NASDAQ:EU

TSXV:EU

www.encoreuranium.com

DALLAS, March 3, 2025 /PRNewswire/ – enCore Energy Corp. EU EU (the “Company” or “enCore”), America’s Clean Energy CompanyTM, today announced its financial and operational results for the fiscal year ended December 31, 2024. The Company expects to file its Annual Report on Form 10-K (“Form 10-K”) with the U.S. Securities and Exchange Commission (“SEC”) later today, which includes the Company’s audited consolidated financial statements, related notes, and management’s discussion and analysis (“MD&A”) for fiscal year 2024, and strategic milestones and outlook for 2025.

Financial Reporting Status Change Commentary:

As of January 1, 2025, the Company’s reporting status with the SEC changed from a foreign private issuer to a U.S. domestic issuer. As a result, the Company transitioned from International Financial Reporting Standards (“IFRS”) to U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) for all its financial reporting requirements.

While this transition resulted in differences in financial reporting under U.S. GAAP compared to IFRS, it also aligns the Company’s accounting treatment with U.S. reporting standards. By adjusting the carrying value of certain assets under U.S. GAAP, the Company expects a lower depreciation base going forward, which may positively impact reported earnings by reducing future non-cash expenses. The Company is an Exploration Stage Issuer, as it has not established proven or probable Mineral Reserves as defined under Subpart 1300 of Regulation S-K of the Exchange Act of 1934 (“S-K 1300”).

Financial Highlights for Fiscal Year 2024 and Future Outlook:

- Revenue: enCore reported total revenue of $58 million, reflecting a 163 percent increase from the year ended December 31, 2023, primarily due to increased uranium extraction. In 2024, sales were made from a combination of extracted and purchased pounds, while in 2023 all sales were from purchased pounds.

- Earnings Per Share: The Company recorded a loss per share of $0.34 for the year ended December 31, 2024, compared to a loss of $0.18 per share for the year ended December 31, 2023, the increase being primarily due to:

-

- Increased exploration and extraction activities in preparation for the ramp-up of the Company’s second ISR plant in late 2024 and the planned increase in well production in early 2025.

- The cost of converting to a large accelerated filer required to be in compliance with 404b of the Sarbanes Oxley Act of 2002, which included expenses of approximately $3 million.

- Net Income/Loss: The Company reported a net loss of $61.3 million for the year ended December 31, 2024, compared to a $25.6 million net loss for the year ended December 31, 2023. The inability to capitalize certain exploratory and development costs under U.S. GAAP which would have been capitalized under IFRS impacted both years, totaling $15 million for 2024, and $8 million for 2023.

- Balance Sheet Strength: enCore ended the year with $39.7 million in cash and cash equivalents.

Operational Achievements and Milestones:

- Uranium Sales: In 2024, enCore completed eight uranium sales to third parties totaling 720,000 pounds U3O8 at an average sales price of $81.02 per pound U3O8, not including converter and transaction costs. The Company used 580,000 pounds sourced from purchased uranium, and 140,000 pounds sourced from uranium extracted at the Rosita Central Processing Plant (“Rosita CPP”) and the Alta Mesa Central Processing Plant (“Alta Mesa CPP”).

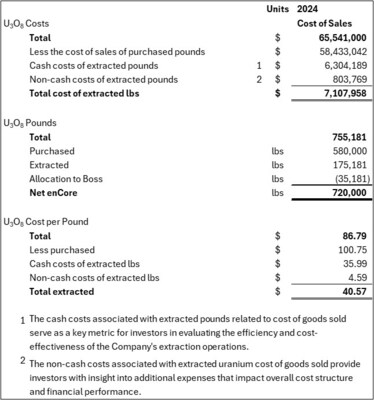

- Uranium Extraction Results: In 2024, for the Rosita and Alta Mesa CPPs combined, 288,589 pounds U3O8 were captured on ion exchange (“IX”) resin, the largest amount of any U.S. producer in 2024. The cost of extraction can be seen in the non-GAAP table in the Appendix.

- Joint Venture Partner: In February 2024, enCore announced a joint venture (“JV”) to develop and operate Alta Mesa with Boss Energy Ltd. (“Boss”). The JV is 70 percent owned by enCore and 30 percent owned by Boss, with enCore remaining the project manager. Through Nov. 30, 2024, 35,181 pounds U3O8 from the JV were transferred to Boss, pursuant to the JV.

