Whales with a lot of money to spend have taken a noticeably bullish stance on Twilio.

Looking at options history for Twilio TWLO we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 30% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $216,471 and 6, calls, for a total amount of $232,568.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $60.0 to $160.0 for Twilio during the past quarter.

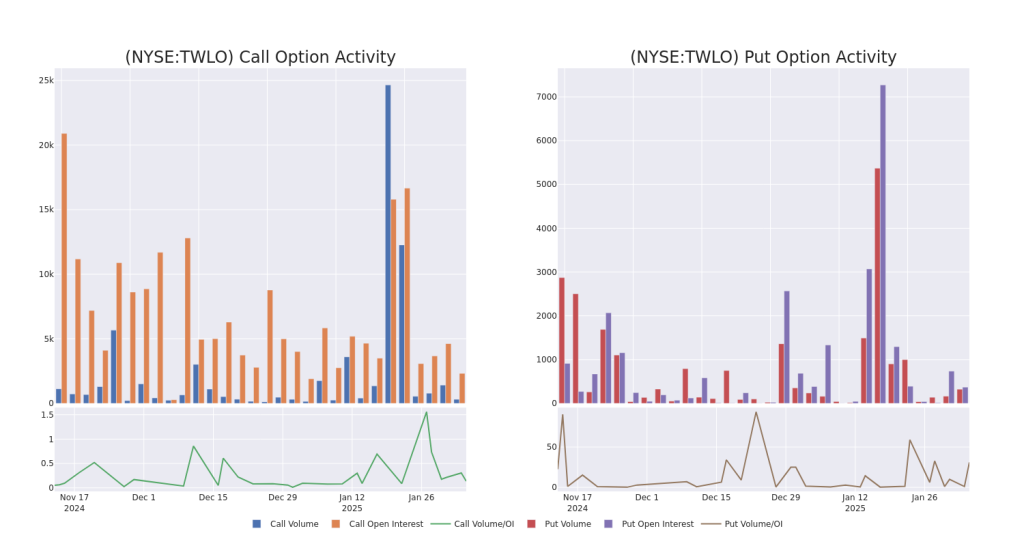

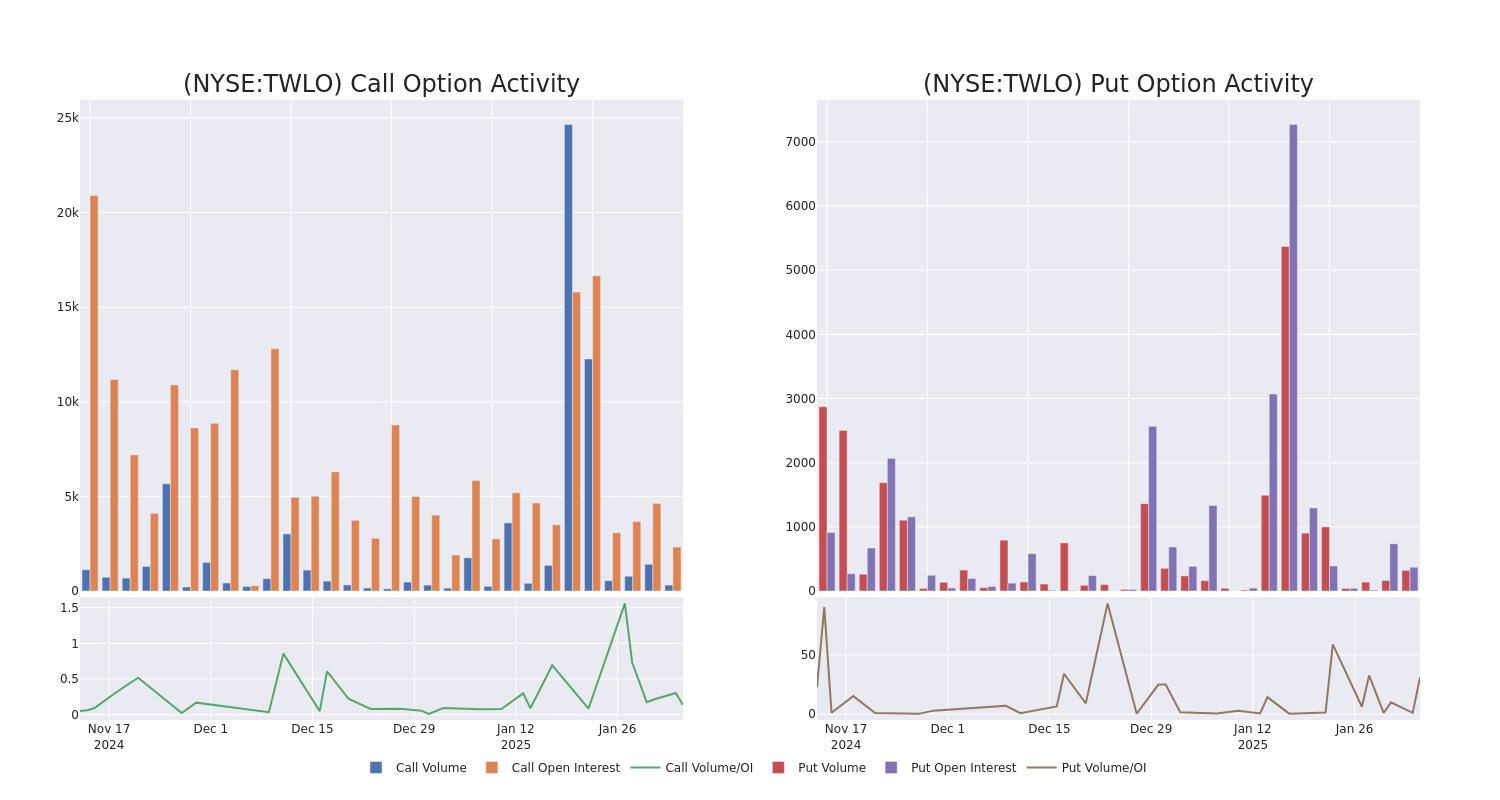

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Twilio’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Twilio’s substantial trades, within a strike price spectrum from $60.0 to $160.0 over the preceding 30 days.

Twilio Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TWLO | CALL | SWEEP | BULLISH | 03/07/25 | $13.25 | $13.15 | $13.15 | $140.00 | $66.1K | 94 | 70 |

| TWLO | CALL | SWEEP | NEUTRAL | 03/21/25 | $11.5 | $10.8 | $11.5 | $145.00 | $40.2K | 211 | 92 |

| TWLO | PUT | TRADE | BEARISH | 01/16/26 | $32.75 | $31.1 | $32.75 | $160.00 | $39.3K | 39 | 37 |

| TWLO | CALL | TRADE | BULLISH | 01/15/27 | $94.85 | $91.65 | $94.0 | $60.00 | $37.6K | 50 | 4 |

| TWLO | PUT | TRADE | BULLISH | 01/16/26 | $19.5 | $19.05 | $19.2 | $135.00 | $36.4K | 8 | 44 |

About Twilio

Twilio is a cloud-based communications platform-as-a-service company offering communication building blocks that allow for a fully customized customer engagement experience spanning voice, video, chat, and SMS messaging. It does this through various application programming interfaces and prebuilt solution applications aimed at improving customer engagement. The company leverages its Super Network, a global network of carrier relationships, to facilitate high-speed, cost-effective communication.

Following our analysis of the options activities associated with Twilio, we pivot to a closer look at the company’s own performance.

Present Market Standing of Twilio

- With a volume of 1,692,165, the price of TWLO is down -0.48% at $145.87.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 9 days.

What Analysts Are Saying About Twilio

5 market experts have recently issued ratings for this stock, with a consensus target price of $133.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Piper Sandler has revised its rating downward to Overweight, adjusting the price target to $142.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Twilio with a target price of $155.

* An analyst from RBC Capital downgraded its action to Underperform with a price target of $50.

* An analyst from Baird has elevated its stance to Outperform, setting a new price target at $160.

* An analyst from Scotiabank has decided to maintain their Sector Outperform rating on Twilio, which currently sits at a price target of $160.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Twilio, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.