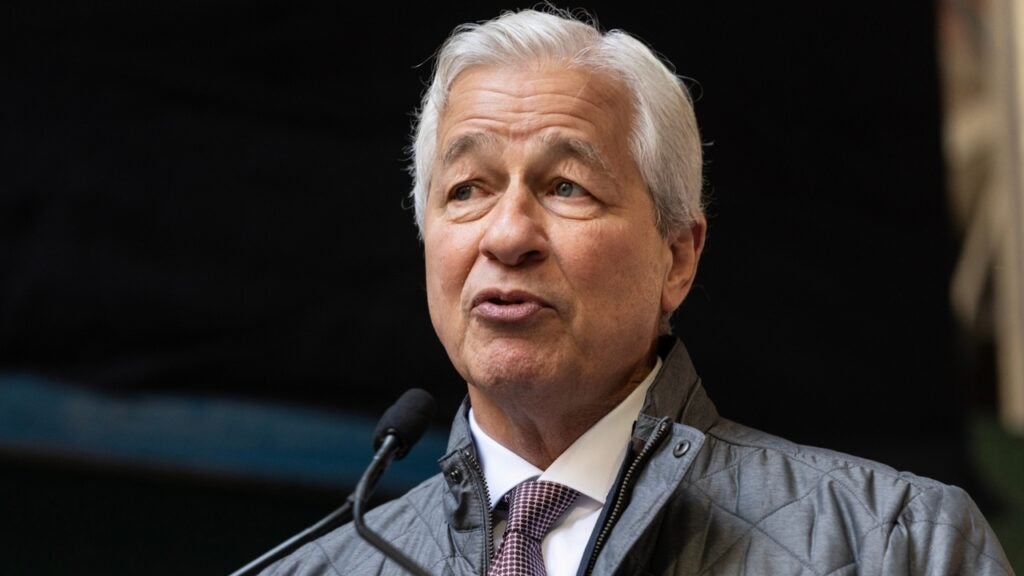

Jamie Dimon, the Chairman and Chief Executive Officer of JPMorgan Chase & Co. JPM, has recently shared insights into why he chose not to pursue a bid for the U.S. presidency. His decision was influenced by family considerations and an absence of political experience.

What Happened: Dimon confirmed in an episode of the How Leaders Lead podcast with host David Novak, that he had considered a political career. However, he ultimately prioritized his family and his responsibilities at JPMorgan.

The JPMorgan Chase CEO voiced concerns about the potential impact on his family life. “Had I run and won, when I was walking into that White House I’d be waving goodbye to my family for four years,” he stated.

Dimon, who earned $39 million in 2024, also cited his lack of political experience as a contributing factor to his decision. He suggested that business acumen may not necessarily be applicable in the political realm and that prior experience in Washington, D.C., should be a prerequisite for a presidential campaign.

Despite his current stance, Dimon did not completely dismiss the possibility of a future in politics. “I would never rule it out—I’m not making any promise to anyone. If I change my mind, I change my mind,” he commented.

SEE ALSO: JPMorgan Chase Unusual Options Activity For February 05

Why It Matters: Dimon’s political inclinations have been a topic of interest, given his active engagement in public discourse. In January, he publicly supported President Donald Trump‘s proposed tariffs, arguing that the national security benefits outweighed potential inflationary impacts.

Moreover, Dimon’s ability to bridge gaps was highlighted when he reconciled with Tesla and SpaceX CEO Elon Musk after a series of public disputes and called him ‘Our Einstein’. Dimon also expressed his interest in assisting Musk with his new role in budget cuts at the Department of Government Efficiency (DOGE). Reports suggest that Musk could team up with Jamie Dimon to persuade bond markets that cost-cutting initiatives at DOGE would be beneficial for U.S. debt.

Over the last 12 months, JPMorgan Chase & Co. stock surged over 50%. The company finished a strong fourth quarter, with a net income of $14 billion, according to data from Benzinga Pro.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.