Whales with a lot of money to spend have taken a noticeably bullish stance on FedEx.

Looking at options history for FedEx FDX we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 77% of the investors opened trades with bullish expectations and 22% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $592,896 and 5, calls, for a total amount of $235,673.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $240.0 to $300.0 for FedEx over the last 3 months.

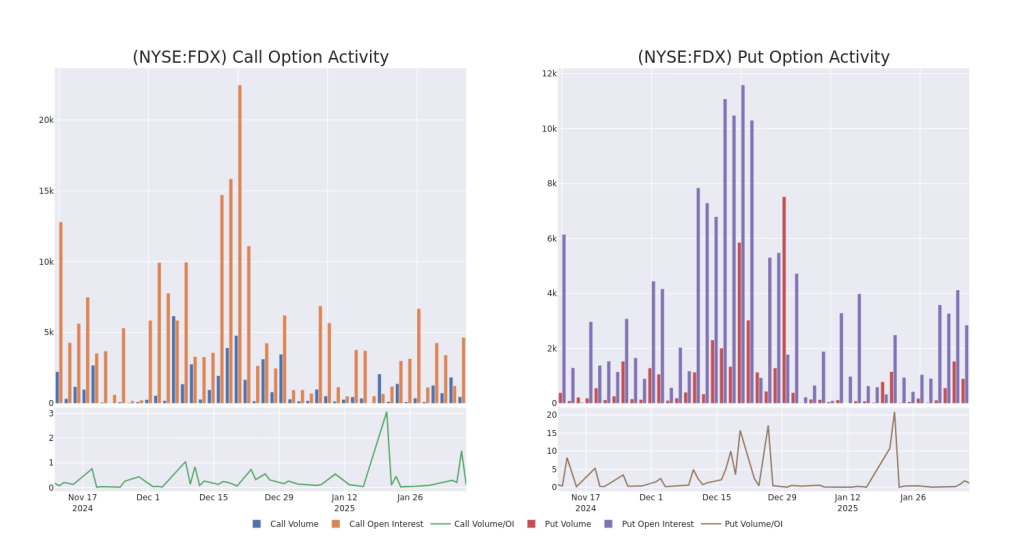

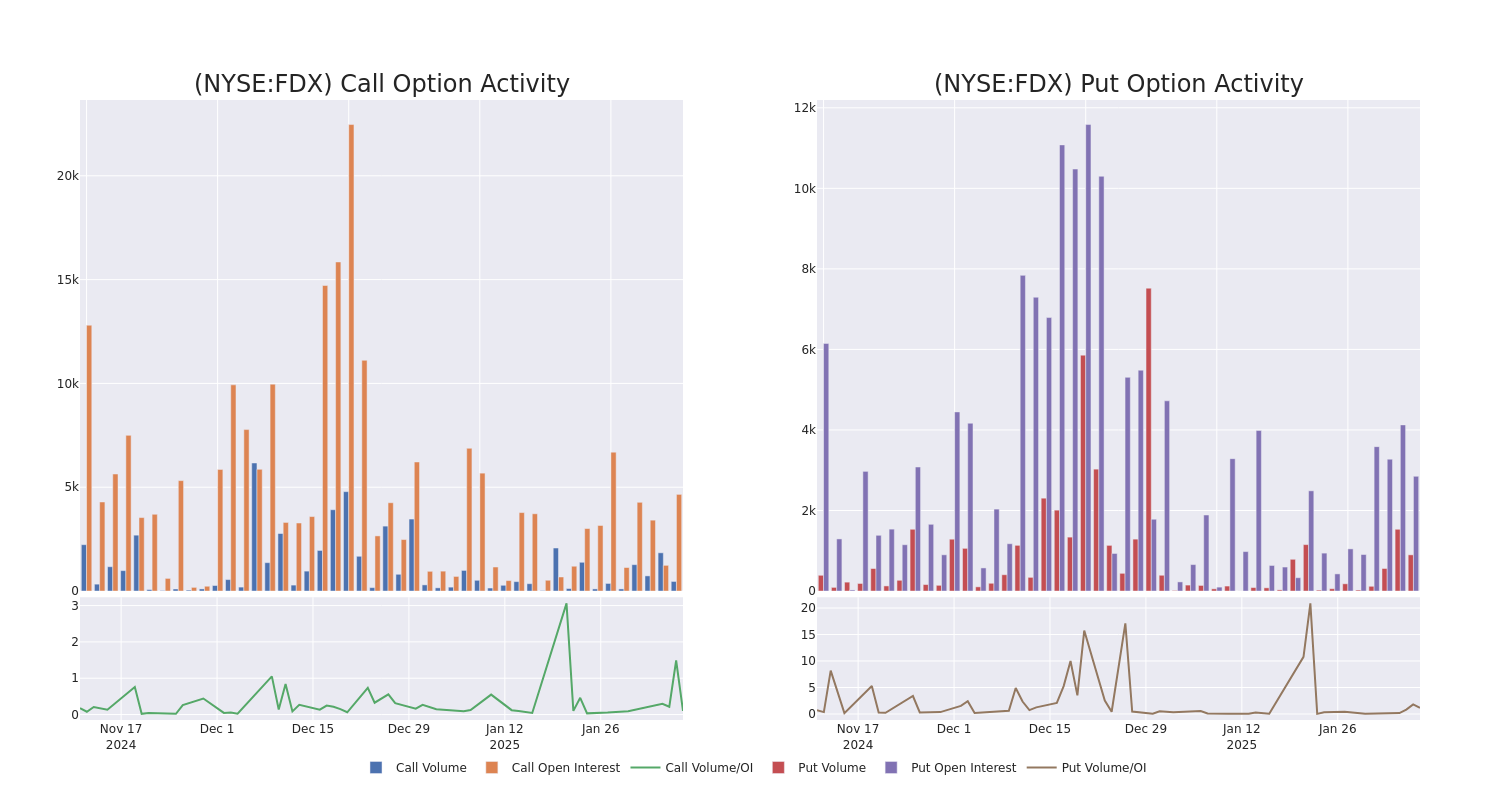

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for FedEx’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of FedEx’s whale trades within a strike price range from $240.0 to $300.0 in the last 30 days.

FedEx Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDX | PUT | TRADE | BEARISH | 02/07/25 | $9.5 | $8.1 | $9.4 | $265.00 | $376.0K | 658 | 410 |

| FDX | PUT | SWEEP | BULLISH | 02/21/25 | $7.75 | $6.85 | $6.92 | $260.00 | $109.7K | 469 | 164 |

| FDX | CALL | SWEEP | BULLISH | 01/15/27 | $53.0 | $51.9 | $53.0 | $240.00 | $63.5K | 117 | 15 |

| FDX | CALL | SWEEP | BULLISH | 04/17/25 | $2.25 | $2.17 | $2.25 | $300.00 | $63.0K | 2.4K | 282 |

| FDX | PUT | TRADE | BULLISH | 03/21/25 | $14.6 | $14.55 | $14.55 | $260.00 | $59.6K | 1.7K | 184 |

About FedEx

FedEx pioneered overnight delivery in 1973 and remains the world’s largest express package provider. In its fiscal 2024, which ended in May, FedEx derived 47% of revenue from its express division, 37% from ground, and 10% from freight, its asset-based less-than-truckload shipping segment. The remainder came from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016, boosting its presence across Europe. TNT was previously the fourth-largest global parcel delivery provider.

In light of the recent options history for FedEx, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

FedEx’s Current Market Status

- With a trading volume of 733,975, the price of FDX is down by 0.0%, reaching $258.77.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 41 days from now.

What Analysts Are Saying About FedEx

In the last month, 2 experts released ratings on this stock with an average target price of $323.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Stifel persists with their Buy rating on FedEx, maintaining a target price of $364.

* Reflecting concerns, an analyst from Loop Capital lowers its rating to Hold with a new price target of $283.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest FedEx options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.