has pulled back significantly from recent highs, even dropping below $90,000, as macro fears and short-term profit-taking weigh on sentiment.

The selloff comes after Bitcoin ETFs saw their first major outflows, combined with concerns over potential tariffs and inflation.

Meanwhile, President Trump’s pro-Bitcoin stance is fueling speculation that the U.S. may build a strategic Bitcoin reserve, a move that would further entrench Bitcoin’s role as a macroeconomic asset.

At LikeFolio, we believe we are in the very early stages of Bitcoin adoption, and the bet is more asymmetric than ever before.

Bitcoin Tailwinds

- Pro-Bitcoin Administration in the U.S.: Trump’s public support for Bitcoin mining, ETFs, and a national reserve is creating a more favorable policy backdrop—a stark contrast to the previous administration’s approach. The idea of Bitcoin being added to U.S. national reserves is gaining traction, positioning BTC as a geopolitical asset, not just a speculative one.

- Institutional Capital is Deeply Embedded: While recent ETF outflows have contributed to Bitcoin’s pullback, major firms continue to accumulate and expand exposure.

- Money Supply Expansion: Milton Friedman once noted that “inflation is always and everywhere a monetary phenomenon.” In other words, when the supply of money increases faster than economic output, inflation follows—and asset prices, particularly those with fixed supply like Bitcoin, tend to react accordingly… and the money supply has just started to expand again…

Bottom Line: This is a short-term pullback in the middle of the strongest structural setup Bitcoin has seen in years. With institutional demand building and policy tailwinds forming, this selloff looks like an accumulation window ahead of major catalysts.

7. Tesla (TSLA)

Tesla stock TSLA is having a tough year, driven by a combination of weakening European sales, political controversy surrounding Elon Musk, and rising competition from Chinese automakers.

Vehicle registrations in key European markets dropped sharply, partly due to shifting consumer sentiment and competitive pressures from brands like Volkswagen and Renault. Additionally, regulatory hurdles in China may delay approval for Tesla’s Full Self-Driving (FSD) technology, limiting expansion in the world’s largest EV market.

While these challenges have pressured the stock, Tesla’s aggressive push into autonomy, energy storage, and affordable EVs presents a compelling long-term opportunity for investors who see past short-term headwinds.

LikeFolio data shows a jump in global web visits in January, suggesting budding interest from consumers – and contrasting with the media narrative at hand.

TSLA Tailwinds

- Robotaxi and Ride-Hailing Expansion: Tesla is laying the foundation for a major shift in how it monetizes its vehicles. The company plans to launch a robotaxi service in Austin, Texas, by June 2025, relying on a fleet of Tesla-owned cars running unsupervised Full Self-Driving (FSD) software. In California, Tesla is preparing a separate ride-hailing service, starting with human drivers but structured in a way that could transition to full autonomy. By owning the fleet instead of just selling cars, Tesla moves into a high-margin, recurring revenue business, competing directly with Uber and Lyft. If successful, this shift could unlock a massive new profit stream and reshape Tesla’s long-term business model.

- Affordable Next-Generation Vehicle: Tesla plans to begin production of a lower-cost EV in the first half of 2025. Rather than waiting for a brand-new manufacturing process, Tesla is leveraging its existing production lines to get these vehicles to market faster and at lower cost. A cheaper model means more consumers can afford a Tesla, helping the company capture a larger share of the EV market while making it harder for rivals to compete on price.

- Energy Storage Expansion: Tesla deployed 31.4 GWh of energy storage in 2024—more than twice the previous year’s total—and hit a record 11 GWh in Q4 alone, a 244% increase year over year. To meet growing demand, Tesla has started production at its new Shanghai Megapack factory, which can produce 10,000 Megapacks annually (40 GWh). Energy storage is becoming a major revenue driver, with Tesla rapidly scaling capacity while competitors struggle to keep up. As grid operators and businesses adopt large-scale battery storage, Tesla is positioning itself as the dominant supplier.

