Deep-pocketed investors have adopted a bullish approach towards MicroStrategy MSTR, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MSTR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 118 extraordinary options activities for MicroStrategy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 34% bearish. Among these notable options, 36 are puts, totaling $2,535,260, and 82 are calls, amounting to $5,032,725.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $0.5 to $1080.0 for MicroStrategy during the past quarter.

Analyzing Volume & Open Interest

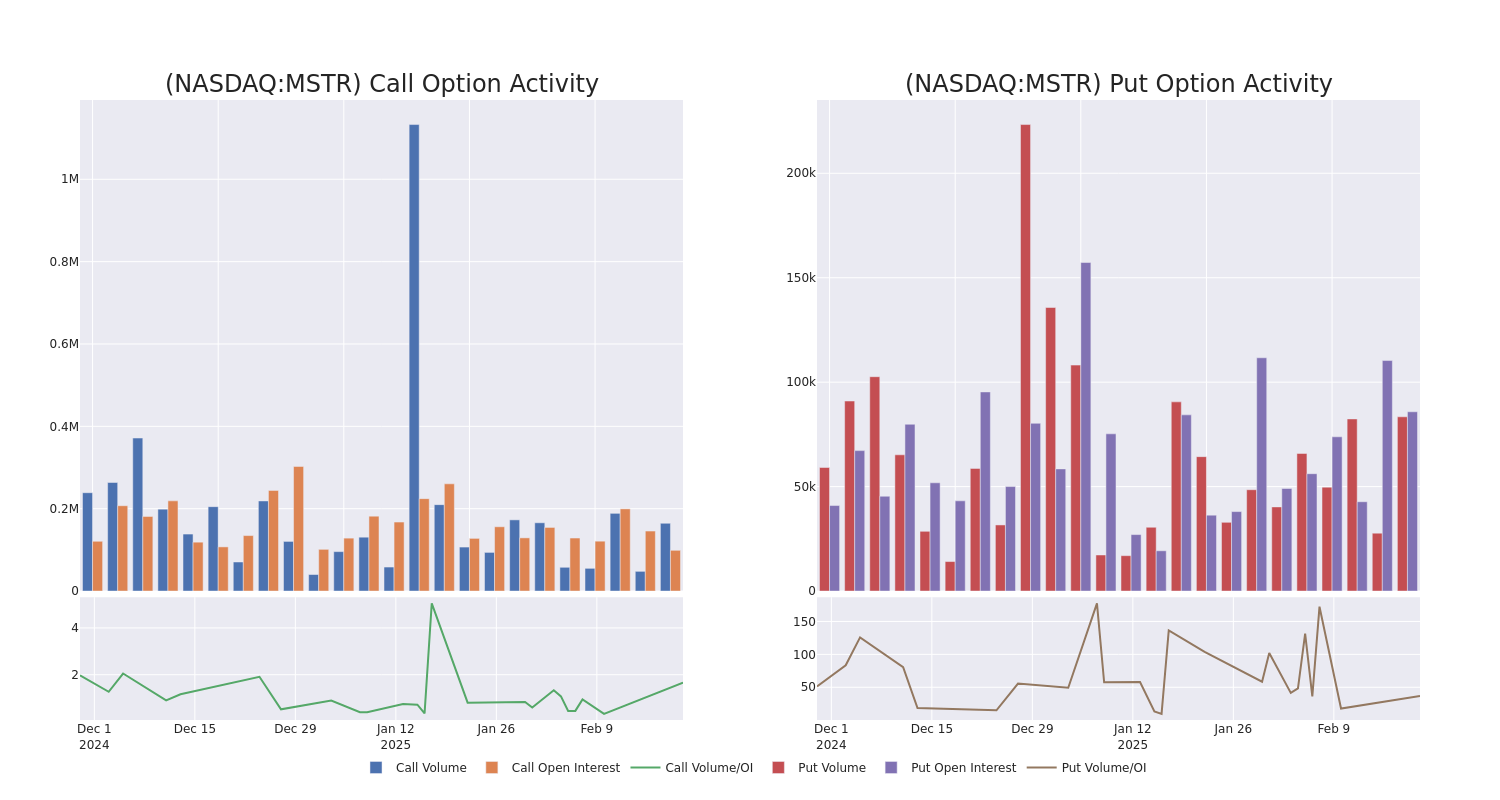

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for MicroStrategy’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MicroStrategy’s whale trades within a strike price range from $0.5 to $1080.0 in the last 30 days.

MicroStrategy Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | SWEEP | BULLISH | 09/19/25 | $28.85 | $28.7 | $28.7 | $600.00 | $999.9K | 3.7K | 79 |

| MSTR | PUT | SWEEP | NEUTRAL | 02/28/25 | $18.15 | $17.4 | $17.79 | $320.00 | $154.7K | 4.1K | 6.9K |

| MSTR | CALL | TRADE | BULLISH | 02/21/25 | $51.0 | $51.0 | $51.0 | $265.00 | $153.0K | 300 | 30 |

| MSTR | CALL | SWEEP | BULLISH | 03/21/25 | $15.0 | $14.4 | $14.8 | $350.00 | $130.2K | 3.4K | 432 |

| MSTR | CALL | TRADE | NEUTRAL | 02/28/25 | $12.8 | $12.2 | $12.48 | $310.00 | $124.8K | 681 | 416 |

About MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company’s reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

In light of the recent options history for MicroStrategy, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of MicroStrategy

- With a volume of 8,171,629, the price of MSTR is down -4.37% at $309.75.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 66 days.

Expert Opinions on MicroStrategy

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $504.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Cantor Fitzgerald continues to hold a Overweight rating for MicroStrategy, targeting a price of $619.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on MicroStrategy with a target price of $421.

* An analyst from Canaccord Genuity has decided to maintain their Buy rating on MicroStrategy, which currently sits at a price target of $409.

* Reflecting concerns, an analyst from Keefe, Bruyette & Woods lowers its rating to Outperform with a new price target of $560.

* In a cautious move, an analyst from Mizuho downgraded its rating to Outperform, setting a price target of $515.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MicroStrategy options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.