Whales with a lot of money to spend have taken a noticeably bearish stance on Arista Networks.

Looking at options history for Arista Networks ANET we detected 98 trades.

If we consider the specifics of each trade, it is accurate to state that 35% of the investors opened trades with bullish expectations and 52% with bearish.

From the overall spotted trades, 38 are puts, for a total amount of $4,749,194 and 60, calls, for a total amount of $3,836,100.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $75.0 and $160.0 for Arista Networks, spanning the last three months.

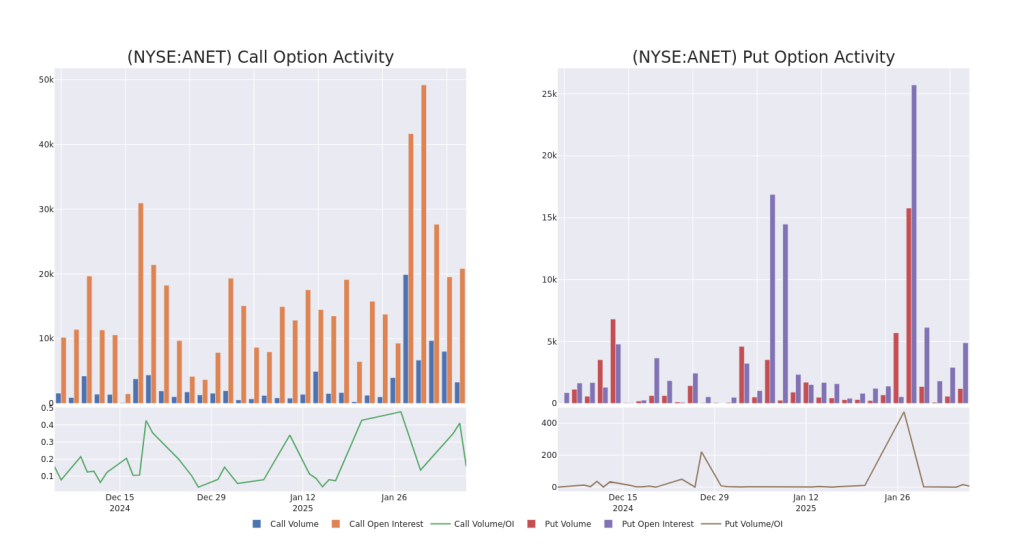

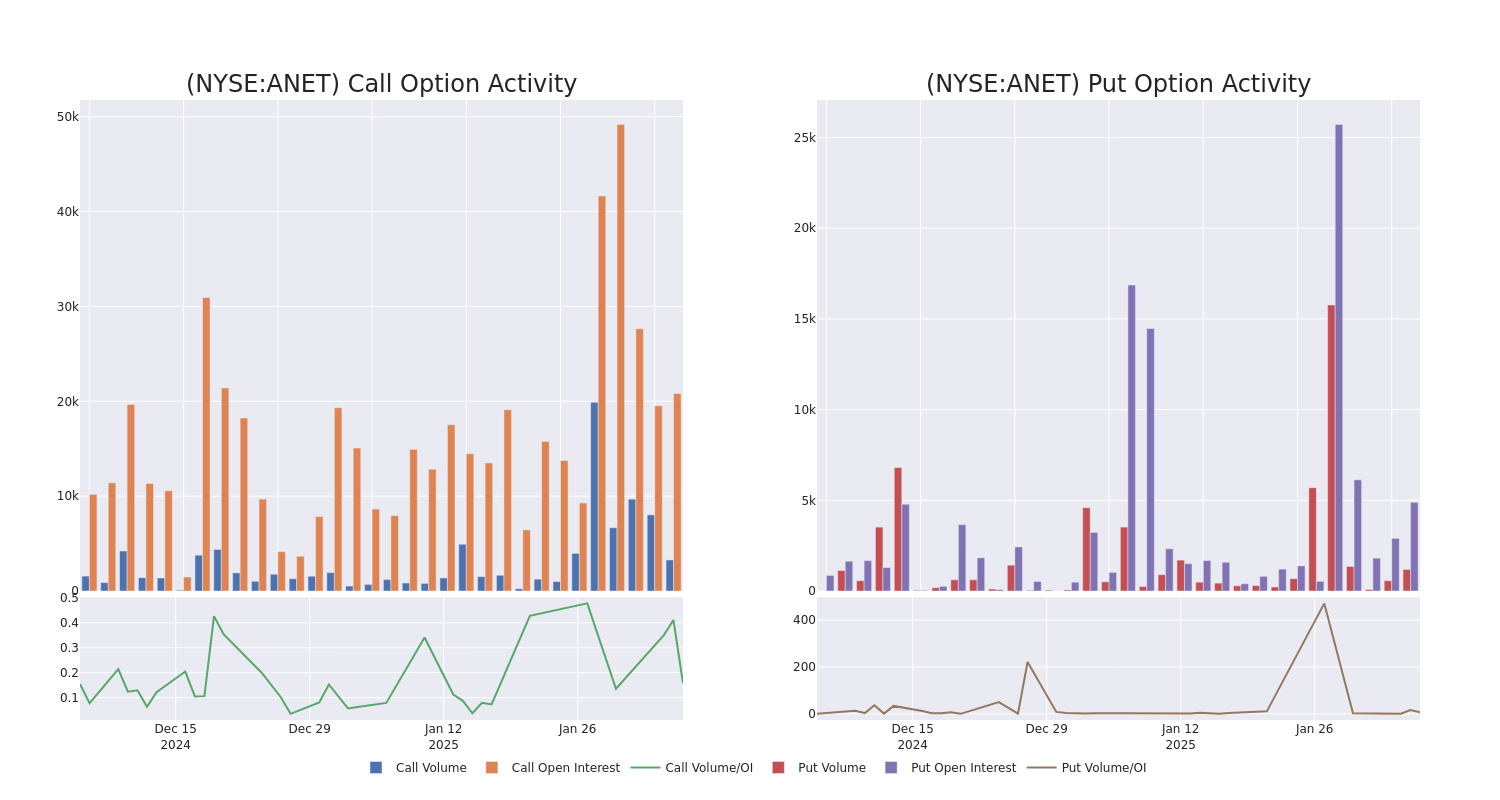

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Arista Networks’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Arista Networks’s whale activity within a strike price range from $75.0 to $160.0 in the last 30 days.

Arista Networks Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | PUT | TRADE | BULLISH | 03/21/25 | $10.9 | $10.6 | $10.61 | $115.00 | $1.7M | 1.9K | 2.3K |

| ANET | PUT | SWEEP | BULLISH | 01/16/26 | $33.6 | $33.3 | $33.3 | $135.00 | $253.0K | 433 | 1 |

| ANET | CALL | SWEEP | BEARISH | 09/19/25 | $6.2 | $5.9 | $5.9 | $150.00 | $230.1K | 201 | 480 |

| ANET | PUT | TRADE | BEARISH | 01/16/26 | $11.2 | $11.1 | $11.2 | $97.50 | $224.0K | 340 | 212 |

| ANET | PUT | SWEEP | NEUTRAL | 03/21/25 | $4.7 | $4.6 | $4.7 | $102.50 | $170.6K | 2.6K | 373 |

About Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

Where Is Arista Networks Standing Right Now?

- With a volume of 11,124,561, the price of ANET is down -5.57% at $110.33.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 6 days.

Expert Opinions on Arista Networks

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $132.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Goldman Sachs persists with their Buy rating on Arista Networks, maintaining a target price of $135.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Arista Networks with a target price of $130.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Arista Networks, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.