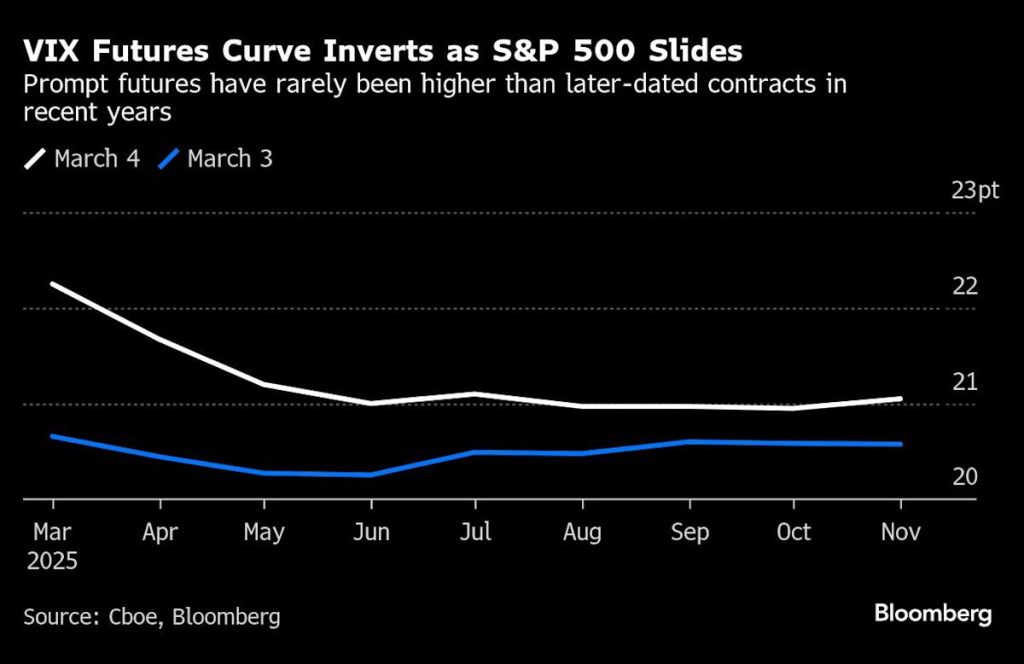

(Bloomberg) — A rout in the S&P 500 Index has boosted demand for short-term hedges, flipping the Cboe VIX Futures curve into a rare inversion.

Most Read from Bloomberg

Traders who had been lining up options to hedge against a steep pullback in the S&P 500 are reaping the benefit. In mid-February, huge volumes of call buying were seen in March-expiry strikes from 20 to 25, and last week more than 260,000 contracts of calls from 55 to 75 were bought.

VIX backwardation — when near-term contracts are higher than long-term — is “certainly indicative of market stress,” with VIX futures and options “rolling up the price curve instead of rolling down,” said Scott Maidel, a partner and portfolio manager at the volatility focused hedge fund QVR Advisors.

Since the curve was inverted for much of 2020 during Covid, in the past couple of years the premium has lasted only short periods. That may be different this time, according to Mandy Xu, head of derivatives market intelligence at Cboe.

“While the curve is technically backwardated, what stands out to me is how flat the curve is overall,” Xu said. “Traders are pricing for volatility to persist as economic uncertainty increases – this is not just a one-time shock to the market.”

Some positions were being moved out to later dates Tuesday, with more than 100,000 March 30/60 call spreads rolled in to April 35/75 spreads, signaling traders taking some profits on the higher-priced near term options and also extending their protection out further in case volatility remains higher.

Another volatility market distress signal that is flashing is the VVIX — a measure of the 30-day expected volatility of the VIX itself, based on trades in VIX options. The “vol of vol” rose above 125 early Tuesday, its highest level since December.

Maidel said that strategies investors looking to trade the VIX could include a type of call spreads where they buy a short dated VIX call, funded by selling a longer-dated VIX call.

Some of the sharp jump in the VIX seen during market drops may also come from a lack of selling pressure. According to Maidel, there are now fewer natural sellers of “long-tail” — or far higher-strike — volatility than in the period before the pandemic, when some fund managers were systematically selling volatility to generate yields.