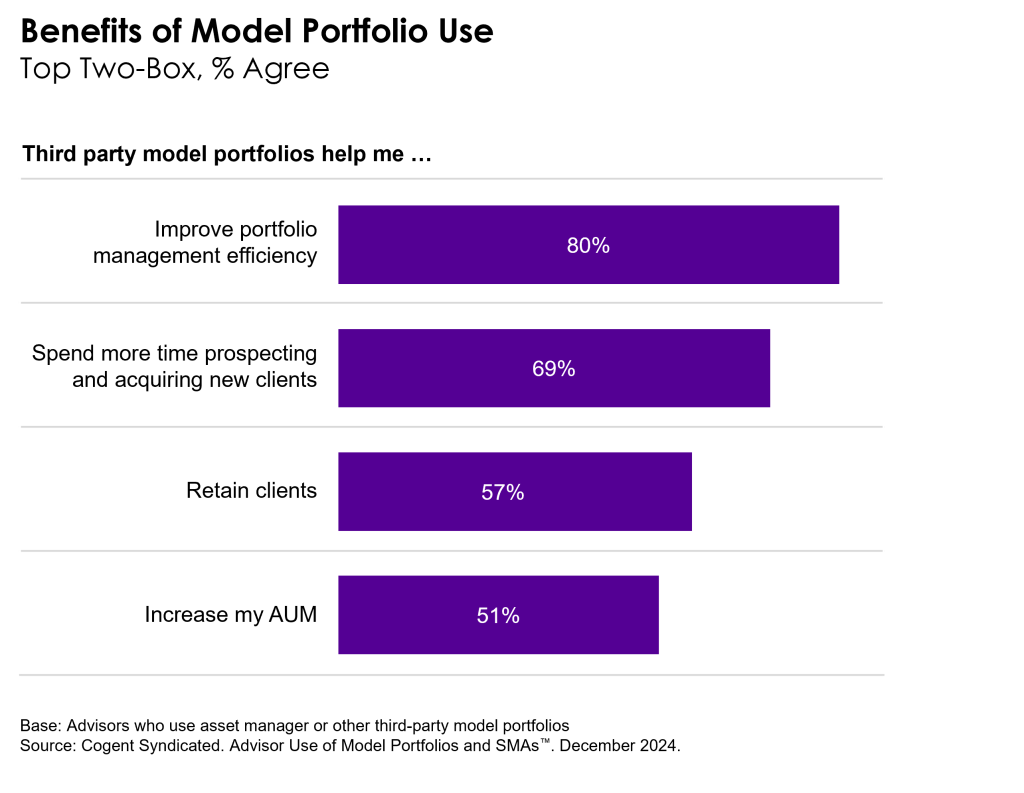

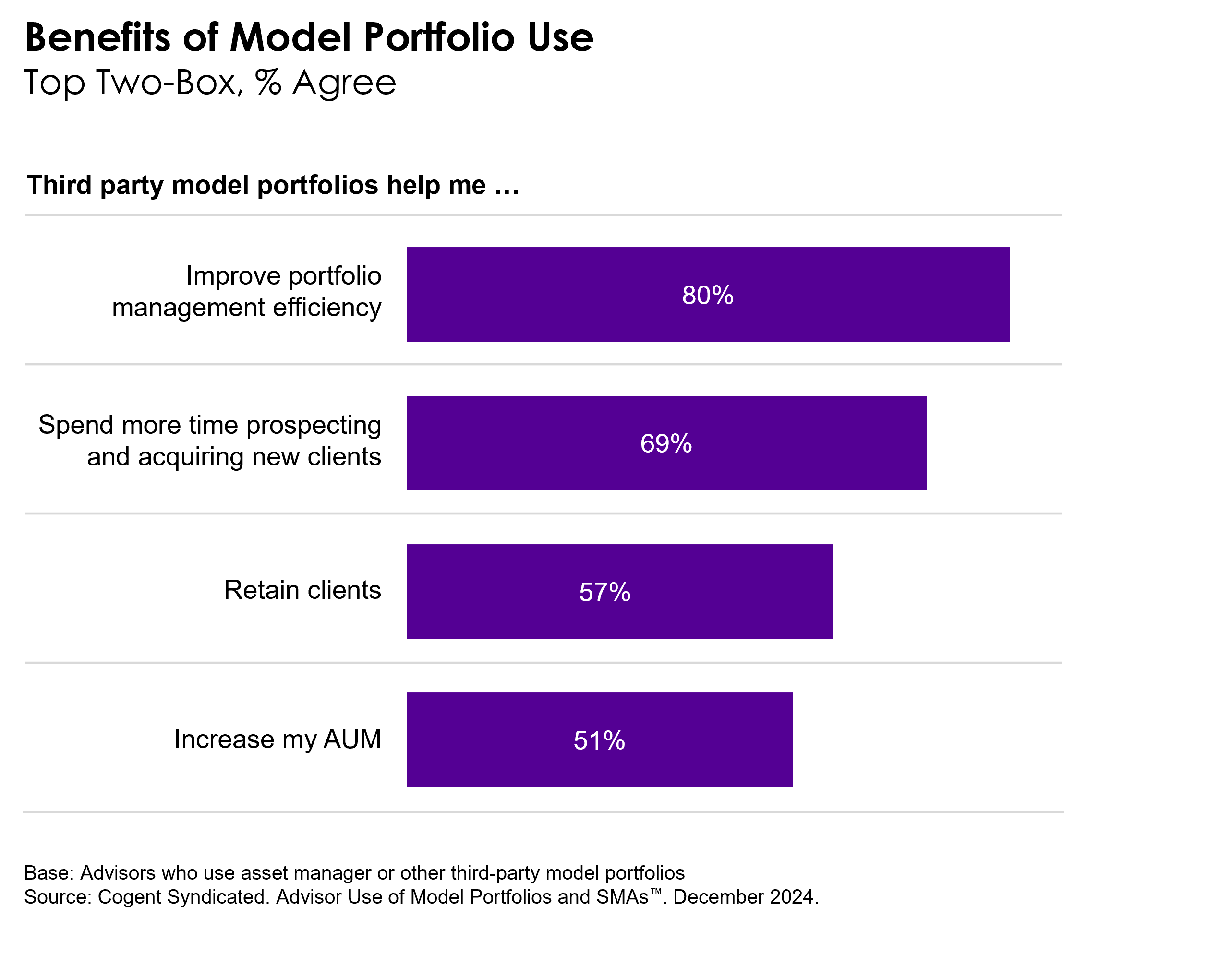

LIVONIA, Mich., March 11, 2025 (GLOBE NEWSWIRE) — Advisors who are using third-party model portfolios most appreciate their ability to improve efficiency and free up time for business development. That’s according to a new Cogent Syndicated report by Escalent, a top data analytics and advisory firm. Eight in ten advisors who have adopted model portfolios say that models help them boost portfolio management efficiency. Meanwhile, almost 70% agree they give them more time for prospecting and acquiring new clients.

These are the latest findings from Cogent Syndicated’s Advisor Use of Model Portfolios and SMAs™ report. This annual study tracks financial advisors’ use of model portfolios, separately managed accounts (SMAs), and direct indexing. It also examines perceptions of leading model portfolio providers, SMA managers, and direct indexing solutions providers, offering insight into the competitive landscape for third-party model providers and asset managers. For the first time this year, the report includes an advisor assessment of the benefits of using model portfolios to explore how providers can encourage wider adoption.

“While managed account assets are growing year over year, advisors are adopting model portfolios at a slower pace than anticipated,” said Meredith Lloyd Rice, a vice president in Escalent’s Cogent Syndicated division. “On the other hand, those who do use model portfolios speak highly of their benefits. The question is whether these advantages can be leveraged to communicate the value of model portfolios to a broader segment of advisors.”

Despite widespread projections for model portfolio growth, interest in increasing utilization is primarily being fueled by existing users. Only 27% of all advisors anticipate expanding their use of model portfolios in the coming year, just a three percentage point increase from last year. Meanwhile, this proportion rises to more than four in ten among heavy users of third-party model portfolio providers.

Among advisors using model portfolios from external providers, there is a clear consensus around their biggest perks. Across broker/deal channels, registered investment advisors (RIAs), and those with both less than $100 million and $100 million or more in assets under management (AUM), existing users agree that the leading advantage of third-party model portfolios is improved portfolio management efficiency. The ability to dedicate more time to acquiring clients and drive business growth comes in at a close second.