- Optimus Humanoid Robot Development: Tesla plans to produce 10,000 Optimus humanoid robots in 2025, with initial units assigned to Tesla’s own factories. By automating repetitive and hazardous tasks, Tesla reduces labor costs and improves efficiency. If these robots prove effective in Tesla’s operations, the company could begin selling them to other industries, opening the door to a new revenue stream in industrial automation.

Bottom Line: Wall Street is missing the forest through the trees – at these levels, TSLA shares look extremely compelling.

6. Hims & Hers Health Inc. (HIMS)

HIMS stock HIMS plunged in February after the FDA ruled that compounded versions of semaglutide (Ozempic/Wegovy) were no longer necessary due to the resolution of supply shortages. These weight-loss prescriptions accounted for ~15% of sales, making the ruling a significant short-term headwind.

Despite the drop, HIMS reported Q4 2024 revenue of $481 million, up 95% year-over-year, and guided 2025 revenue between $2.3B–$2.4B, exceeding expectations. The company also delivered its first full year of GAAP profitability, generating $126 million in net income and nearly $200 million in free cash flow.

Shares continued to sell off after these results, but this reaction may be overdone, given the company’s strong subscriber growth and ongoing category expansion.

HIMS Tailwinds

- Subscriber Growth + Recurring Revenue: Hims & Hers reached 2.2 million subscribers by the end of 2024, a 45% year-over-year increase. More than half of these subscribers are using personalized treatments, which come with higher price points and lower churn rates. This rapid increase in paying users translates directly into stronger recurring revenue, giving the company more cash flow to reinvest in customer acquisition and new services.

- Testosterone and Menopause Treatments Expand Addressable Market: In late 2024, Hims & Hers launched treatments for low testosterone (TRT) and menopause. These conditions affect tens of millions of people, yet traditional healthcare providers often underserve them due to long wait times and lack of specialists. By offering direct-to-consumer access, Hims & Hers captures demand that competitors are failing to meet. If these treatments scale as expected, they could become as large as the company’s existing hair loss and erectile dysfunction businesses.

- UK Expansion Sets Up Future Growth: The company entered the UK market, extending its prescription and wellness services beyond the U.S. With regulatory approval in place and local partnerships forming, this move gives Hims & Hers access to a healthcare system where telemedicine is growing rapidly. Success in the UK would provide a playbook for further international expansion, potentially into other European markets.

- Acquisition of Trybe Labs Adds At-Home Testing, Increasing Margins: In February 2025, Hims & Hers acquired Trybe Labs, a company specializing in at-home lab testing. This acquisition allows Hims & Hers to provide diagnostic tests directly to customers rather than referring them to third-party labs, cutting costs and capturing more revenue per patient. Adding testing also makes it easier to prescribe personalized treatments, increasing the likelihood that customers will remain within the Hims & Hers ecosystem rather than seeking care elsewhere.

- Demographic Expansion: Last quarter the Hers platform accounted for 30% of total revenue. Web data suggests this will continue to be a growth driver moving forward – February growth and overall platform visits hit all-time highs.

Bottom Line

The FDA ruling is a short-term overreaction—HIMS’ core business is thriving, with 45% subscriber growth, category expansion, and rising demand for personalized treatments. The stock’s pullback presents an accumulation opportunity in a company rapidly scaling its platform while maintaining profitability.

Up Next: The Top 5 Opportunities Most Investors Are Missing

While the names above are getting attention, LikeFolio has identified its TOP 5 companies that represent the biggest opportunities in today’s market:

- A fintech platform seeing record deposit growth and engagement despite loan concerns

- A retail trading app with sustained user growth that’s been unfairly punished

- An independent ad tech firm taking on the giants

- A behind-the-scenes AI data provider powering the next generation of models

- A transportation innovator on the verge of commercial deployment

Click here to see LikeFolio’s Top 5 Stock Opportunities

Each of these companies is experiencing strong tailwinds according to LikeFolio’s consumer data, yet their stocks have pulled back significantly during recent market volatility.

Note: Complete breakdown of these opportunities, including detailed consumer trend data and actionable investment insights, available exclusively on the LikeFolio platform.

Featured image by Likefolio

This post was authored by an external contributor and does not represent Benzinga’s opinions and has not been edited for content. This contains sponsored content and is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.