Whales with a lot of money to spend have taken a noticeably bullish stance on Oklo.

Looking at options history for Oklo OKLO we detected 37 trades.

If we consider the specifics of each trade, it is accurate to state that 51% of the investors opened trades with bullish expectations and 45% with bearish.

From the overall spotted trades, 19 are puts, for a total amount of $1,670,621 and 18, calls, for a total amount of $1,504,783.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $15.0 and $60.0 for Oklo, spanning the last three months.

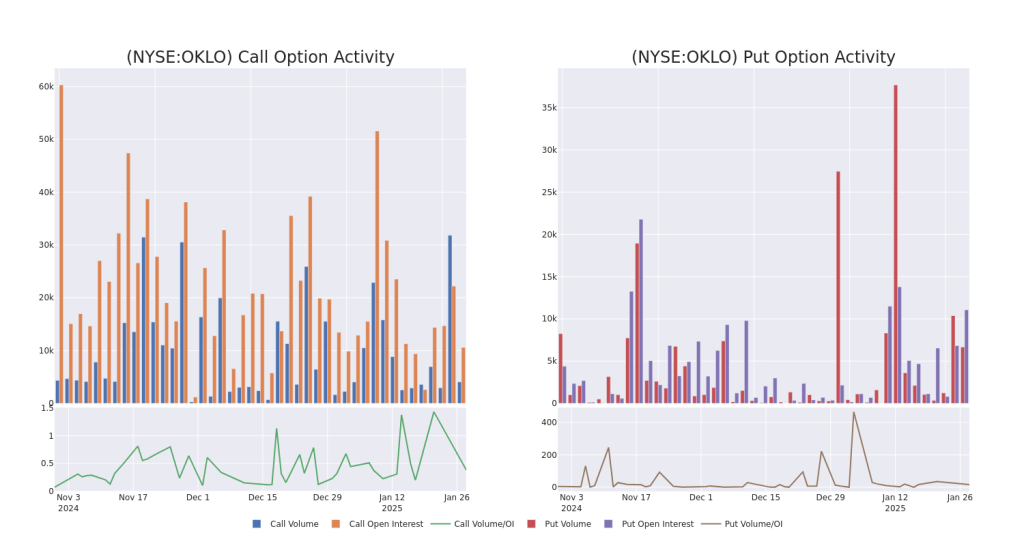

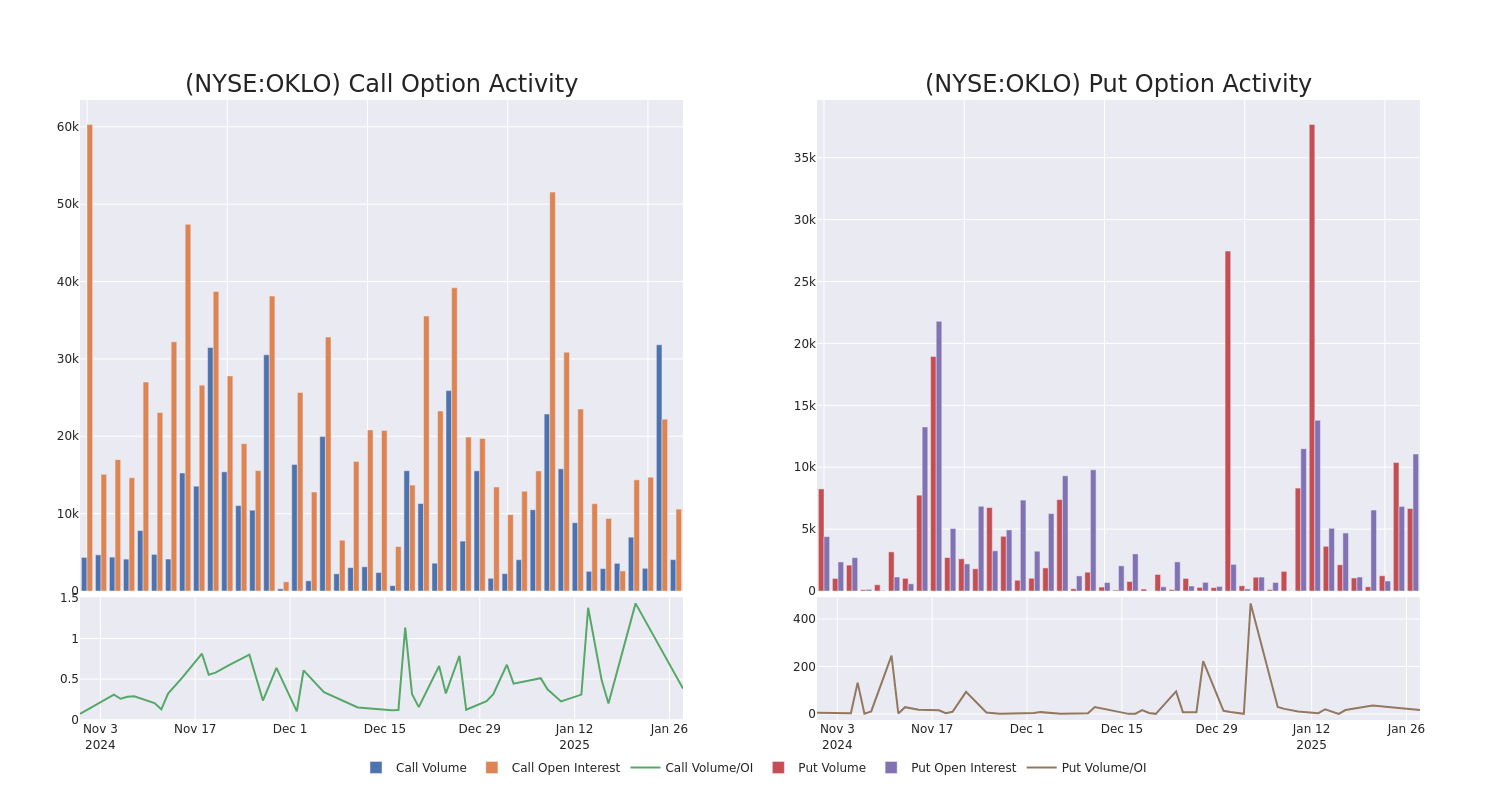

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Oklo’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Oklo’s whale trades within a strike price range from $15.0 to $60.0 in the last 30 days.

Oklo Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OKLO | CALL | SWEEP | BULLISH | 02/21/25 | $5.25 | $5.0 | $5.25 | $29.00 | $525.0K | 489 | 1.0K |

| OKLO | PUT | SWEEP | BULLISH | 05/16/25 | $9.1 | $8.8 | $8.84 | $34.00 | $442.8K | 645 | 501 |

| OKLO | PUT | SWEEP | BEARISH | 01/31/25 | $2.35 | $2.35 | $2.35 | $31.00 | $235.0K | 2.6K | 2.0K |

| OKLO | PUT | SWEEP | BEARISH | 02/21/25 | $4.0 | $3.8 | $4.0 | $30.00 | $200.0K | 2.6K | 638 |

| OKLO | PUT | SWEEP | BULLISH | 01/31/25 | $2.14 | $2.08 | $2.08 | $31.00 | $156.0K | 2.6K | 304 |

About Oklo

Oklo Inc is developing advanced fission power plants to provide clean, reliable, and affordable energy at scale. It is pursuing two complementary tracks to address this demand: providing reliable, commercial-scale energy to customers; and selling used nuclear fuel recycling services to the U.S. market. The Company plans to commercialize its liquid metal fast reactor technology with the Aurora powerhouse product line. The first commercial Aurora powerhouse is designed to produce up to 15 megawatts of electricity (MWe) on both recycled nuclear fuel and fresh fuel.

Following our analysis of the options activities associated with Oklo, we pivot to a closer look at the company’s own performance.

Oklo’s Current Market Status

- With a volume of 24,815,047, the price of OKLO is up 6.22% at $33.05.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 16 days.

Professional Analyst Ratings for Oklo

In the last month, 3 experts released ratings on this stock with an average target price of $40.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Craig-Hallum downgraded its rating to Buy, setting a price target of $44.

* An analyst from Citigroup has decided to maintain their Neutral rating on Oklo, which currently sits at a price target of $31.

* Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Oklo, targeting a price of $45.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oklo with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.