(Reuters) – Robinhood said on Monday the U.S. Securities and Exchange Commission had closed its probe into the firm’s crypto trading arm with no action, signaling further regulatory changes in the crypto industry since President Donald Trump took office.

The retail trading platform’s shares were up 3.3% in premarket hours.

Robinhood had received a so-called ‘Wells notice’ in May last year, which is issued when the SEC is planning to bring enforcement action against a company, over crypto tokens traded on its platform.

However, the SEC has moved to ease its crypto-related regulations under Trump’s leadership. It has established a task force to focus on clarifying the regulatory framework around crypto assets and rescinded key accounting guidance.

These overhauls come ahead of the arrival of Paul Atkins, Trump’s pick for the SEC chair, whom crypto industry executives see as a friendly pick.

“We applaud the staff’s decision to close this investigation with no action,” said Dan Gallagher, Chief Legal, Compliance and Corporate Affairs Officer at Robinhood Markets, in a blog post.

The SEC did not immediately respond to Reuters’ request for comment.

The SEC dropped a lawsuit against crypto firm Coinbase last week, ending a contentious, years-long legal battle that was once considered existential for the trading platform.

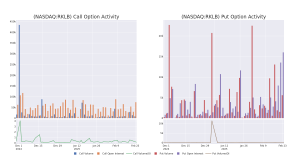

Robinhood earlier this month beat fourth-quarter profit estimates, helped by a surge in equity, option and crypto trading on its platform following Trump’s return to the White House.

(Reporting by Jaiveer Singh Shekhawat in Bengaluru; Editing by Shreya Biswas)