Whales with a lot of money to spend have taken a noticeably bullish stance on Oklo.

Looking at options history for Oklo OKLO we detected 35 trades.

If we consider the specifics of each trade, it is accurate to state that 48% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 20 are puts, for a total amount of $852,722 and 15, calls, for a total amount of $675,968.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $47.0 for Oklo over the last 3 months.

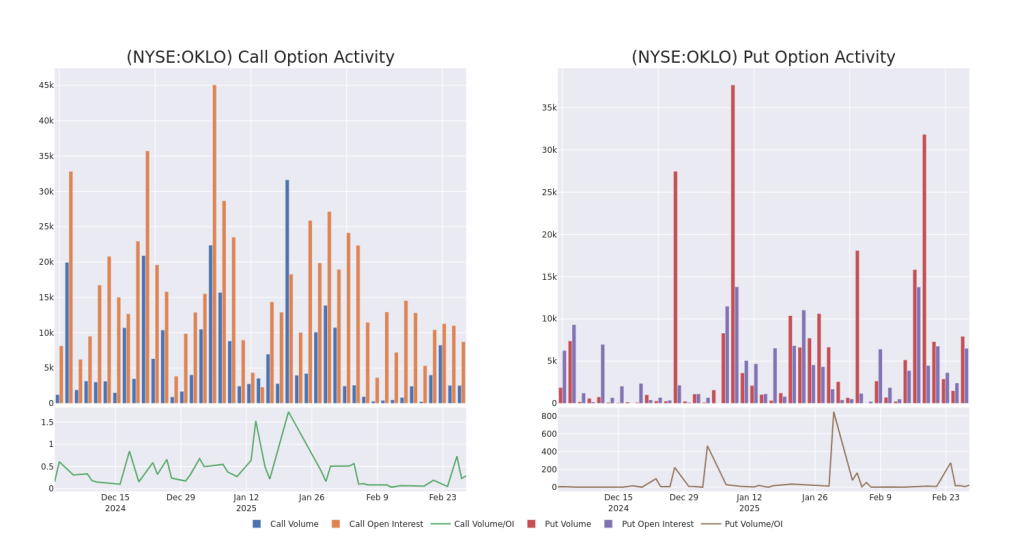

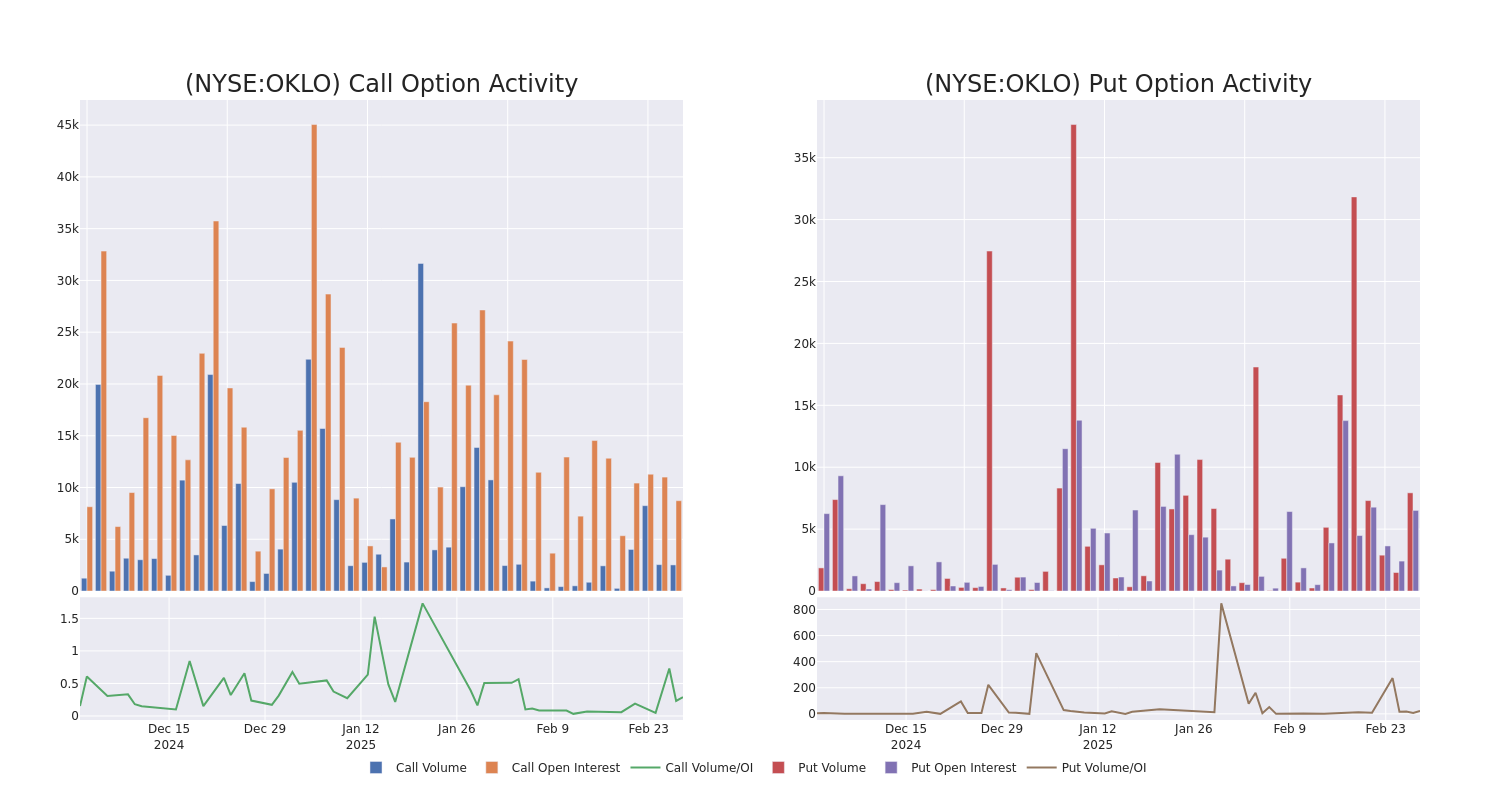

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Oklo’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Oklo’s substantial trades, within a strike price spectrum from $20.0 to $47.0 over the preceding 30 days.

Oklo Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OKLO | PUT | TRADE | BULLISH | 01/16/26 | $5.9 | $5.65 | $5.73 | $22.50 | $257.8K | 979 | 1.0K |

| OKLO | CALL | SWEEP | BEARISH | 03/07/25 | $2.26 | $2.14 | $2.14 | $36.00 | $85.6K | 180 | 892 |

| OKLO | CALL | TRADE | BULLISH | 03/21/25 | $6.3 | $5.9 | $6.3 | $30.00 | $62.3K | 3.1K | 118 |

| OKLO | CALL | SWEEP | BULLISH | 09/19/25 | $11.9 | $11.2 | $11.8 | $34.00 | $59.0K | 15 | 62 |

| OKLO | CALL | TRADE | BEARISH | 09/19/25 | $12.15 | $11.5 | $11.72 | $33.00 | $58.6K | 29 | 50 |

About Oklo

Oklo Inc is developing advanced fission power plants to provide clean, reliable, and affordable energy at scale. It is pursuing two complementary tracks to address this demand: providing reliable, commercial-scale energy to customers; and selling used nuclear fuel recycling services to the U.S. market. The Company plans to commercialize its liquid metal fast reactor technology with the Aurora powerhouse product line. The first commercial Aurora powerhouse is designed to produce up to 15 megawatts of electricity (MWe) on both recycled nuclear fuel and fresh fuel.

In light of the recent options history for Oklo, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Oklo

- With a volume of 11,182,131, the price of OKLO is up 2.07% at $33.06.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 11 days.

What The Experts Say On Oklo

In the last month, 1 experts released ratings on this stock with an average target price of $58.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B. Riley Securities persists with their Buy rating on Oklo, maintaining a target price of $58.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oklo with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.