Vertex Pharmaceuticals Incorporated VRTX reported mixed results for its fourth quarter on Monday.

The company posted quarterly adjusted earnings of $3.48 per share which missed the analyst consensus estimate of $4.03 per share. The company reported quarterly sales of $2.912 billion which beat the analyst consensus estimate of $2.781 billion.

“2024 marked a year of tremendous growth for Vertex and we anticipate 2025 will be another important year with the landmark JOURNAVX approval and launch for moderate-to-severe acute pain; the launch of our fifth CF medicine, ALYFTREK; the continuing global launch of CASGEVY; and multiple ongoing pivotal trials. We are excited to drive diversification of the revenue base, disease areas of focus, R&D pipeline, and geographies to continue to deliver long-term value to both patients and shareholders,” said Reshma Kewalramani, M.D., Chief Executive Officer and President of Vertex.

Vertex Pharmaceuticals said it sees FY25 revenue of $11.75 billion to $12.00 billion, versus market estimates of $11.84 billion.

Vertex Pharmaceuticals shares fell 2.5% to trade at $458.15 on Tuesday.

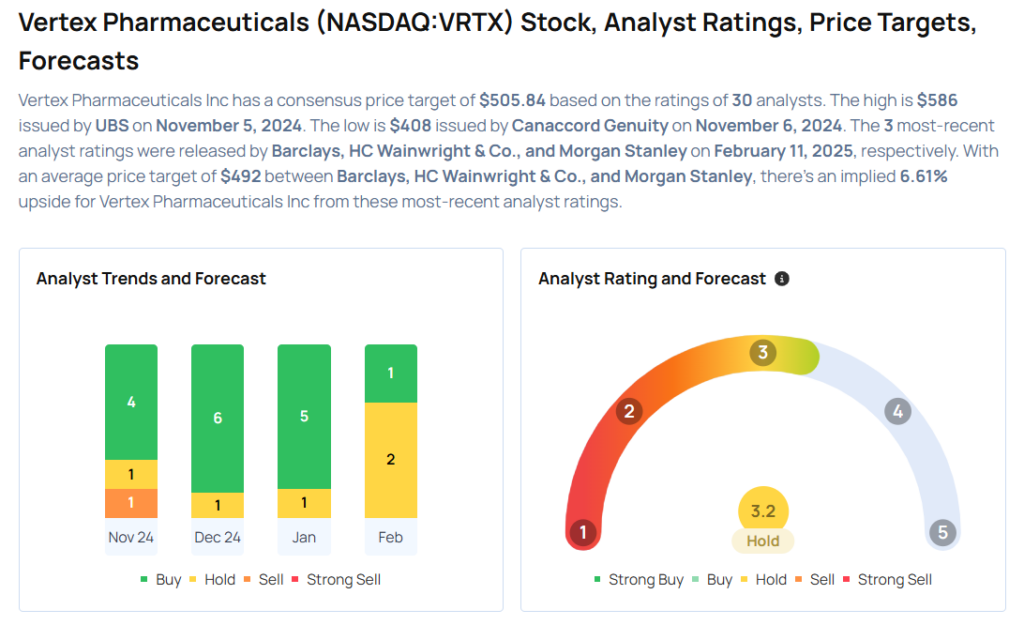

These analysts made changes to their price targets on Vertex Pharmaceuticals following earnings announcement.

- Morgan Stanley analyst Matthew Harrison maintained Vertex Pharmaceuticals with an Equal-Weight and raised the price target from $450 to $459.

- Barclays analyst Gena Wang maintained the stock with an Equal-Weight and raised the price target from $435 to $46.

- HC Wainwright & Co. analyst Andrew Fein, meanwhile, reiterated Vertex Pharmaceuticals with a Buy and maintained a $550 price target.

Considering buying VRTX stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.