Financial giants have made a conspicuous bullish move on EHang Holdings. Our analysis of options history for EHang Holdings EH revealed 30 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $865,978, and 18 were calls, valued at $1,044,396.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $17.0 to $32.0 for EHang Holdings over the last 3 months.

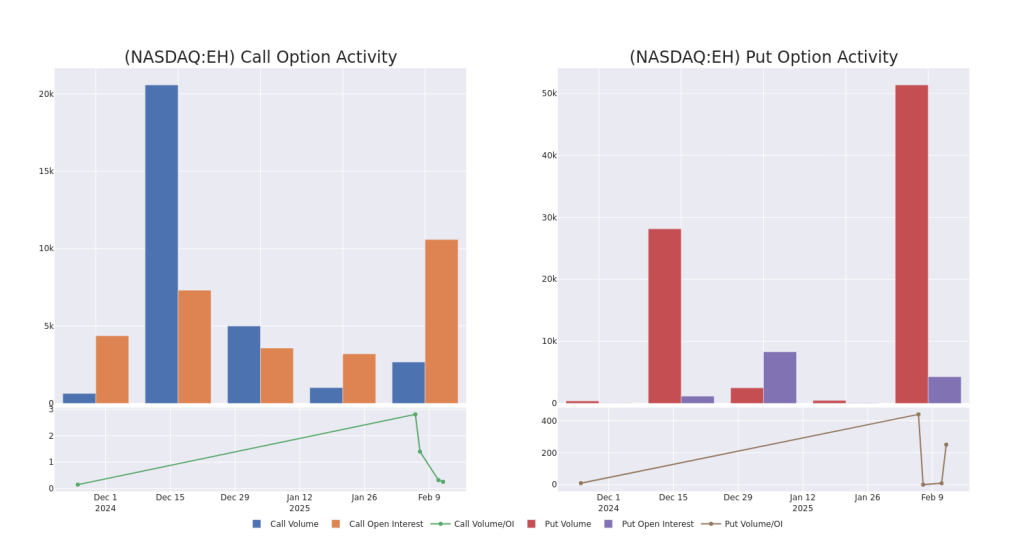

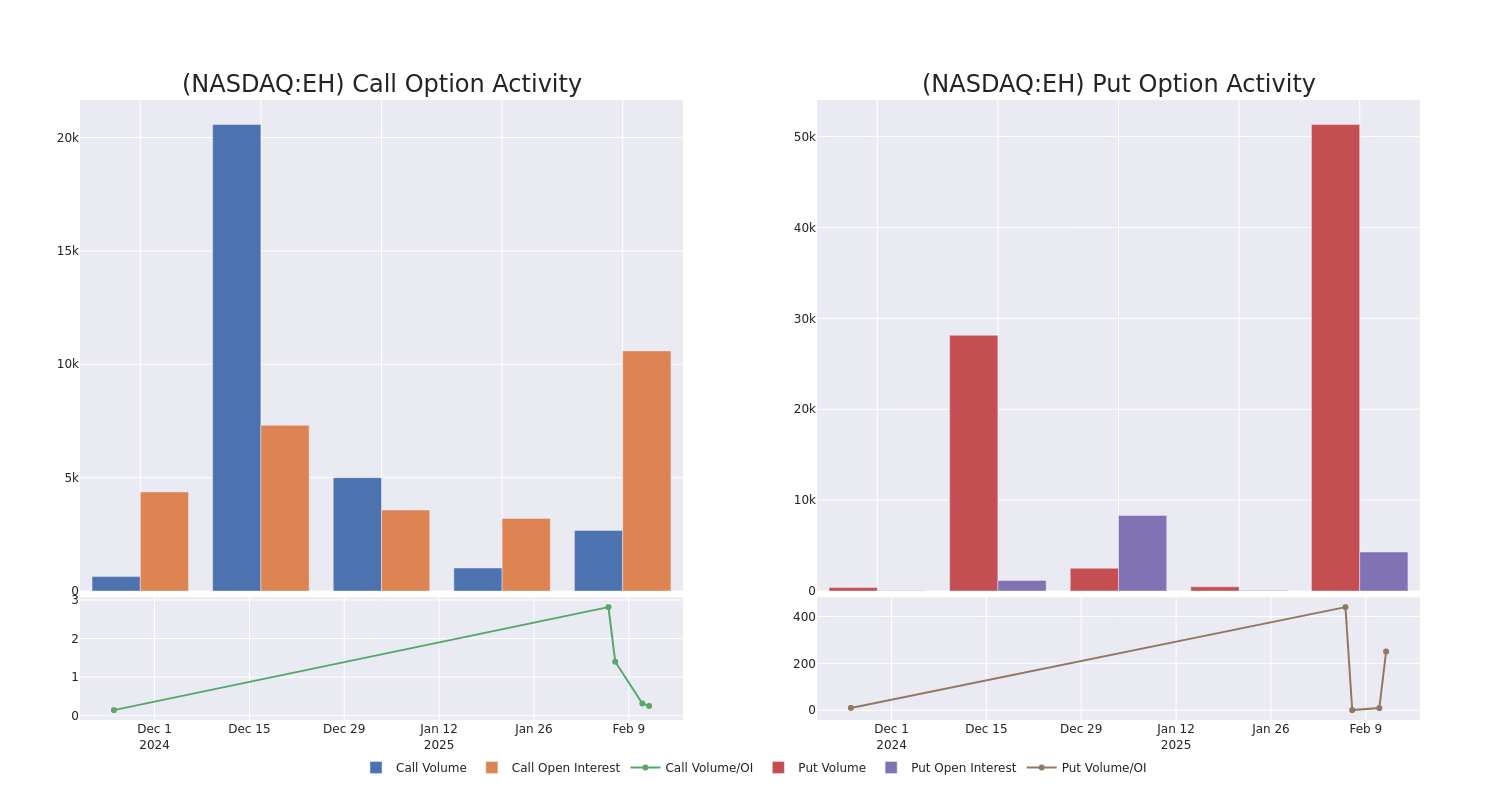

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for EHang Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across EHang Holdings’s significant trades, within a strike price range of $17.0 to $32.0, over the past month.

EHang Holdings Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EH | CALL | SWEEP | BEARISH | 02/14/25 | $9.2 | $7.1 | $7.3 | $17.50 | $218.2K | 471 | 300 |

| EH | CALL | SWEEP | BEARISH | 02/14/25 | $5.9 | $5.7 | $5.73 | $19.00 | $171.5K | 1.7K | 302 |

| EH | PUT | SWEEP | BEARISH | 07/18/25 | $2.15 | $2.0 | $2.15 | $19.00 | $129.0K | 134 | 1.0K |

| EH | PUT | SWEEP | BULLISH | 04/17/25 | $1.2 | $1.0 | $1.05 | $19.00 | $105.0K | 208 | 6.4K |

| EH | PUT | TRADE | BULLISH | 04/17/25 | $1.1 | $0.95 | $1.0 | $19.00 | $100.0K | 208 | 7.4K |

About EHang Holdings

EHang Holdings Ltd is an urban air mobility (UAM) technology platform company. It focuses on making safe, autonomous, eco-friendly air mobility accessible to everyone. EHang provides customers in various industries with unmanned aerial vehicle (UAV) systems and solutions: air mobility (including passenger transportation and logistics), smart city management, and aerial media solutions. EHang’s EH216-S has received a production certificate and standard airworthiness certificate for passenger-carrying pilotless eVTOL aircraft issued by the Civil Aviation Administration of China. The group continues to explore the boundaries of the sky to make flying technologies benefit life in smart cities.

Current Position of EHang Holdings

- Trading volume stands at 6,838,266, with EH’s price up by 21.64%, positioned at $25.19.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 30 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest EHang Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.