Whales with a lot of money to spend have taken a noticeably bullish stance on Atlassian.

Looking at options history for Atlassian TEAM we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 15% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $233,880 and 7, calls, for a total amount of $63,494,144.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $165.0 and $440.0 for Atlassian, spanning the last three months.

Insights into Volume & Open Interest

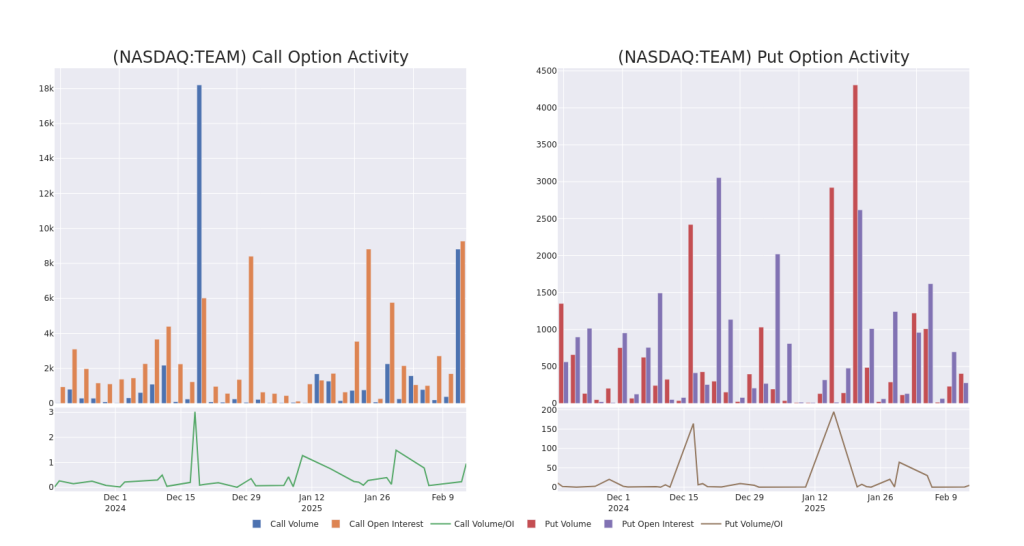

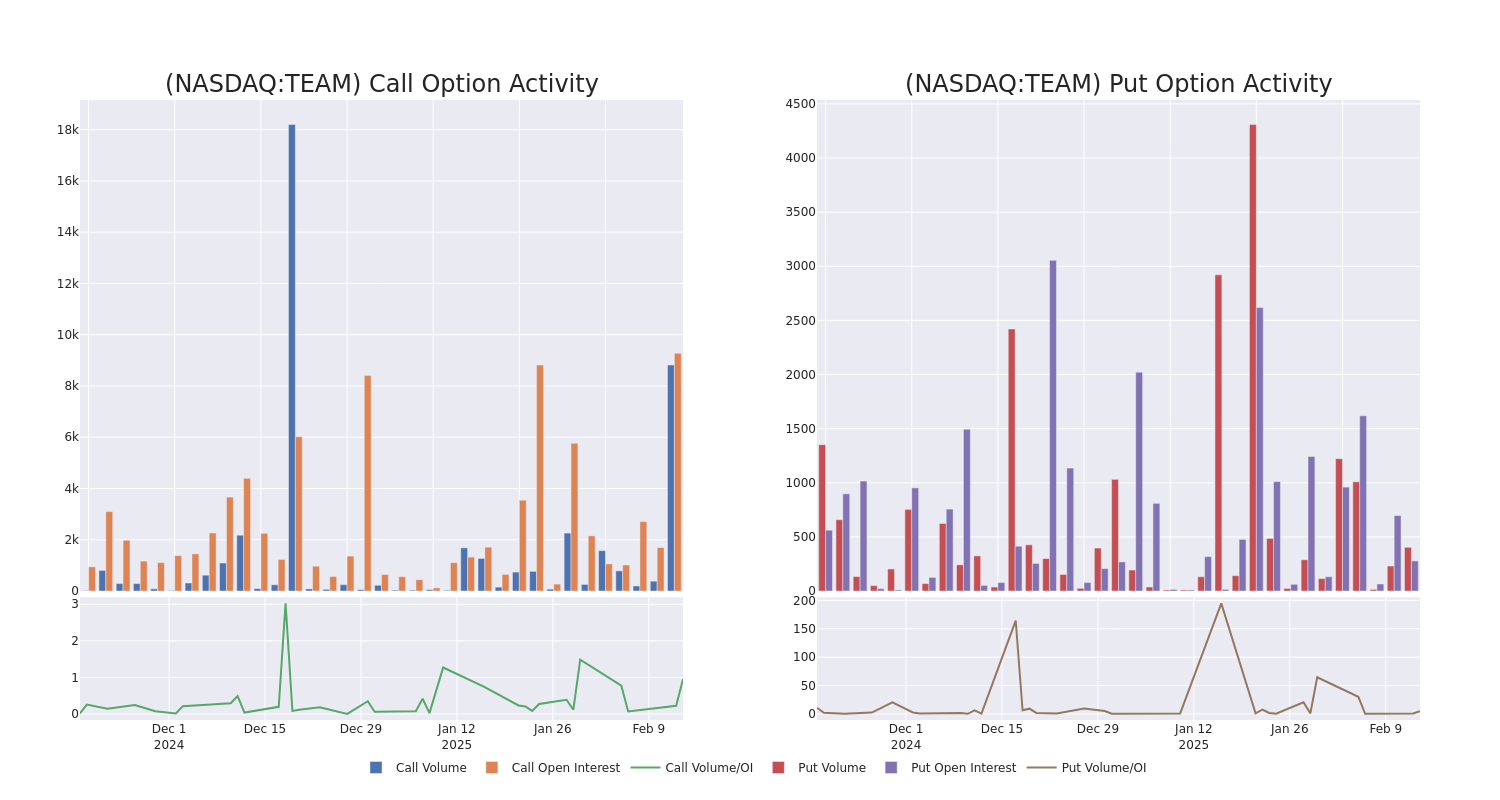

In today’s trading context, the average open interest for options of Atlassian stands at 1061.78, with a total volume reaching 9,220.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Atlassian, situated within the strike price corridor from $165.0 to $440.0, throughout the last 30 days.

Atlassian Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TEAM | CALL | TRADE | BEARISH | 06/20/25 | $73.3 | $72.1 | $72.35 | $250.00 | $62.9M | 8.9K | 8.7K |

| TEAM | CALL | SWEEP | NEUTRAL | 01/16/26 | $62.1 | $61.5 | $62.1 | $310.00 | $124.2K | 122 | 41 |

| TEAM | CALL | TRADE | NEUTRAL | 01/16/26 | $124.0 | $121.9 | $123.0 | $210.00 | $123.0K | 64 | 10 |

| TEAM | CALL | SWEEP | BULLISH | 01/16/26 | $59.8 | $57.0 | $59.39 | $310.00 | $118.6K | 122 | 21 |

| TEAM | CALL | TRADE | NEUTRAL | 01/16/26 | $21.8 | $20.4 | $21.06 | $440.00 | $84.2K | 36 | 40 |

About Atlassian

Atlassian produces software that helps teams work together more efficiently and effectively. The company provides project planning and management software, collaboration tools, and IT help desk solutions. The company operates in four segments: subscriptions (term licenses and cloud agreements), maintenance (annual maintenance contracts that provide support and periodic updates and are generally attached to perpetual license sales), perpetual license (upfront sale for indefinite usage of the software), and other (training, strategic consulting, and revenue from the Atlassian Marketplace app store). Atlassian was founded in 2002 and is headquartered in Sydney.

Where Is Atlassian Standing Right Now?

- Currently trading with a volume of 2,010,381, the TEAM’s price is down by -0.95%, now at $312.99.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 69 days.

What The Experts Say On Atlassian

5 market experts have recently issued ratings for this stock, with a consensus target price of $326.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Atlassian with a target price of $375.

* An analyst from Morgan Stanley persists with their Overweight rating on Atlassian, maintaining a target price of $315.

* An analyst from Macquarie has decided to maintain their Neutral rating on Atlassian, which currently sits at a price target of $317.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Atlassian with a target price of $300.

* Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for Atlassian, targeting a price of $325.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Atlassian, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.