By Rae Wee and Koh Gui Qing

SINGAPORE/NEW YORK (Reuters) -Global stocks eased on Thursday, halting a rally sparked by U.S. President Donald Trump’s mammoth spending plans for artificial intelligence infrastructure as some of that excitement fizzled out, though Chinese shares fared better on Beijing’s support.

Stock futures pointed to a negative open in Europe and the U.S., with EUROSTOXX 50 futures falling 0.23%. FTSE futures eased 0.3%.

Nasdaq futures lost 0.17%, while S&P 500 futures slipped 0.09%.

Trump’s announcement of a $500 billion private-sector AI infrastructure investment plan from a venture involving Oracle, OpenAI and SoftBank late on Tuesday had initially turbocharged a rally in global share markets, which drew further support from upbeat earnings results.

Those developments initially overshadowed concerns over Trump’s plans for tariffs, sending the pan-European STOXX 600 to a record high in the previous session along with Wall Street’s S&P 500.

“Clearly, the path of least resistance continues to lead to the upside in the equity space, with participants ably shrugging off tariff-related uncertainties for now,” said Michael Brown, senior research strategist at Pepperstone.

“That said, next week brings a chunky slate of event risk, including the first FOMC decision of the year, as well as earnings from megacaps… It wouldn’t be too surprising to see some equity longs trimmed into that bonanza.”

MSCI’s broadest index of Asia-Pacific shares outside Japan was similarly on track to snap a seven-day winning streak on Thursday and was last 0.15% lower, after getting a brief lift earlier in the session on the back of Beijing’s latest measures to shore up its crumbling stock market.

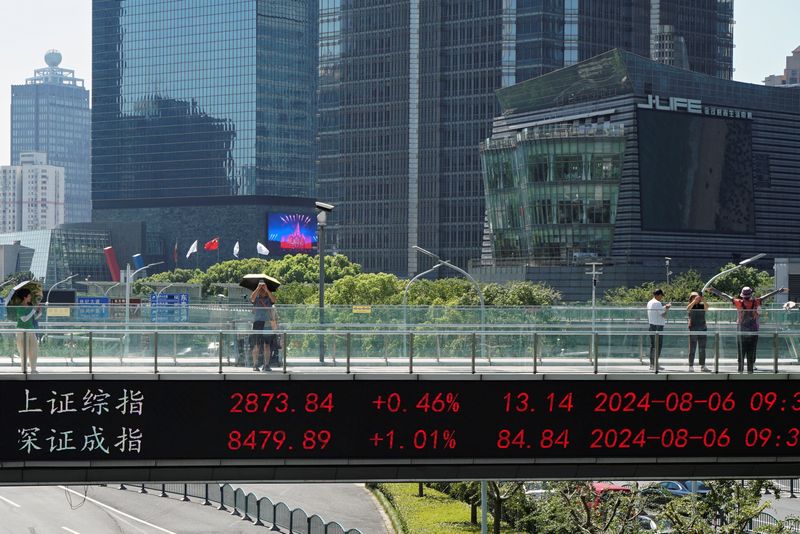

China announced plans to channel hundreds of billions of yuan of investment from state-owned insurers into shares, just after Trump said he was proposing to slap a 10% punitive duty on Chinese imports.

Chinese stocks surged more than 1% on the back of the news, though gave up some of those gains over the course of the trading session.

The CSI300 blue-chip index edged up 0.19%, while the Shanghai Composite Index advanced 0.53%.

Hong Kong’s Hang Seng Index last traded 0.6% lower.

“The persistent underperformance of China equities is a barometer of the country’s fundamental economic difficulties, along with falling bond yields,” said Alvin Tan, head of Asia FX strategy at RBC Capital Markets.

“They point to the domestic difficulties. And U.S. tariffs will worsen the problem especially with China growing more reliant on net exports to power growth.”