Financial giants have made a conspicuous bullish move on Dollar Tree. Our analysis of options history for Dollar Tree DLTR revealed 13 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $875,042, and 4 were calls, valued at $271,340.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $67.0 to $78.0 for Dollar Tree over the last 3 months.

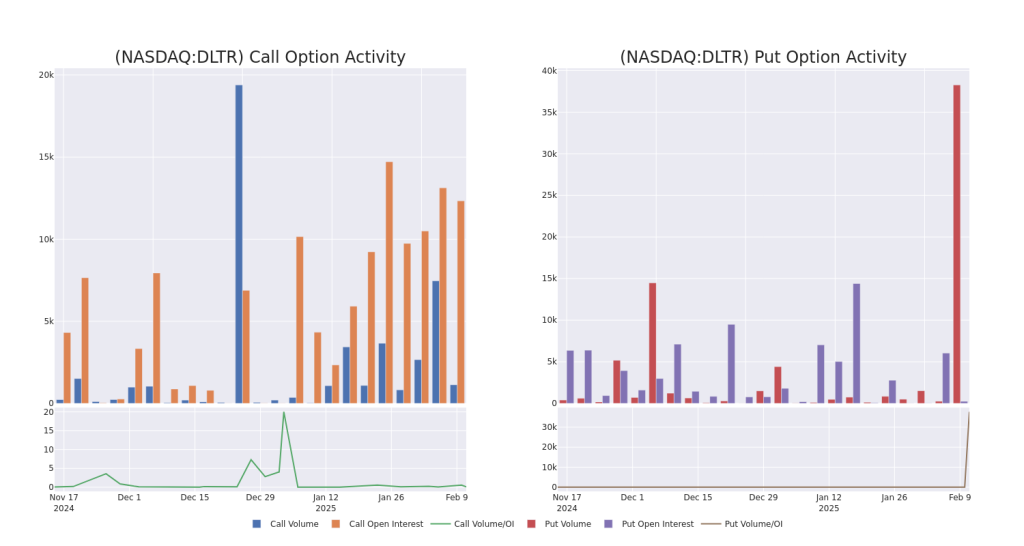

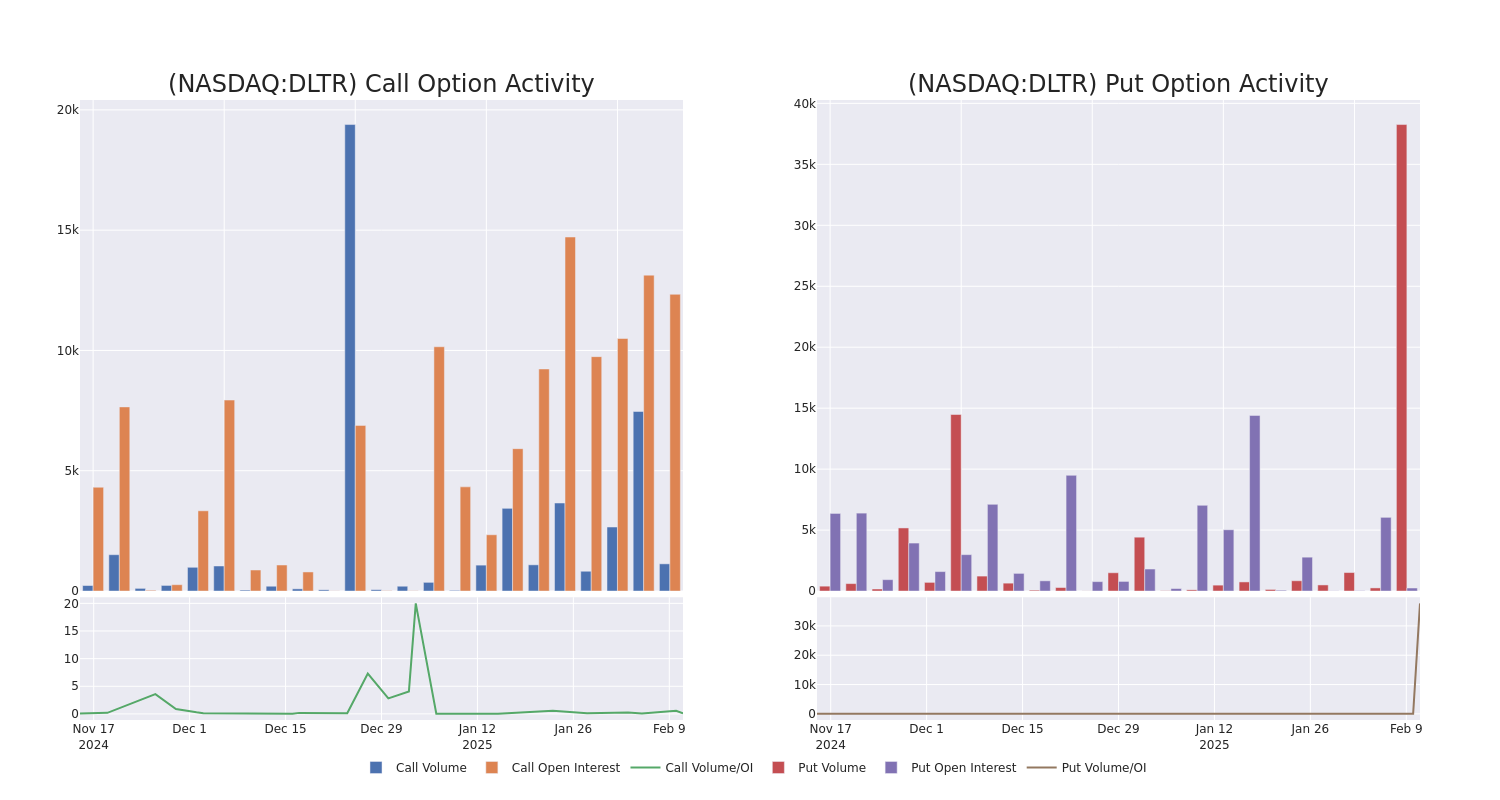

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Dollar Tree options trades today is 2097.0 with a total volume of 39,395.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dollar Tree’s big money trades within a strike price range of $67.0 to $78.0 over the last 30 days.

Dollar Tree 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DLTR | PUT | TRADE | BULLISH | 03/14/25 | $4.0 | $3.45 | $3.5 | $71.00 | $175.0K | 1 | 7.1K |

| DLTR | PUT | TRADE | BULLISH | 03/14/25 | $4.0 | $3.4 | $3.5 | $71.00 | $174.6K | 1 | 6.6K |

| DLTR | CALL | TRADE | BEARISH | 03/14/25 | $5.45 | $2.28 | $3.5 | $76.00 | $122.5K | 0 | 350 |

| DLTR | PUT | TRADE | BULLISH | 03/14/25 | $3.95 | $3.4 | $3.45 | $71.00 | $103.5K | 1 | 8.1K |

| DLTR | PUT | TRADE | BULLISH | 03/14/25 | $3.95 | $3.35 | $3.45 | $71.00 | $103.5K | 1 | 7.8K |

About Dollar Tree

Dollar Tree operates discount stores across the United States and Canada, with over 8,800 shops under its namesake banner and 7,700 under Family Dollar. About 47% of Dollar Tree’s sales in fiscal 2023 were composed of consumables (including food, health and beauty, and cleaning products), around 45% from variety items (including toys and homewares), and over 5% from seasonal items. Dollar Tree sells most of its merchandise at the $1.25 price point and positions its stores in well-populated suburban markets. Conversely, Family Dollar primarily sells consumable merchandise (80% of the banner’s sales) at prices below $10. About two thirds of Family Dollar’s stores are in urban and suburban markets, with the remaining one third located in rural areas.

In light of the recent options history for Dollar Tree, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Dollar Tree

- Currently trading with a volume of 831,027, the DLTR’s price is down by -1.99%, now at $72.39.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 29 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dollar Tree with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.