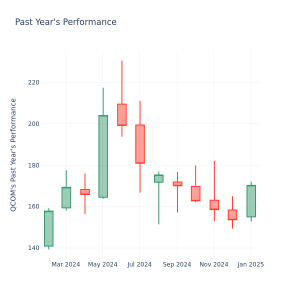

NEW YORK (AP) — U.S. stock indexes slipped on Thursday as Wall Street’s weak end to last year carried into 2025.

The S&P 500 fell 0.2% to extend the four-day losing streak that dimmed the close of its stellar 2024. The index pinballed through the day between an early gain of 0.9% and a later loss of 0.9% before locking in its longest losing streak since April.

The Dow Jones Industrial Average fell 151 points, or 0.4%, after an early gain of 360 points disappeared, and the Nasdaq composite lost 0.2%.

Tesla helped drag the market lower after disclosing it delivered fewer vehicles in the last three months of 2024 than analysts expected. The electric-vehicle company’s stock slumped 6.1%.

Tesla was one of the big winners of 2024, particularly after Donald Trump’s Election Day victory raised speculation that Elon Musk’s close relationship with the president-elect could help the company. But critics have been warning that prices all across the stock market have run too high, too quickly and are at risk of a pullback.

Consider a measure tracked by Bank of America of how heavily Wall Street analysts are recommending stocks, which recently hit its highest level since early 2022, according to strategist Savita Subramanian. She says the measure has been a reliable contrarian indicator in the past, and it’s only a bit shy of triggering a signal to sell for those who are leery when much of Wall Street herds in the same direction.

Elsewhere on Wall Street, H.B. Fuller sank 7.5% after the seller of adhesives, sealants and other specialty chemical products said it’s recently seen a slowdown in sales to a number of its customer categories.

On the winning side of Wall Street were companies tied to the energy industry after prices rose for crude oil and natural gas.

Constellation Energy jumped 8.4% for the one of the biggest gains in the S&P 500 after announcing it won more than $1 billion in combined contracts with the U.S. General Services Administration to supply power and perform energy savings and conservation measures.

Some Big Tech stocks also helped limit the market’s losses. Nvidia, whose chips are powering the world’s move into artificial-intelligence technology, rose 3% after following up its nearly 240% surge in 2023 with a better than 170% jump last year.

Some investors and analysts are counting on the AI rush to continue, even though critics say it’s made stock prices too expensive. As the calendar flips to a new year, Wedbush analyst Dan Ives says it’s the ”same tech playbook in year 3 of this tech AI driven bull market,” for example.