High-rolling investors have positioned themselves bullish on ZIM Integrated Shipping ZIM, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ZIM often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 10 options trades for ZIM Integrated Shipping. This is not a typical pattern.

The sentiment among these major traders is split, with 70% bullish and 20% bearish. Among all the options we identified, there was one put, amounting to $46,000, and 9 calls, totaling $716,813.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $13.0 and $25.0 for ZIM Integrated Shipping, spanning the last three months.

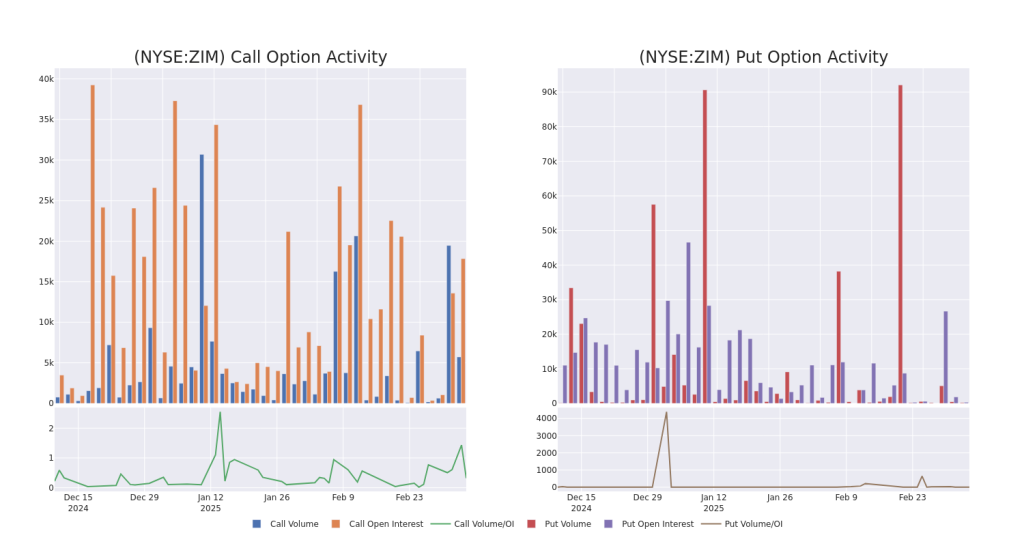

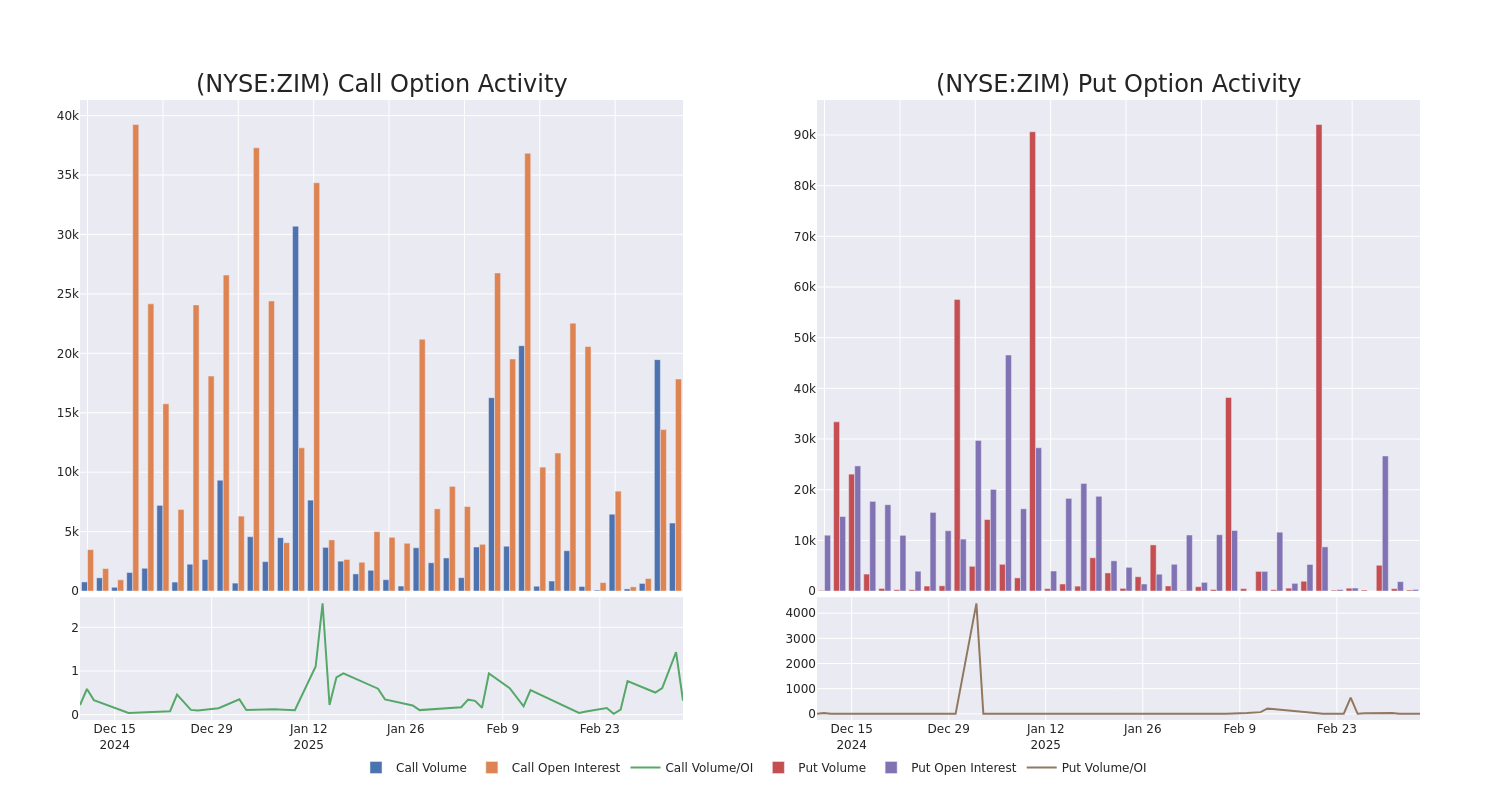

Volume & Open Interest Development

In today’s trading context, the average open interest for options of ZIM Integrated Shipping stands at 2592.71, with a total volume reaching 5,922.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ZIM Integrated Shipping, situated within the strike price corridor from $13.0 to $25.0, throughout the last 30 days.

ZIM Integrated Shipping Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZIM | CALL | TRADE | BEARISH | 03/21/25 | $5.0 | $4.5 | $4.5 | $17.16 | $112.5K | 1.7K | 250 |

| ZIM | CALL | TRADE | BULLISH | 03/07/25 | $0.75 | $0.52 | $0.75 | $20.00 | $108.7K | 2.2K | 1.4K |

| ZIM | CALL | TRADE | BULLISH | 03/21/25 | $4.35 | $3.7 | $4.2 | $17.16 | $105.0K | 1.7K | 250 |

