Esteemed investor Peter Lynch shared his insights on the current state of the stock market and his strategies for selecting stocks.

What Happened: Lynch, in his discussion with Barron’s, emphasized the superiority of growth stocks, which are companies experiencing significant sales growth, over non-growth stocks. He warned investors not to mistake earnings growth, which can include turnarounds and cyclicals, for sales growth.

Despite the growing popularity of passive management, Lynch pointed out that active management continues to flourish at Fidelity, with many funds consistently outperforming their benchmarks.

Lynch underscored the importance of investing in companies that offer innovative products or services. He cited Stop & Shop and Dunkin’ Donuts as examples of successful local companies.

During the interview, when asked about what characterizes a great company, Lynch said, “My best stocks have been ones where I didn’t have to worry about the big picture. A company with a better mousetrap, a growth company in a non-growth industry.

He expressed regret for not investing sooner in companies such as Walmart Inc. WMT and Sherwin Williams Co. SHW, attributing this to a lack of research and an underestimation of their growth potential.

Lynch advised investors to invest in a stock during the early stages of its growth and to sell before it reaches its peak. He also raised concerns about the current scarcity of growth companies, flagging this as a potential warning sign.

“If you cannot find growth companies in innings three through five of the ballgame, look at turnarounds, special situations, back at the cyclicals. There’s a real shortage now of growth companies. That is a red flag, because all the money is flowing into a few companies. There’s an end to that game. It will scare me if this trend continues for a couple more years,” he added.

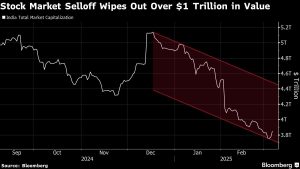

Why It Matters: Lynch’s insights come at a time when the stock market is experiencing significant volatility. His emphasis on the importance of growth stocks and active management provides valuable guidance for investors navigating this uncertain landscape.

His regret over missed investment opportunities serves as a reminder of the importance of thorough research and the potential benefits of investing in companies with strong growth potential.

His warning about the scarcity of growth companies could signal a shift in market dynamics, making his insights particularly relevant for investors.

Read Next

Momentum56.05

Growth46.68

Quality69.89

Value19.24

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.