- Uranium Inventories: During 2024, the Company acquired 825,000 pounds U3O8. As of December 31, 2024, the Company held 358,408 pounds U3O8 as inventory.

- Uranium Central Processing Plants: In 2024, enCore focused on starting up its uranium recovery operations at the Rosita CPP, which began operations in November 2023; and at the Alta Mesa CPP which commenced operations in June 2024. The Company is proud of the team’s ability to bring these two extraction plants online.

- Uranium Contracting: Throughout 2024, enCore created a balanced uranium sales agreement portfolio to provide multiple pricing structures to support future market changes and production plans. The Company has executed twelve uranium sales agreements to supply uranium to nuclear power plants in the United States and one legacy uranium sales agreement with a uranium trading company. These agreements represent various delivery periods from 2024 through 2034. enCore’s uranium sales agreement portfolio is a mix of market related pricing, hybrid base price and market related pricing, base escalated pricing, and fixed prices. As of December 31, 2024, the Company had 8.30 million pounds U3O8 in committed uranium sales from 2025 through 2033. Six of the current contracts provide the optionality to add an additional 2.2 million pounds U3O8 through 2033.

- Sustainability: In October 2024, enCore issued its inaugural Sustainability Report detailing the Company’s environmental, social responsibility, and governance for its South Texas operations. The report also set forth key performance indicators that establish goals for continuing improvement.

2025 Outlook and Future Planned Activities:

enCore remains committed to advancing extraction-ready projects, deploying capital responsibly, and strengthening its team to support the continued growth of its ISR uranium production capacity to meet the growing demand for a secure domestic uranium supply.

- Focusing on Continued Extraction Growth: enCore is focused on installing wellfield patterns to expand uranium extraction in South Texas. Since the start of 2024, the Company has increased the number of drilling rigs to 17 operating in South Texas. The increased drilling rig count will alleviate bottlenecks in wellfield pattern replacement rates observed earlier in the year that delayed expansion of uranium extraction. The Upper Spring Creek Project will provide uranium-bearing resin to the Rosita CPP following final permitting expected to be complete in 2025. The Company also made substantial progress at its Dewey Terrace and Dewey-Burdock Projects along the Wyoming–South Dakota border, as well as the Gas Hills Project in Wyoming. These efforts align with the Company’s strategy to advance extraction-ready projects and scale its ISR uranium recovery capacity.

- Regulatory Approvals: enCore continues to advance key permitting and licensing milestones for its projects in South Texas, South Dakota and Wyoming.

On March 2, 2025, the board of directors of enCore appointed Robert Willette, the current Chief Legal Officer, as Acting Chief Executive Officer, effectively immediately. Mr. Willette succeeds Paul Goranson, who is no longer serving as enCore’s Chief Executive Officer or as a member of the board of directors.

Investor Information

enCore’s full financial statements, including MD&A, are available in the Company’s Annual Report on Form 10-K, to be filed with the SEC. The report can be accessed at www.sec.gov and on enCore’s investor relations page at www.encoreuranium.com.

Technical Disclosure and Qualified Person

John M. Seeley, Ph.D., P.G., C.P.G., enCore’s Manager of Geology and Exploration, and a Qualified Person under Canadian National Instrument 43-101 and S-K 1300, has reviewed and approved the technical disclosure in this news release on behalf of the Company.

About enCore Energy Corp.

enCore Energy Corp., America’s Clean Energy Company™, is committed to providing clean, reliable, and affordable fuel for nuclear energy as the only United States uranium producer with multiple extraction facilities in operation. The enCore team is led by industry experts with extensive knowledge and experience in all aspects of In-Situ Recovery uranium operations and the nuclear fuel cycle. enCore solely utilizes ISR for uranium extraction, a well-known and proven technology co-developed by the leaders at enCore Energy.

Following up on enCore’s demonstrated success in South Texas, future projects in enCore’s pipeline include the Dewey-Burdock Project in South Dakota and the Gas Hills Project in Wyoming. The Company holds other non-core assets including significant New Mexico resources and conventional projects in Arizona, Utah, and Wyoming along with proprietary databases. enCore is committed to working with local communities and Indigenous governments to create positive impact from corporate developments.

Learn more at www.encoreuranium.com.

Cautionary Note Regarding Forward Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and Canadian securities laws that are based on management’s current expectations, assumptions, and beliefs. Forward-looking statements can often be identified by such words as “expects”, “plans”, “believes”, “intends”, “continue”, “potential”, “remains”, and similar expressions or variations (including negative variations) of such words and phrases, or statements that certain actions, events or results “may”, “could”, or “will” be taken.

