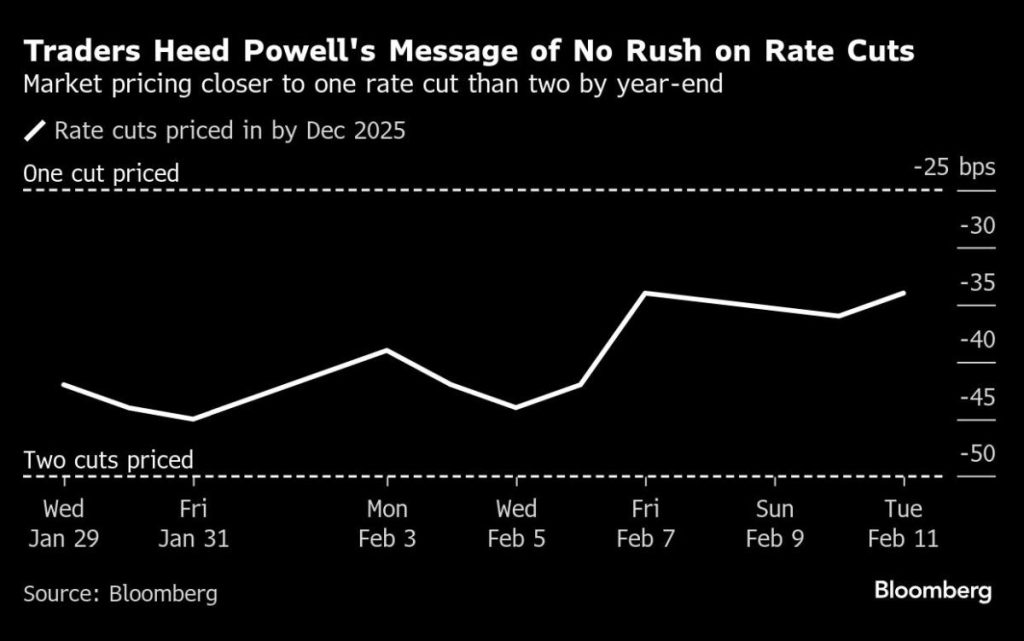

(Bloomberg) — Wall Street traders sent bond yields soaring after hot inflation data spurred bets the Federal Reserve won’t have much room to cut rates, though stocks pared most of Wednesday’s losses as tech buyers stepped in. Oil sank as the US agreed with Russia to begin talks on ending the war in Ukraine.

Treasury 10-year yields soared the most since Dec. 18 when hawkish Fed signals rattled trading. Money markets are now projecting the first – and only – US rate reduction late this year. Almost every major group in the S&P 500 fell, though the gauge trimmed most of a 1.1% slide as Tesla Inc. led gains in megacaps and Meta Platforms Inc. rose for an 18th straight session. For the first time since November, the Nasdaq 100 erased an intraday loss of 1%. In late hours, Cisco Systems Inc. jumped on an upbeat sales forecast.

Follow The Big Take daily podcast wherever you listen.

US inflation picked up broadly at the start of the year, with the monthly consumer price index rising in January by the most since August 2023. Fed Chair Jerome Powell said the latest CPI shows that while the central bank has made substantial progress toward taming inflation, there is still more work to do, “so we want to keep policy restrictive for now.”

“Higher-for-longer may have just gotten a little longer,” said Ellen Zentner at Morgan Stanley Wealth Management. “The Fed has been waiting for clear signs that inflation is trending lower again, and this morning they got the opposite. Until that changes, the markets are going to have to remain patient about additional rate cuts.”

Steve Sosnick at Interactive Brokers says it’s really tough to take today’s numbers in stride.

“The bond market didn’t,” he said. “One feature of the current equity market seems to be this mantra: ‘Every dip is a buying opportunity. The bigger the dip, the bigger the opportunity’.”

Sosnick notes that in a way stocks can be a hedge against modest inflation, since earnings per share are measured in nominal terms. Inflation raises those nominal results, particularly for companies with relatively inelastic demand for their products, he added.

“The largest tech stocks fit that bill, at least while the enthusiasm for all things related to artificial intelligence continues,” he noted. “And thus, the dips get bought, even with a hot, hot, hot inflation report.”