(Bloomberg) — US government bonds trimmed their losses late in Thursday trading as equities came under pressure, leaving yields near the lowest levels since December.

Most Read from Bloomberg

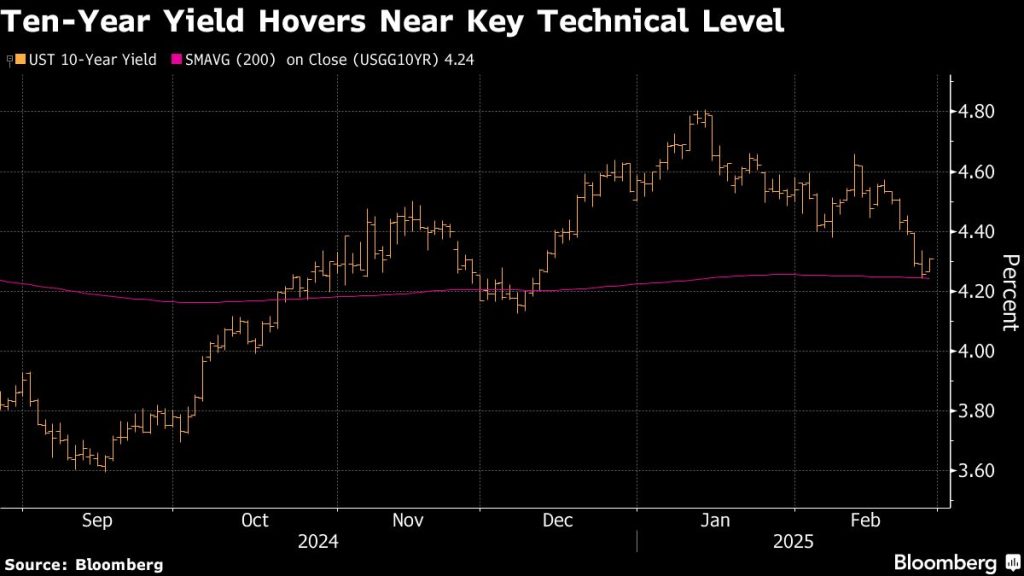

Late in the New York session, the two-year yield was lower by one basis point at 4.06%, while the 10-year was a touch higher at 4.27% — and down from a session peak of 4.31%. The moves came as Federal Reserve officials underlined their expectations that interest rates will stay on hold for some time.

Economic data and comments from President Donald Trump earlier on Thursday, meanwhile, had failed to provide a fresh catalyst to buy Treasuries. Yields remained slightly higher after upward revisions to price gauges in the fourth-quarter US gross domestic product report and a bigger-than-expected jump in jobless claims. Meanwhile, Trump said tariffs would go into effect March 4 on imports from Mexico, Canada and China.

The bond market has rallied for six straight sessions, fueled by weaker-than-expected economic data and speculation that tariffs and US government retrenchment will make things worse, at least in the short term. Higher by about three basis points across maturities Thursday, yields remain some 30 basis points below their February peaks and on course for steep monthly declines.

“The market has been taken off guard in the last week with some US macro weakness,” said Evelyne Gomez-Liechti, strategist at Mizuno International.

Speaking Thursday, Philadelphia Fed President Patrick Harker said officials should allow their policy stance to continue to lower inflation, signaling support for holding interest rates steady for now. Cleveland Fed President Beth Hammack said interest rates are not “meaningfully restrictive” and should be held steady for some time as officials wait for evidence inflation is returning to their 2% target.

The ICE BofA MOVE Index, which measures implied volatility for a basket of fixed-income assets, has risen to a six-week high.

Mounting worries and confusion over the impact Trump’s threatened trade tariffs have spurred bets the Federal Reserve will need to shift its focus away from inflation to tackling economic weakness with lower interest rates.

That’s putting more attention on economic growth indicators, and traders have resumed fully pricing in two quarter-point cuts by the Fed this year.