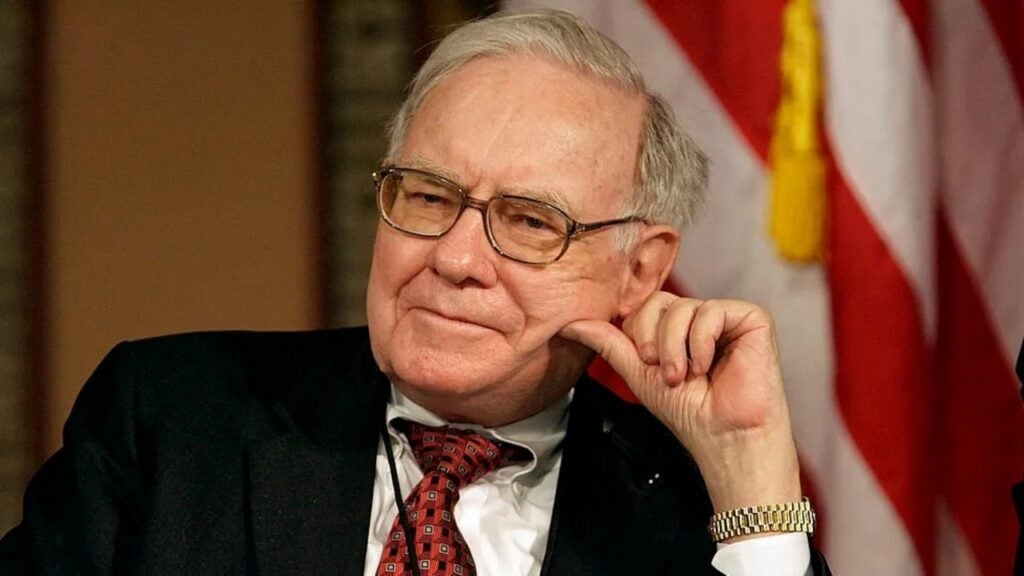

Berkshire Hathaway Chairman Warren Buffett has been a legendary figure in investment circles for over half a century, and his stock picks are keenly watched by both experienced and rookie players.

However, the “Oracle of Omaha” has remained steadfast in his opposition to cryptocurrencies and related investments, even though some of them may have outperformed the hottest equities in his portfolio.

What happened: In terms of market value, Apple Inc. AAPL was Berkshire Hathaway’s biggest holding, with a stake worth nearly $70 billion at the end of September, according to an SEC filing.

The Apple position accounted for 26.24% of Berkshire Hathaway’s portfolio. Over the last year, the stock has gained 21.64%.

See Also: Man Whose $775 Million Bitcoin Fortune Lies Buried In A Landfill Now Wants To Buy The Trash Heap

However, the gains paled in comparison to the returns offered by the iShares Bitcoin Trust ETF IBIT, the largest Bitcoin BTC/USD investment vehicle, launched only a year ago.

Shares of IBIT surged 93.23% in the last year and 64.63% over the last six months.

But despite the impressive returns, the ETF, or any other cryptocurrency investments, have struggled to come on Buffett’s radar. If anything, Buffett has severely criticized them.

Why It Matters: Despite the impressive returns, the ETF, or any other cryptocurrency investments, have struggled to come on Buffett’s radar. If anything, Buffett has severely criticized them.

Back in 2018, Buffett famously predicted a “bad ending” for cryptocurrencies. As for Bitcoin, the seasoned investor has used considerably more nasty terms, describing it as “rat poison squared.”

Notably, the Berkshire Hathaway chairman has made no mention of the asset class in the last few years, despite the total market valuation topping trillions of dollars.

Price Action: Shares of Apple closed 0.01% higher at $227.64 during Monday’s regular trading session, according to data from Benzinga Pro. Year-to-date, the stock was down 9.09%.

IBIT shares closed 1.70% higher at $55.40 on Monday and up 4.39% year-to-date.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.