Deep-pocketed investors have adopted a bearish approach towards MARA Holdings MARA, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MARA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 50 extraordinary options activities for MARA Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 50% bearish. Among these notable options, 6 are puts, totaling $377,783, and 44 are calls, amounting to $3,067,080.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $9.0 to $50.0 for MARA Holdings over the recent three months.

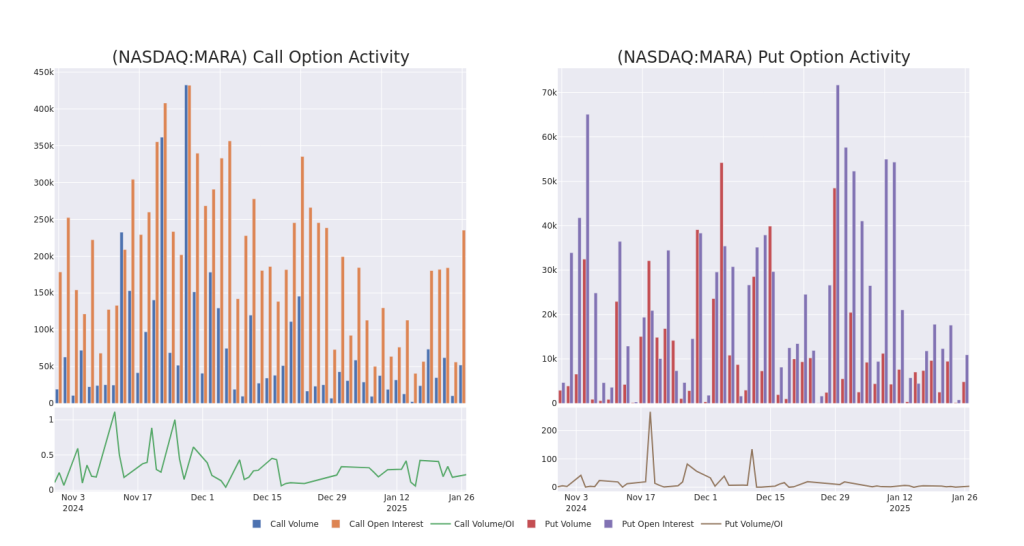

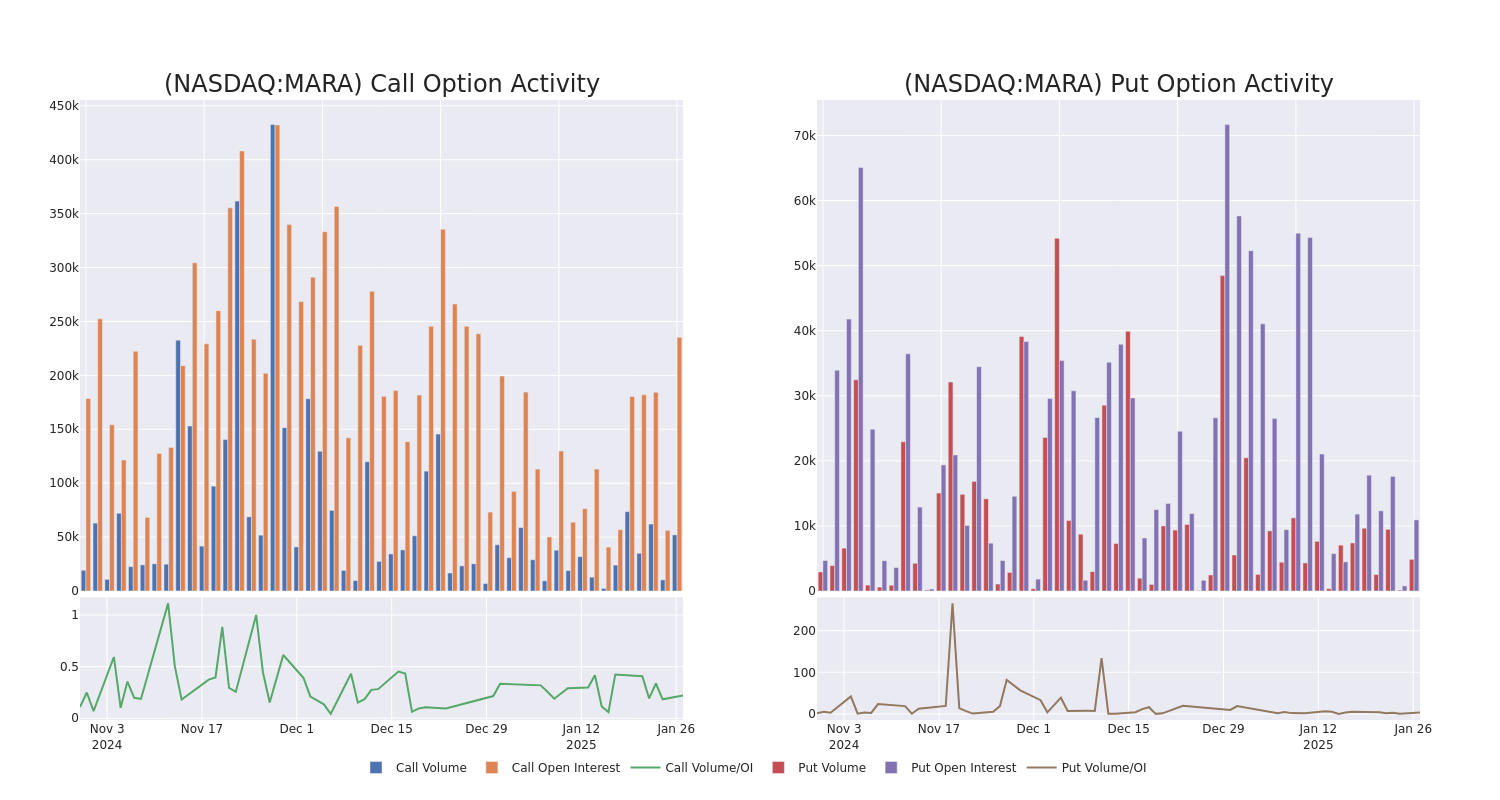

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MARA Holdings’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MARA Holdings’s whale activity within a strike price range from $9.0 to $50.0 in the last 30 days.

MARA Holdings 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MARA | CALL | SWEEP | BEARISH | 03/21/25 | $7.6 | $7.5 | $7.5 | $11.00 | $500.2K | 1.5K | 752 |

| MARA | CALL | TRADE | BULLISH | 02/28/25 | $0.83 | $0.82 | $0.83 | $22.00 | $165.8K | 407 | 2.1K |

| MARA | CALL | TRADE | BEARISH | 02/28/25 | $8.3 | $8.15 | $8.2 | $10.00 | $164.8K | 908 | 503 |

| MARA | CALL | TRADE | BULLISH | 02/28/25 | $8.3 | $7.65 | $8.2 | $10.00 | $164.8K | 908 | 302 |

| MARA | PUT | TRADE | BEARISH | 12/19/25 | $15.2 | $14.9 | $15.2 | $30.00 | $152.0K | 2.5K | 200 |

About MARA Holdings

MARA Holdings Inc leverages digital asset compute to support the energy transformation. It secures the blockchain ledger and supports the energy transformation by converting clean, stranded, or underutilized energy into economic value.

In light of the recent options history for MARA Holdings, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of MARA Holdings

- Currently trading with a volume of 32,641,995, the MARA’s price is down by -10.66%, now at $17.86.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 30 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MARA Holdings with Benzinga Pro for real-time alerts.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.