Meanwhile, fees, variety in investment options and performance remain persistent concerns, continuing a trend seen in previous years.

With a deeper understanding of concerns and the benefits that current users find most valuable about model portfolios, providers have an opportunity to refine their messaging, leaning into these qualities to boost advisor buy-in.

“Our data shows that advisors who use model portfolios clearly recognize their value,” said Linda York, a senior vice president in Escalent’s Cogent Syndicated division. “The challenge now is bridging that gap for those who have yet to embrace them. To expand distribution for their model portfolios, firms must sell advisors on the benefits of partnering with an external provider. Emphasizing the diversity of investment options, low fees, and strong performance — along with highlighting the advantages shared by existing users — will all be key to overcoming common concerns and increasing adoption.”

About Advisor Use of Model Portfolios and SMAs™

Cogent Syndicated conducted an online survey with approximately 400 registered financial advisors from September to October 2024. In order to qualify, respondents were required to have an active book of business of at least $5 million and offer investment advice or planning services to individual investors on a fee or transactional basis. Cogent sets quota targets and weights the data to be representative of the overall advisor universe using the Discovery Data Financial Services Industry database as a sample source. Escalent will supply the exact wording of any survey question upon request.

About Escalent

Escalent is an award-winning data analytics and advisory firm specializing in industries facing disruption and business transformation. As catalysts of progress for more than 40 years, we accelerate growth by creating a seamless flow between primary, secondary, syndicated, and internal business data, providing consulting and advisory services from insights through implementation. We are 2,000 team members strong, following the acquisition of C Space and Hall & Partners in April 2023. Escalent is headquartered in Livonia, Michigan, with locations across the US and in Australia, Canada, China, India, Ireland, the Philippines, Singapore, South Africa, UAE, and the UK. Visit escalent.co to see how we are helping shape the brands that are reshaping the world.

CONTACT: Kim Eberhardt

248.417.2460

keberhardt@identitypr.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/111615c3-a588-44ae-8300-8e287d982dd7

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.