Deep-pocketed investors have adopted a bullish approach towards Alphabet GOOGL, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GOOGL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 17 extraordinary options activities for Alphabet. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 58% leaning bullish and 35% bearish. Among these notable options, 2 are puts, totaling $98,760, and 15 are calls, amounting to $827,689.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $150.0 and $300.0 for Alphabet, spanning the last three months.

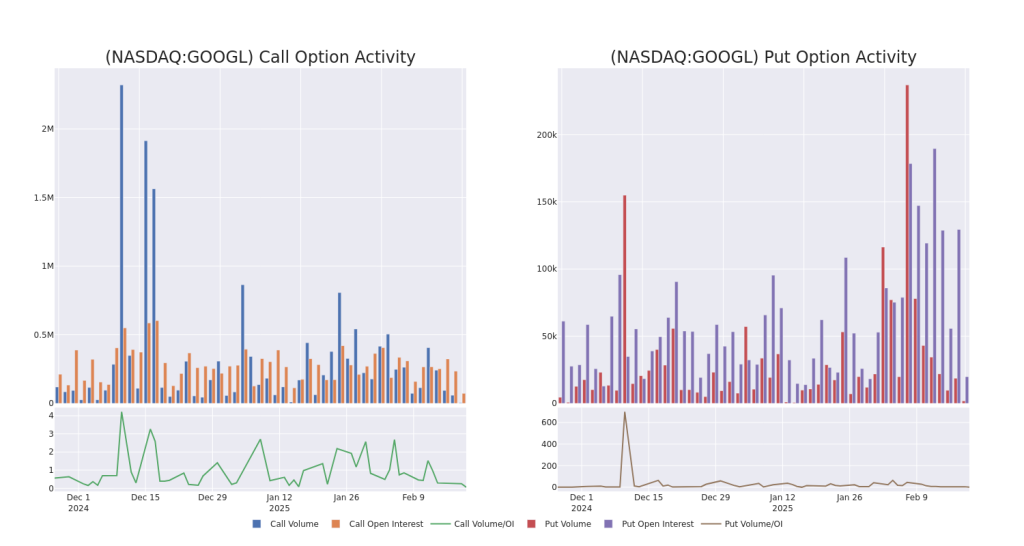

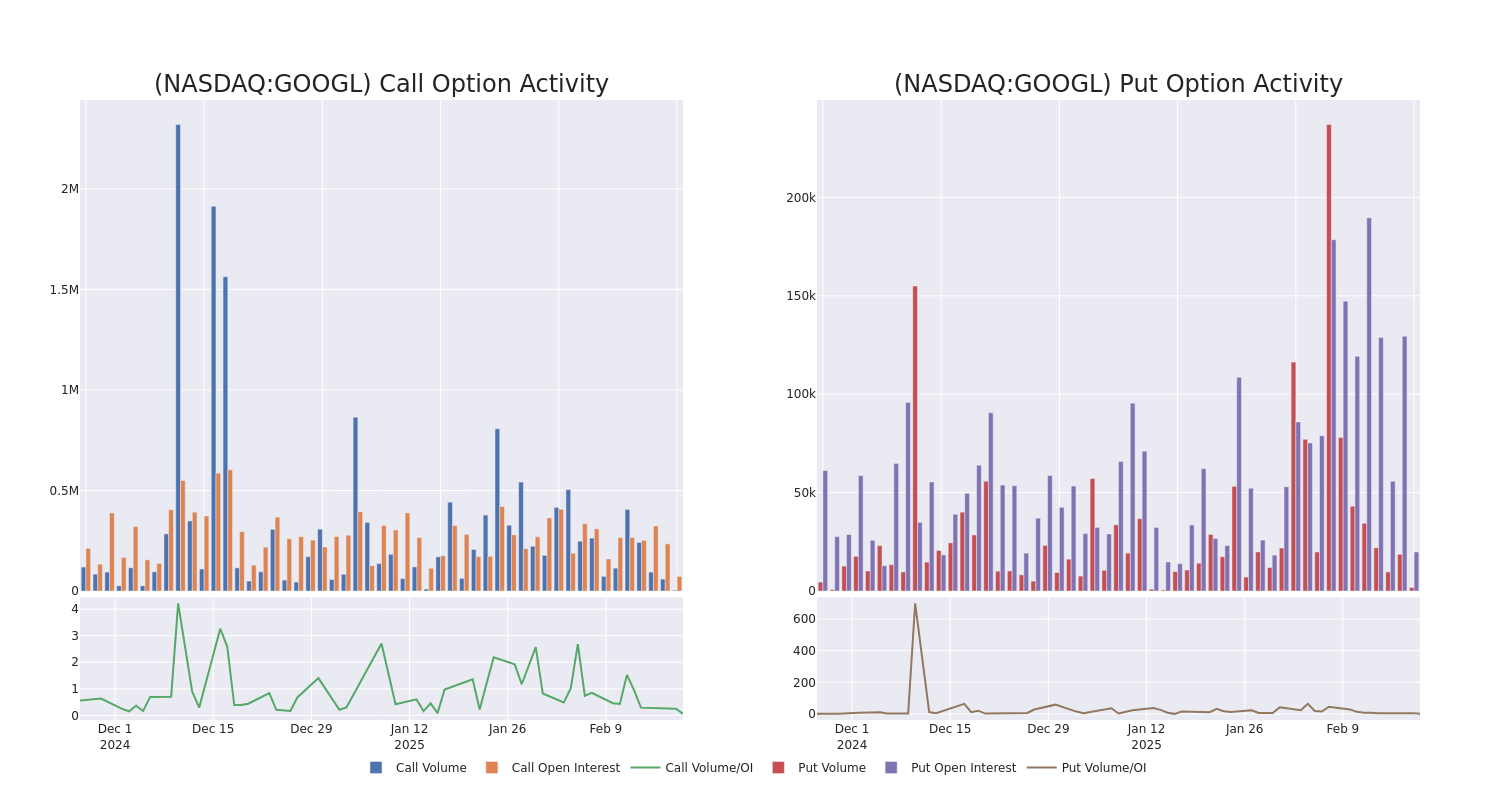

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Alphabet’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Alphabet’s whale trades within a strike price range from $150.0 to $300.0 in the last 30 days.

Alphabet Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOOGL | CALL | TRADE | BULLISH | 06/20/25 | $38.4 | $38.05 | $38.3 | $150.00 | $153.2K | 2.7K | 0 |

| GOOGL | CALL | TRADE | BULLISH | 03/20/26 | $25.8 | $25.55 | $25.7 | $185.00 | $128.5K | 405 | 15 |

| GOOGL | CALL | TRADE | BULLISH | 06/20/25 | $8.3 | $8.25 | $8.3 | $195.00 | $88.8K | 6.1K | 309 |

| GOOGL | CALL | SWEEP | BEARISH | 06/20/25 | $8.15 | $8.1 | $8.1 | $195.00 | $76.9K | 6.1K | 19 |

| GOOGL | PUT | SWEEP | BULLISH | 05/16/25 | $4.45 | $4.4 | $4.4 | $170.00 | $56.7K | 3.6K | 1.3K |

About Alphabet

Alphabet is a holding company that wholly owns internet giant Google. The California-based company derives slightly less than 90% of its revenue from Google services, the vast majority of which is advertising sales. Alongside online ads, Google services houses sales stemming from Google’s subscription services (YouTube TV, YouTube Music among others), platforms (sales and in-app purchases on Play Store), and devices (Chromebooks, Pixel smartphones, and smart home products such as Chromecast). Google’s cloud computing platform, or GCP, accounts for roughly 10% of Alphabet’s revenue with the firm’s investments in up-and-coming technologies such as self-driving cars (Waymo), health (Verily), and internet access (Google Fiber) making up the rest.

Having examined the options trading patterns of Alphabet, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Alphabet

- Trading volume stands at 5,349,686, with GOOGL’s price down by -0.96%, positioned at $183.49.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 63 days.

Professional Analyst Ratings for Alphabet

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $213.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Cantor Fitzgerald persists with their Neutral rating on Alphabet, maintaining a target price of $210.

* An analyst from Citigroup persists with their Buy rating on Alphabet, maintaining a target price of $229.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Alphabet with a target price of $220.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Alphabet, which currently sits at a price target of $210.

* An analyst from DA Davidson persists with their Neutral rating on Alphabet, maintaining a target price of $200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Alphabet options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.