(Bloomberg) — Ethereum used to be seen as the most likely challenger to Bitcoin’s status as the preeminent cryptocurrency, and the one best positioned to make the blockchain a more useful technology.

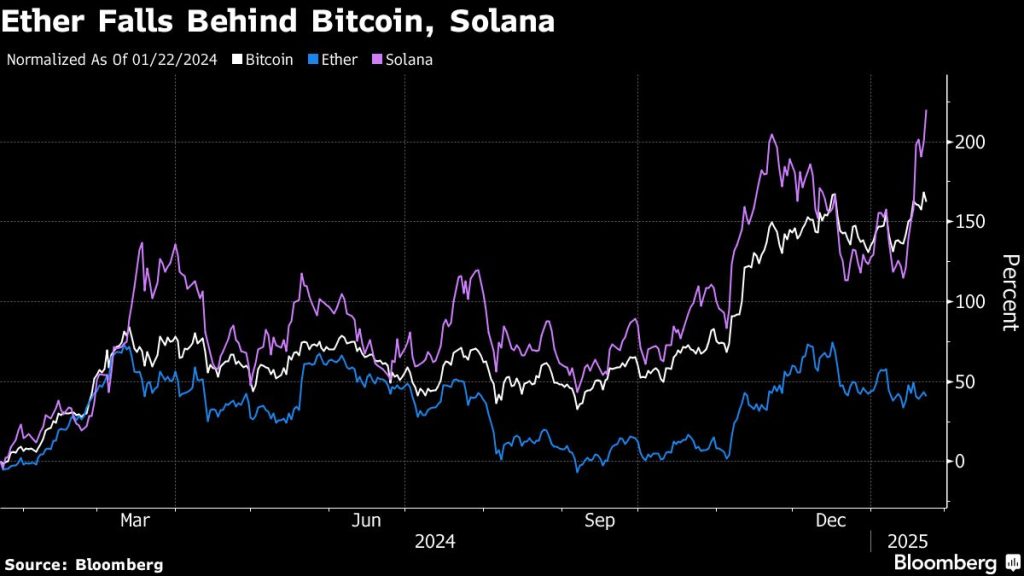

But as Bitcoin and many other cryptocurrencies have been soaring in recent months — thanks to President Donald Trump’s embrace — Ethereum has struggled to keep pace, despite hosting the second most valuable digital token, Ether. While Bitcoin has gone up about 160% over the last year, Ether has only risen 45%.

To help the token and its decentralized network regain some momentum, the founder of Ethereum, Vitalik Buterin, and the Ethereum Foundation he created, are throwing their weight behind a new startup that hopes to market Ether as the best cryptocurrency for Wall Street.

A former bond trader at Nomura Holdings Inc. and UBS Group AG, Vivek Raman is founding the company, Etherealize, with investments from Buterin and the foundation. While Buterin’s organization confirmed the funding, it and Raman declined to say how much money was involved. Raman said that he and a team of eight full-time employees began operating this month in New York, where they are marketing Ethereum to financial firms while also building products that will make the network easier for banks to use.

“If there’s any time it’s going to work, it’s right now when all the headwinds that existed in the past are now suddenly tailwinds, from regulatory to technology to Ethereum being ready to have institutional presence,” Raman said.

Ethereum was launched by Buterin and a team of co-founders in 2015 and quickly won a reputation as a more brainy and sophisticated alternative to Bitcoin. The new blockchain introduced by Ethereum was designed to host complicated financial transactions in so-called smart contracts.

During the big cryptocurrency booms in 2017 and 2021, Ethereum was at the center of the action and its price went up much more quickly than Bitcoin.

But as the industry has revived over the past year, Ethereum has been out of step with some of the prevailing trends. The biggest of these has to do with the increasingly widespread view that Bitcoin is a scarce asset that can serve as a digital alternative to gold. That idea has only gained traction since Trump began talking about the creation of a national strategic Bitcoin reserve last summer.

It became much easier for investors of all sizes to treat Bitcoin as an investment after the first American exchange-traded funds debuted in early 2024. While Ether ETFs were approved by regulators in July, they now hold only about a 10th of the assets in Bitcoin ETFs in the US.