(Bloomberg) — Anxiety that tariffs and government firings will torpedo growth in the world’s largest economy extended a three-week stretch of volatility across global markets Monday. American stocks fell as Wall Street forecasters tempered bullish views while demand for recession havens boosted sovereign bonds in the US and Europe.

Most Read from Bloomberg

The S&P 500 extended its slide from a record to nearly 8% after erasing all of its gains since Donald Trump was elected president on the strength of what Wall Street considered his “pro-growth” agenda. Benchmark Treasury yields have dropped almost 30 basis points in the past month on bets that an economic slowdown would force the Federal Reserve to cut rates. US credit risk hit the highest in 2025, and over 10 high-grade companies delayed bond sales.

Speculation is intensifying that Trump is willing to tolerate hardship in the economy and markets in pursuit of long-term goals involving tariffs and smaller government.

He said the US economy faces “a period of transition,” deflecting concerns about the risks of a cooldown as his early focus on tariffs and federal job cuts causes market turmoil. Asked on Fox News’ Sunday Morning Futures whether he’s expecting a recession, Trump said, “I hate to predict things like that. There is a period of transition, because what we’re doing is very big.”

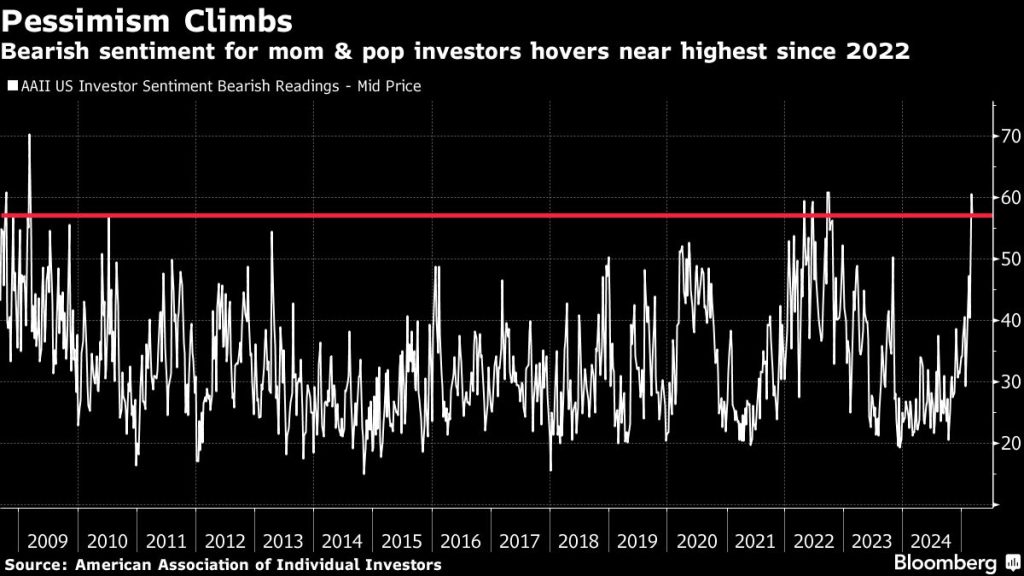

“President Trump doubled down on the current policy path and acknowledged the chance of a slowdown, and that’s weighing on sentiment,” said Tom Essaye at The Sevens Report.

A chorus of Wall Street strategists is warning about higher stock volatility, with Morgan Stanley’s Michael Wilson the latest to sound the alarm on economic growth worries. Other market forecasters including at JPMorgan Chase & Co. and RBC Capital Markets have also tempered bullish calls for 2025 as Trump’s tariffs stoke fears of slowing economic growth.

“There are always multiple forces at work in the market, but right now, almost all of them are taking a back seat to tariffs,” said Chris Larkin at E*Trade from Morgan Stanley. “Until there’s more clarity on trade policy, traders and investors should anticipate continued volatility.”

The S&P 500 fell 1.8%, set to close below its 200-day moving average for the first time since November 2023. The Nasdaq 100 slid 2.6%. The Dow Jones Industrial Average slipped 0.8%.