Super Micro Computer Inc. SMCI outlined an ambitious growth trajectory on Tuesday, projecting fiscal year 2026 revenue of $40 billion despite recent challenges including delayed financial filings and regulatory investigations.

What Happened: During its second-quarter earnings call, CEO Charles Liang characterized the $40 billion target as a “conservative estimation,” forecasting 65% year-over-year growth. This comes as the company reported preliminary second-quarter revenue between $5.6 billion and $5.7 billion, representing a 54% increase from the previous year.

However, Supermicro scaled back its fiscal year 2025 guidance to $23.5-25 billion from its previous forecast of $26-30 billion, citing product transition impacts and delays in new technology deployment.

To strengthen its financial position, Supermicro announced a $700 million convertible senior notes placement due 2028, while also amending existing notes due 2029. The company ended the second quarter with $1.4 billion in cash, improving to approximately $2 billion by Jan. 31.

Nasdaq Exchange granted SMCI until Feb. 25 to file its 10-K, with delisting risk if it misses the deadline.

Why It Matters: The company faces ongoing scrutiny following Ernst & Young‘s resignation as auditor in October and subsequent Department of Justice and SEC subpoenas related to a short seller report. Supermicro expects to file its delayed financial reports by Feb. 25, with management maintaining that an independent Special Committee found no evidence of fraud or misconduct.

Looking ahead, Supermicro emphasized its competitive advantages in liquid cooling technology, claiming a 60% market share. “We expect more than 30% of new data centers worldwide to adopt liquid cooling infrastructure within the next twelve months,” Liang noted, pointing to growing AI infrastructure demand.

The company operates at partial capacity, with U.S. facilities at 55% utilization and significant room for expansion in Taiwan and Malaysia operations, positioning it for potential growth as AI adoption accelerates globally.

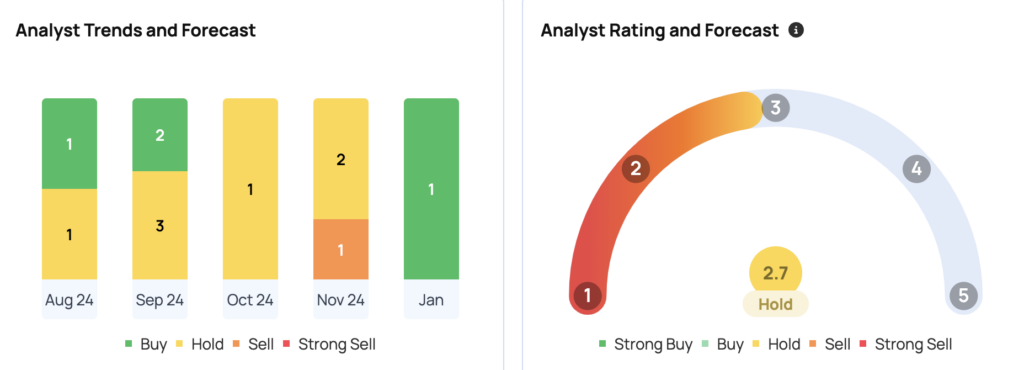

SMCI’s consensus price target is $467.47 from 17 analysts, with a high of $1,300 and a low of $23. The latest ratings from Loop Capital, Goldman Sachs, and J.P. Morgan average $30.33, implying a 27.52% downside.

Price Action: Super Micro Computer Inc. stock closed at $38.61 on Tuesday, down 9.47% for the day. In after-hours trading, the stock rebounded 8.39%. Year to date, shares have gained 28.49%, but over the past year, the stock has declined 50.05%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.