Snap Inc. SNAP reported better-than-expected fourth-quarter financial results after Tuesday’s closing bell.

Snap reported quarterly earnings of 16 cents per share, which beat the analyst consensus estimate of 14 cents. Quarterly revenue came in at $1.55 billion, which beat the analyst consensus estimate of $1.54 billion and is an increase over revenue of $1.36 billion from the same period last year.

Snapchat had 453 million daily active users in the fourth quarter, up 9% year-over-year.

“In 2024 we made significant progress on our core priorities of growing our community and improving depth of engagement, driving top-line revenue growth and diversifying our revenue sources, while building toward our long-term vision for augmented reality,” said Evan Spiegel, Snap CEO

Snap shares gained 3.9% to close at $11.60 on Tuesday.

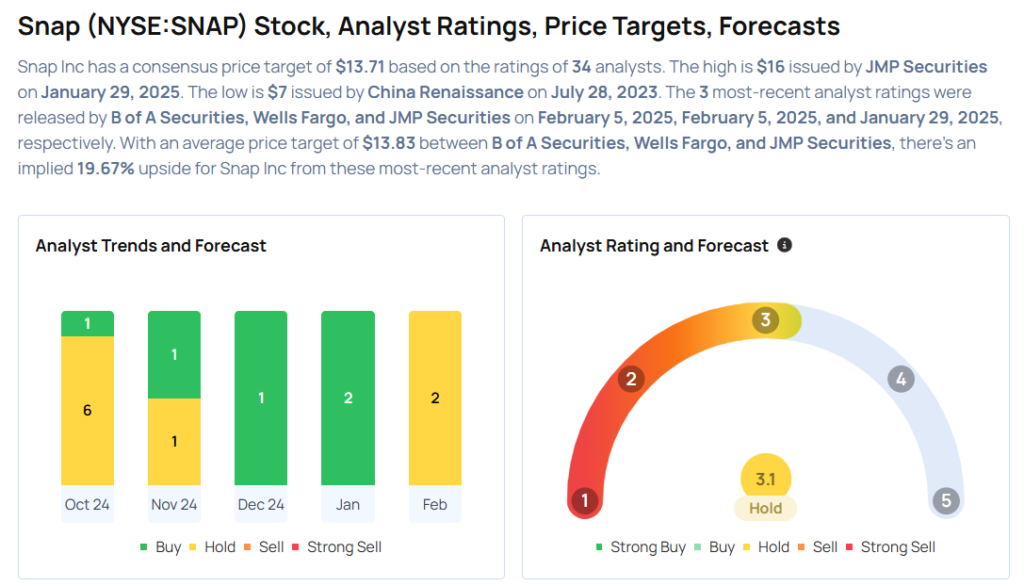

These analysts made changes to their price targets on Snap following earnings announcement.

- Wells Fargo analyst Ken Gawrelski downgraded Snap from Overweight to Equal-Weight and lowered the price target from $15 to $11.

- B of A Securities analyst Justin Post maintained the stock with a Neutral and raised the price target from $14 to $14.5.

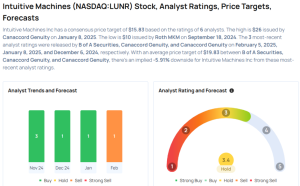

Considering buying SNAP stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.