Forward-looking statements and information that are not statements of historical fact include, but are not limited to, any information relating to statements regarding future or potential extraction, and any other statements regarding future expectations, beliefs, goals or prospects, statements regarding the success of current and future ISR operations, including projects in our pipeline, our development plans, our future extraction plans and associated economics, including the assumptions underlying the economic analyses, the Company’s expectations for a lower deprecation base going forward and the impact to reported earnings, the belief that 2025 will demonstrate improvements in efficiency, timing and overall productivity, that the projects will be a reliable supplier of fuel, the expected timing of a commercial operation, estimated mineral resources and financials, expected major plant aspects that the projects will be successfully operable ISR operations, the ability to meet the increasing demand for clean, reliable nuclear energy, the ability to complete and expected timing of completion of permitting and licensing and our commitment to working with local communities and indigenous governments to create positive impact from corporate developments should be considered forward looking statements. All such forward-looking statements are not guarantees of future results and forward-looking statements are subject to important risks and uncertainties, many of which are beyond the Company’s ability to control or predict, that could cause actual results to differ materially from those expressed in any forward looking statement, including those described in greater detail in our filings with the SEC and on SEDAR+, particularly those described in our Annual Report on Form 10-K, annual information from and MD&A. Forward-looking statements necessarily involve known and unknown risks, including, without limitation, risks associated with assumptions regarding project economics; discount rates; expenditures and the current cost environment; timing and schedule of the projects, general economic conditions; adverse industry events; future legislative and regulatory developments; the ability of enCore to implement its business strategies; and other risks. A number of important factors could cause actual results or events to differ materially from those indicated or implied by such forward-looking statements, including without limitation exploration and development risks, changes in commodity prices, access to skilled personnel, the results of exploration and development activities; extraction risks; uninsured risks; regulatory risks; defects in title; the availability of materials and equipment, timeliness of government approvals and unanticipated environmental impacts on operations; litigation risks; risks posed by the economic and political environments in which the Company operates and intends to operate; increased competition; assumptions regarding market trends and the expected demand and desires for the Company’s products and proposed products; reliance on industry equipment manufacturers, suppliers and others; the failure to adequately protect intellectual property; the failure to adequately manage future growth; adverse market conditions, the failure to satisfy ongoing regulatory requirements and factors relating to forward looking statements listed above. Should one or more of these risks materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated, or expected. The Company assumes no obligation to update the information in this communication, except as required by law. Additional information identifying risks and uncertainties is contained in filings by the Company with the various securities commissions which are available online at www.sec.gov and www.sedarplus.ca. Forward-looking statements are provided for the purpose of providing information about the current expectations, beliefs and plans of management. Such statements may not be appropriate for other purposes and readers should not place undue reliance on these forward-looking statements, that speak only as of the date hereof, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures. A “non-GAAP financial measure” is defined as a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flows of the Company. The non-GAAP financial measures used within this press release are total cost of extracted pounds, uranium cost per extracted pound, total cost of extracted inventory and uranium cost per extracted pound in inventory. Total cost of extracted pounds is the cost of sales less the cost of sales of purchased goods, which includes the aggregate purchase price of uranium sourced from purchased uranium. Uranium cost per extracted pound is the total cost of extracted pounds divided by the pounds of uranium extracted during the period. Total cost of extracted inventory is inventory less purchased uranium inventories. Uranium cost per pound of extracted inventory is the total cost of extracted inventory divided by pounds of extracted inventory. We consider the total cost of extracted pounds, uranium cost per extracted pound total cost of extracted inventory and uranium cost per pound of extracted inventory, including allocations of cash and non-cash costs, in evaluating the efficiency and cost-effectiveness of the Company’s extraction operations and overall cost structure.

Appendix: Tables

Non-GAAP measures for 2024 uranium product sold and inventory held on December 31, 2024

Table 1.1 – Non-GAAP Measures for 2024 Uranium Product Sales

Table 1.2 – Non-GAAP Measures for Inventory Held by the Company on December 31, 2024.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/encore-energy-corp-reports-fiscal-year-2024-financial-results-and-files-annual-report-on-form-10-k-302389952.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/encore-energy-corp-reports-fiscal-year-2024-financial-results-and-files-annual-report-on-form-10-k-302389952.html

SOURCE enCore Energy Corp.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.