| ZIM | CALL | TRADE | BULLISH | 04/04/25 | $8.0 | $7.85 | $8.0 | $13.00 | $104.0K | 130 | 0 |

| ZIM | CALL | TRADE | BULLISH | 04/17/25 | $4.3 | $4.05 | $4.3 | $17.16 | $86.0K | 5.1K | 10 |

About ZIM Integrated Shipping

ZIM Integrated Shipping Services Ltd is an asset-light container liner shipping company. It offers tailored services, including land transportation and logistical services, specialized shipping solutions, including the transportation of out-of-gauge cargo, refrigerated cargo, and dangerous and hazardous cargo. Its services include Cargo Services, Digital Services, Schedules, and Shipping Trades and Lines. Geographically, it derives a majority of its revenue from the Pacific trade region.

In light of the recent options history for ZIM Integrated Shipping, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of ZIM Integrated Shipping

- With a trading volume of 4,685,067, the price of ZIM is up by 8.62%, reaching $21.48.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 5 days from now.

Expert Opinions on ZIM Integrated Shipping

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $9.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Underweight rating for ZIM Integrated Shipping, targeting a price of $9.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for ZIM Integrated Shipping, Benzinga Pro gives you real-time options trades alerts.

Momentum91.28

Growth–

Quality–

Value99.13

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.