Whales with a lot of money to spend have taken a noticeably bullish stance on JPMorgan Chase.

Looking at options history for JPMorgan Chase JPM we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 35% with bearish.

From the overall spotted trades, 12 are puts, for a total amount of $673,449 and 5, calls, for a total amount of $257,523.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $185.0 to $280.0 for JPMorgan Chase over the last 3 months.

Insights into Volume & Open Interest

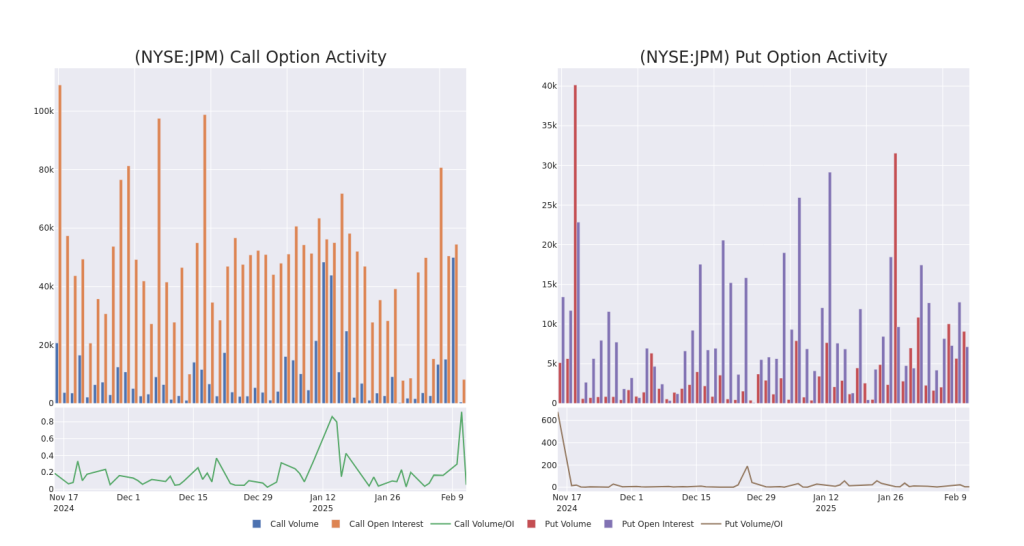

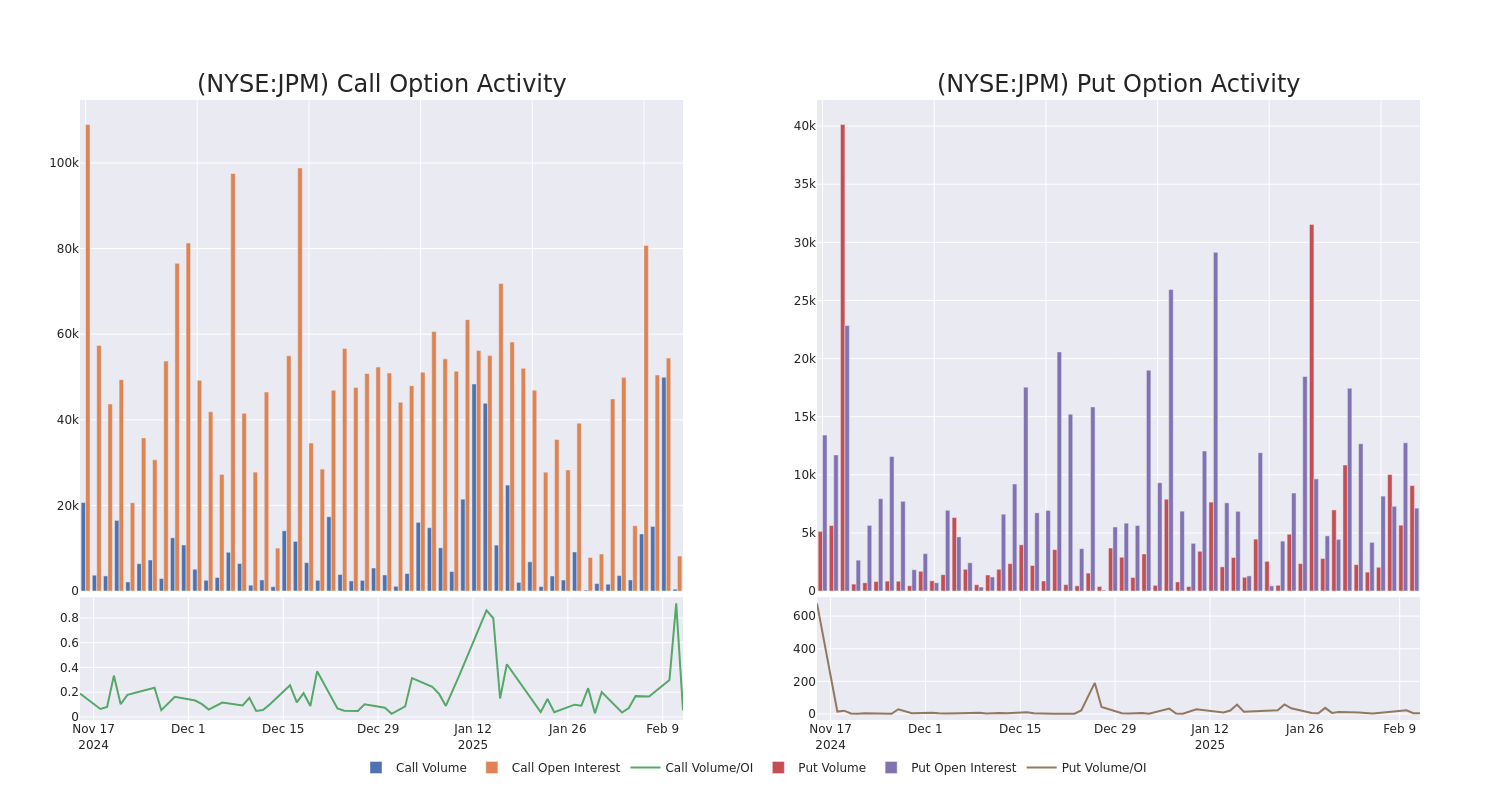

In today’s trading context, the average open interest for options of JPMorgan Chase stands at 1276.42, with a total volume reaching 9,507.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in JPMorgan Chase, situated within the strike price corridor from $185.0 to $280.0, throughout the last 30 days.

JPMorgan Chase Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | CALL | TRADE | BULLISH | 04/17/25 | $10.95 | $10.75 | $10.95 | $275.00 | $98.5K | 2.5K | 96 |

| JPM | PUT | SWEEP | NEUTRAL | 02/21/25 | $1.86 | $1.74 | $1.85 | $270.00 | $92.5K | 2.7K | 501 |

| JPM | PUT | SWEEP | BULLISH | 02/21/25 | $1.66 | $1.61 | $1.65 | $270.00 | $77.5K | 2.7K | 1.3K |

| JPM | PUT | TRADE | BULLISH | 01/16/26 | $24.0 | $23.95 | $23.95 | $280.00 | $71.8K | 88 | 30 |

| JPM | PUT | SWEEP | BULLISH | 02/21/25 | $2.01 | $1.86 | $1.95 | $270.00 | $68.2K | 2.7K | 862 |

About JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segments: consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

After a thorough review of the options trading surrounding JPMorgan Chase, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of JPMorgan Chase

- Trading volume stands at 888,124, with JPM’s price up by 0.34%, positioned at $275.93.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 58 days.

What Analysts Are Saying About JPMorgan Chase

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $287.25.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for JPMorgan Chase, targeting a price of $330.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on JPMorgan Chase with a target price of $287.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Hold rating for JPMorgan Chase, targeting a price of $268.

* Consistent in their evaluation, an analyst from Keefe, Bruyette & Woods keeps a Market Perform rating on JPMorgan Chase with a target price of $264.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JPMorgan Chase with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.