It’s been a great time to be a goldbug. Whether investors are bullish on the precious metal as a financial asset because they’re skeptical of fiat currency, worried about a broader economic collapse, or have other motivations, the spot price of gold has climbed more than 40% in the past 12 months, doubling the S&P 500’s gain during that span. No one officially holds more of the yellow metal than the U.S. government, however, and a simple accounting change could result in a roughly $750 billion windfall on the country’s balance sheet.

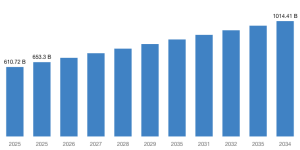

According to the government’s financial statements, the U.S. owns about 261.6 million troy ounces, or almost 8,200 metric tons, of gold. Those reserves are currently valued at a set rate of $42.22 an ounce, or around where the metal’s price sat in the early 1970s, producing a book value of $11 billion. At gold’s current spot price of about $2,920 per ounce, however, the market value of those holdings is nearly $765 billion.

There’s debate about whether that bookkeeping change would have any true impact. Nonetheless, as Gillian Tett wrote in the Financial Times last week, speculation about such a move has picked up as new Treasury Secretary Scott Bessent tries to implement President Donald Trump’s economic vision for America without spooking markets.

“We’re going to monetize the asset side of the U.S. balance sheet for the American people,” Bessent said last Monday, when Trump signed an executive order calling for the creation of a sovereign wealth fund. “We’re going to put the assets to work, and I think it’s going to be very exciting.”

The Treasury Department did not respond to a request for comment, but the definition of monetization means changing something into money, or at least expressing the asset in terms of a currency. So, what would an additional $750 billion do for the U.S government? Not much, said Jay Hatfield, the CEO of Infrastructure Capital Advisors, which manages ETFs and several hedge funds.

For the mark-to-market change to have any impact, he said, the U.S. would presumably need to sell off some of its gold reserves for cash. It would be hard for the Treasury to do that without tanking the market for the precious metal.

“It’s going to be like Armageddon if they try to dump any significant amount of gold,” Hatfield said.

Rob Haworth, a senior investment strategist and commodities researcher at U.S. Bank Wealth Management, agrees such a sale would be difficult. Central bank buying, particularly by China, has helped drive gold’s surge since 2022. Massive sales by the U.S. would likely have the opposite effect.