On surface level, satellite and launch service specialist Rocket Lab USA Inc. RKLB presents itself as a sterling opportunity. For one thing, it’s positioned as one of the top players in the burgeoning space economy. On another note, the company is coming off the back of a strong first-quarter sales print. Nevertheless, RKLB stock has been hurting in recent sessions and the pain may worsen.

In isolation, RKLB stock should stand out as an unequivocal sector leader. Following the market close on Thursday, Rocket Lab reported fourth-quarter revenue of $132.39 million, beating the consensus estimate of $130.58 million. On the bottom line, the space specialist posted a loss of 10 cents per share, in line with expectations.

Additionally, Rocket Lab founder and CEO Peter Beck introduced Flatellite, a low-cost, mass-producible satellite developed by the company for large constellations. This technology will allow enterprises participating in the space economy to facilitate communication among groups of satellites to perform specialized tasks. Further, the innovation has powerful implications for national security, defense and commercial industries.

So, the question of the hour: why is the market response to the earnings report lackluster? The answer lies in the following guidance.

Rocket Lab anticipates that first-quarter revenue will range from $117 million to $123 million. This guidance conspicuously fell short of analysts’ consensus view of $135.67 million. Subsequently, the matter drew unwanted attention toward RKLB’s sky-high sales multiple, which stands at nearly 27 times trailing-12-month (TTM) revenue.

Unfortunately, the problem is that even assuming sales rise to the highest-analyst estimate for fiscal 2025 of $649.78 million, RKLB stock would be trading at a sales multiple of over 15 times. In the first calendar quarter last year, RKLB exchanged hands at only 8.1 times revenue. Hence, the disconnect between Rocket Lab’s fourth-quarter performance and market sentiment for its equity.

Technical And Statistical Risks Also Cloud RKLB Stock

While Rocket Lab might seem to be a discounted investment, the problem is professional traders must make a distinction between an entity being undervalued versus merely being cheap. This assessment isn’t as easy as it sounds, thereby introducing technical risks to RKLB stock. As if to reinforce the point, RKLB doesn’t enjoy a statistically robust framework when responding to extreme volatility.

To be sure, the space economy is a massive industry, one which Morgan Stanley predicts could reach $1 trillion by 2040. However, McKinley & Company issued a reality check — colloquially a truth bomb — against excessive speculation. “Given the capital-intensive nature of space products, [venture capitalists] like to see that companies have the proprietary and unique tech to achieve clear differentiation and a strong ‘competitive moat’ to prevent future market share erosion,” the consulting firm wrote.

By logical deduction, there are significant technical risks against RKLB stock, especially if it cannot quickly and convincingly storm above the psychological threshold of $20. The longer the security lingers sandwiched between its 50-day and 200-day moving averages (at $26.53 and $13.52, respectively), the more the hot sales multiple may induce anxiety among shareholders — especially shareholders who are already deeply profitable (for now).

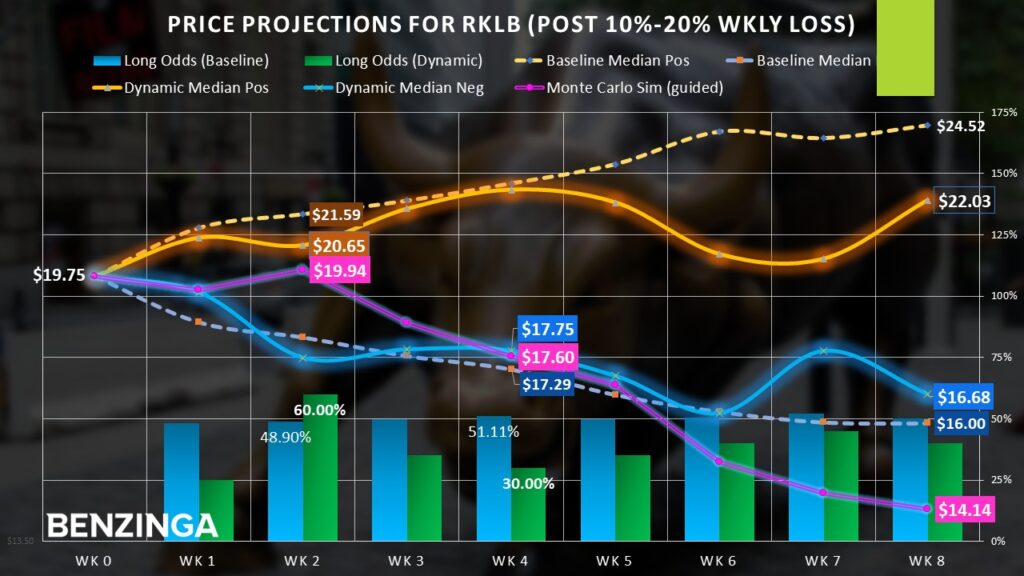

To emphasize the risks, RKLB stock by nature is a coin flip. Using data since its public market debut, a position entered at the beginning of the week has a 48.1% chance of rising by the end of it. Over an eight-week period, this baseline probability is 50/50.

When calculating probabilities dynamically — in this case, accounting for severe volatility — pricing behaviors shift unfavorably. Following a one-week loss between 10% and 20%, RKLB historically has a 25% chance of rising in the first subsequent week. Over an eight-week holding period, the likelihood of profitability is only 40%.

For this week, RKLB stock is on pace to lose around 17%. Assuming prevailing winds under similar circumstances materialize, the outlook is more negative than positive.

Rocket Lab’s Wild Nature Delights Agnostic Traders

Although Rocket Lab may not be the most comfortable investment based on its wild nature, the framework seems to delight agnostic traders who are looking to extract profits no matter the direction.

In this case, while the probabilities may imply a net negative outcome for RKLB stock, the trajectory will likely not be perfectly linear. Running a guided Monte Carlo simulation reflecting RKLB’s probability dynamics reveals the possibility of a dead-cat bounce within the next two weeks before ultimately eroding to around where its 200 DMA currently sits.

With this market intelligence, traders can deploy two different options strategies. First, one could consider a 19/20 bull call spread for the options chain expiring March 14. This transaction involves buying the $19 call (at a $182 ask) and simultaneously selling the $20 call (at a $125 bid). The idea is to front run the potential dead-cat bounce.

Traders use the short call sale to offset some of the long call’s debit, resulting in a net debit of $57. The maximum reward should RKLB stock reach $20 at expiration is $43, or a 75.4% payout.

However, the most aggressive trade may be the 18/17 bear put spread for the options chain expiring March 28. This expiration period coincides with when RKLB stock is projected to incur the lowest odds of upside success from the anchor point.

Specifically, the above transaction involves buying the $18 put (at a $116 ask) and simultaneously selling the $17 put (at a $73 bid), resulting in a net debit paid of $43. The maximum reward should RKLB stock drop to $17 is $57 or a 132.6% payout.

For the March 28 expiration, speculators can go less aggressive with a 19/18 bear put spread, although the payout diminishes considerably to 72.4% due to the higher likelihood of success.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.