Coinbase (COIN) is a highly rated stock that is very popular with option traders.

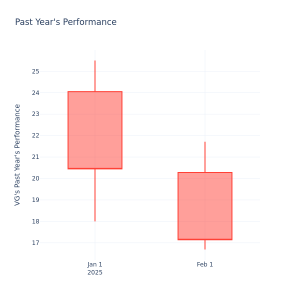

There is also some volatility skew due to earnings on Feb. 13, with short-term options showing higher implied volatility than long-term options.

↑

X

Danger Ahead: This Sell Signal Tells You When To Get Out Of A Highflying Stock

One way to take advantage of this skew is via a diagonal put spread.

This option strategy is an advanced strategy because it utilizes options over different expiration periods and different strike prices.

Let’s look at an example:

Traders could sell a Feb. 14 put with a strike price of 240 and buy a Feb. 28 put with a strike price of 230.

As of Wednesday’s close, the Feb. 14 put could be sold for around $3.40 and the Feb. 28 put could be bought for $4.30.

Max Loss For Coinbase Stock Trade

The trade would result in a net debit of around $0.90, which means there is very little risk on the upside. The worst thing that can happen is the put expires worthless, and the trader loses the $90 in premium paid.

The risk on the trade is on the downside, with a potential maximum loss of $1,090. You calculated it by taking the difference in the spread (10) multiplied by 100 and adding the premium paid (90).

The maximum potential gain is around $900. It would occur if Coinbase closes right at 240 on Feb. 14.

The breakeven price is around 225. The trade will do well if Coinbase stays above 240 for the next week or so.

Aiming for a return of around 10%-15% makes sense, and I would set a similar stop loss.

The worst-case scenario is a sharp drop in Coinbase early in the trade. For this reason, if the stock drops below 240 in the next week or so, I would also consider closing the trade early to minimize losses.

Coinbase Stock Volatility

One of the advantages of the trade is that the put we are selling has higher volatility (92%) than the put we are buying (78%). Just like stocks, when it comes to volatility, we want to buy low and sell high.

Closing before the earnings date of Feb. 13 is a good idea to avoid earnings risk.

According to the IBD Stock Checkup, Coinbase stock is ranked number 6 in its group and has a Composite Rating of 97, an EPS Rating of 81 and a Relative Strength Rating of 92.

The cash secured put on Robinhood (HOOD) discussed Jan. 3o can be closed because it has already achieved a full profit.

It’s important to remember that options are risky and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

Gavin McMaster has a Masters in Applied Finance and Investment. He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. Follow him on X/Twitter at @OptiontradinIQ

YOU MIGHT ALSO LIKE:

Amazon Earnings Option Trade Can Return $230

Boeing Stock Is Cruising In A Narrow Range. Here’s How To Profit If It Changes Altitude.

Realty Income Stock Today: Trade This Covered Call, Generate 18% Annualized Return

Option Trade On TSMC Stock Could Return 33% In About 3 Weeks