The Trade Desk, Inc. TTD will release its fourth-quarter financial results after the closing bell on Wednesday, Feb. 12.

Analysts expect the Ventura, California-based company to report quarterly earnings at 57 cents per share, up from 41 cents per share in the year-ago period. Trade Desk projects quarterly revenue of $759.56 million, compared to $605.8 million a year earlier, according to data from Benzinga Pro.

On Jan. 15, Trade Desk announced an agreement to acquire Sincera.

Trade Desk shares fell 1.9% to close at $120.21 on Tuesday.

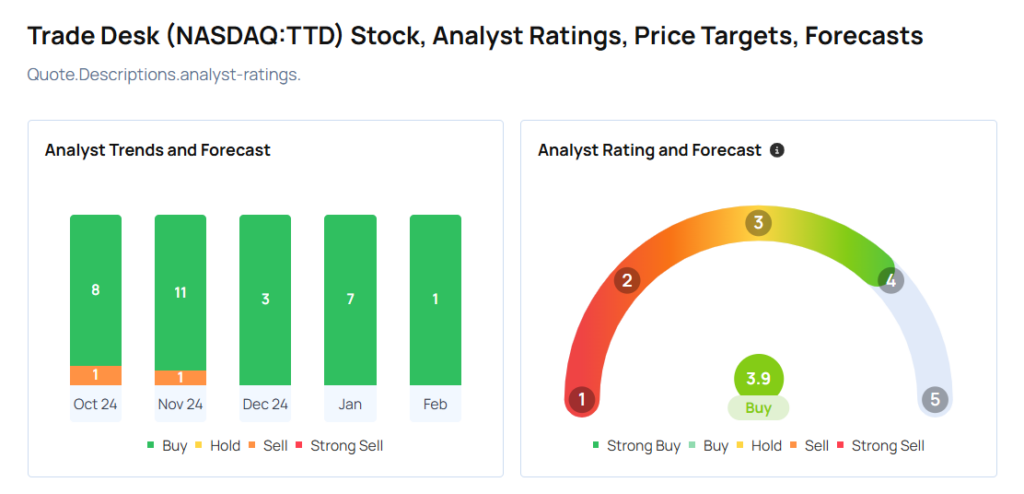

Benzinga readers can access the latest analyst ratings on the <a href=”https://www.benzinga.com/analyst-ratings/analyst-color/22/09/28888638/exclusive-study-finds-benzinga-analyst-ratings-data-yields-market-beating-strategie”><em> Analyst Stock Ratings </em></a> page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate <a href=”https://www.benzinga.com/quote/HCA/analyst-ratings”><em> analysts have rated the company </em></a> in the recent period.

- Keybanc analyst Alex Markgraff maintained an Overweight rating and raised the price target from $140 to $142 on Feb. 10, 2025. This analyst has an accuracy rate of 74%.

- BMO Capital analyst Brian Pitz maintained an Outperform rating and raised the price target from $125 to $160 on Jan. 15, 2025. This analyst has an accuracy rate of 78%.

- Morgan Stanley analyst Matthew Cost maintained an Overweight rating and raised the price target from $130 to $145 on Jan. 13, 2025. This analyst has an accuracy rate of 68%.

- Wells Fargo analyst Alec Brondolo maintained an Overweight rating and increased the price target from $141 to $142 on Jan. 13, 2025. This analyst has an accuracy rate of 62%.

- Wedbush analyst Scott Devitt maintained an Outperform rating and raised the price target from $135 to $145 on Jan. 6, 2025. This analyst has an accuracy rate of 84%.

Considering buying TTD stock? Here’s what analysts think:

Read This Next:

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.