High-rolling investors have positioned themselves bearish on Cytokinetics CYTK, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CYTK often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 11 options trades for Cytokinetics. This is not a typical pattern.

The sentiment among these major traders is split, with 18% bullish and 72% bearish. Among all the options we identified, there was one put, amounting to $26,400, and 10 calls, totaling $2,209,345.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $60.0 for Cytokinetics over the recent three months.

Insights into Volume & Open Interest

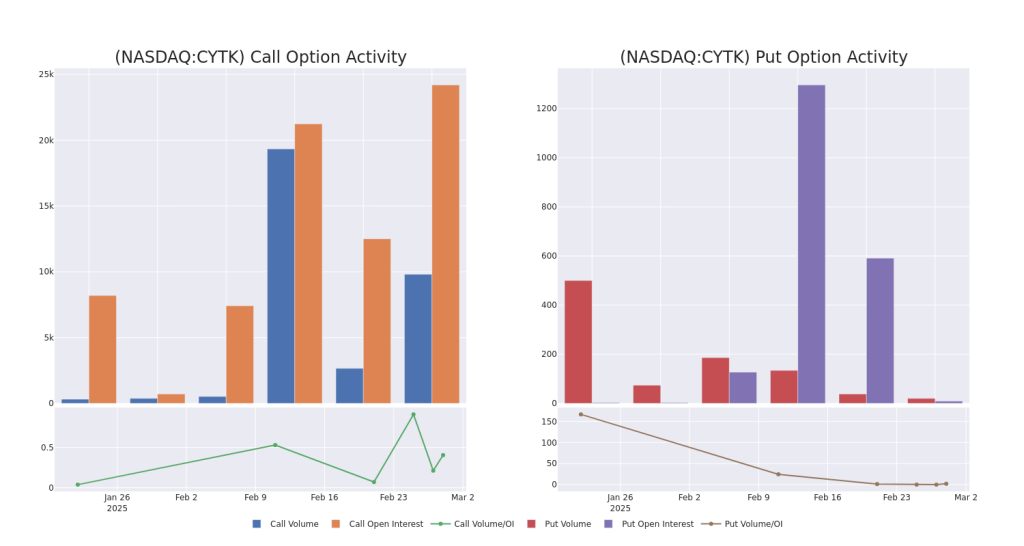

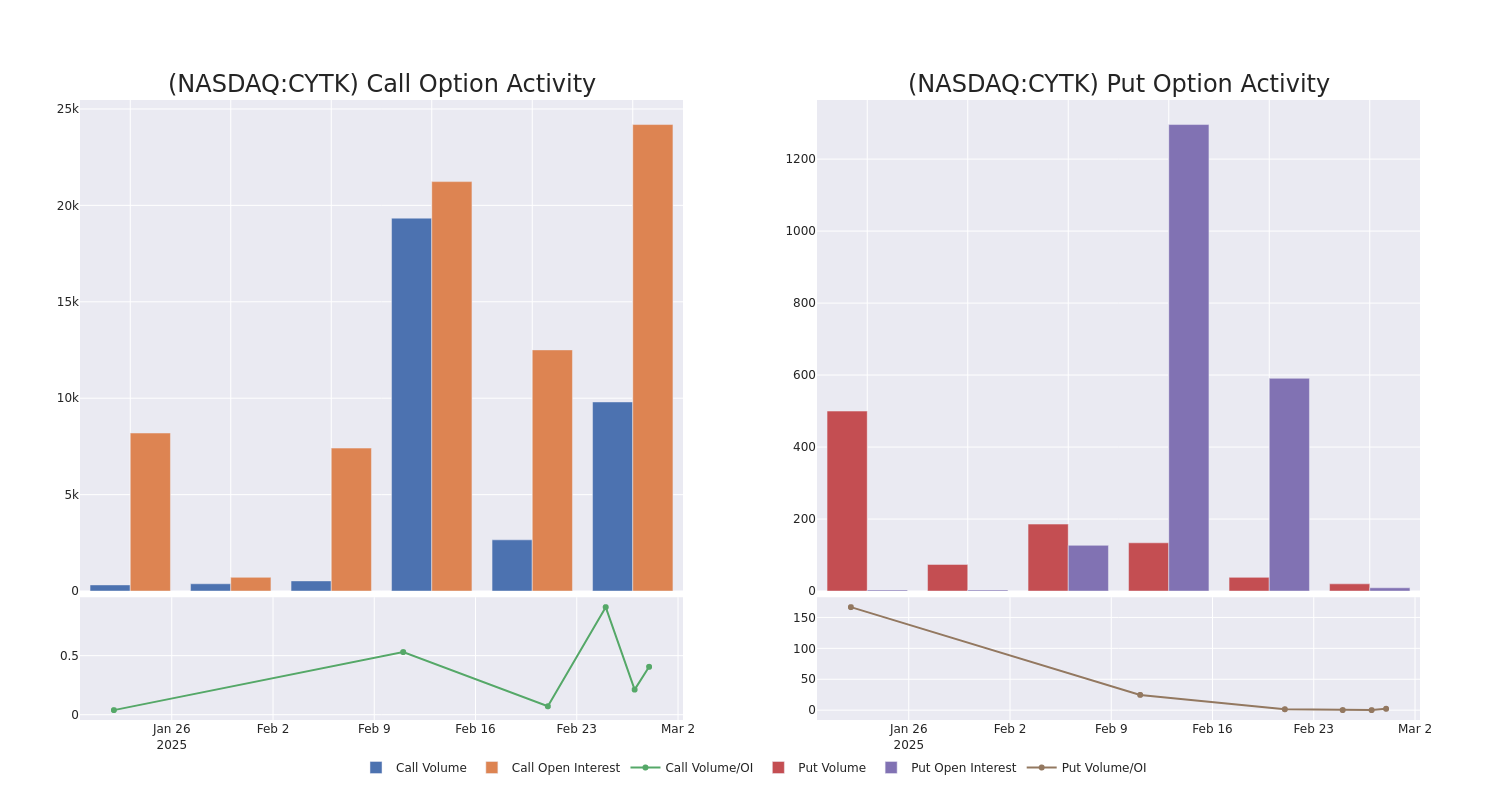

In today’s trading context, the average open interest for options of Cytokinetics stands at 6050.25, with a total volume reaching 9,826.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cytokinetics, situated within the strike price corridor from $45.0 to $60.0, throughout the last 30 days.

Cytokinetics Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CYTK | CALL | TRADE | BULLISH | 01/16/26 | $8.3 | $8.0 | $8.3 | $60.00 | $593.4K | 10.8K | 1.0K |

| CYTK | CALL | TRADE | BEARISH | 05/16/25 | $6.5 | $6.1 | $6.1 | $50.00 | $301.9K | 12.9K | 503 |

| CYTK | CALL | TRADE | BEARISH | 05/16/25 | $7.5 | $6.6 | $6.6 | $50.00 | $301.6K | 12.9K | 1.5K |

| CYTK | CALL | SWEEP | BEARISH | 01/16/26 | $8.4 | $8.0 | $8.4 | $60.00 | $238.5K | 10.8K | 297 |

| CYTK | CALL | TRADE | BEARISH | 05/16/25 | $6.1 | $5.8 | $5.8 | $50.00 | $233.1K | 12.9K | 2.0K |

About Cytokinetics

Cytokinetics Inc is a biotechnology company that develops muscle biology-driven treatments for diseases characterized by reduced muscle function, muscle weakness, and fatigue. The company develops treatments for diseases such as amyotrophic lateral sclerosis, heart failure, spinal muscular atrophy, and chronic obstructive pulmonary diseases. The treatment is based on small molecules specifically engineered to increase muscle function and contractility. The company is developing muscle-directed investigational medicines that may potentially improve the health span of people with devastating cardiovascular and neuromuscular diseases of impaired muscle function.

Following our analysis of the options activities associated with Cytokinetics, we pivot to a closer look at the company’s own performance.

Where Is Cytokinetics Standing Right Now?

- With a trading volume of 1,337,052, the price of CYTK is down by -6.22%, reaching $44.5.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 68 days from now.

What Analysts Are Saying About Cytokinetics

In the last month, 5 experts released ratings on this stock with an average target price of $84.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a positive move, an analyst from Morgan Stanley has upgraded their rating to Overweight and adjusted the price target to $67.

* An analyst from Citigroup has revised its rating downward to Buy, adjusting the price target to $86.

* An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $72.

* In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $120.

* Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $78.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cytokinetics options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.