Darden Restaurants, Inc. DRI reported weaker-than-expected first-quarter financial results on Thursday.

The company reported adjusted earnings per share of $1.75, missing the analyst consensus estimate of $1.83. Quarterly sales of $2.76 billion missed the street view of $2.80 billion.

“While we fell short of our expectations for the first quarter, I firmly believe in the strength of our business,” said Darden President & CEO Rick Cardenas.

Darden’s directors have approved a quarterly cash dividend of $1.40 per share on the company’s outstanding common stock. This dividend will be paid on November 1 to shareholders, as recorded as of the close of business on October 10.

Darden’s shares gained 8.3% to close at $172.27 on Thursday.

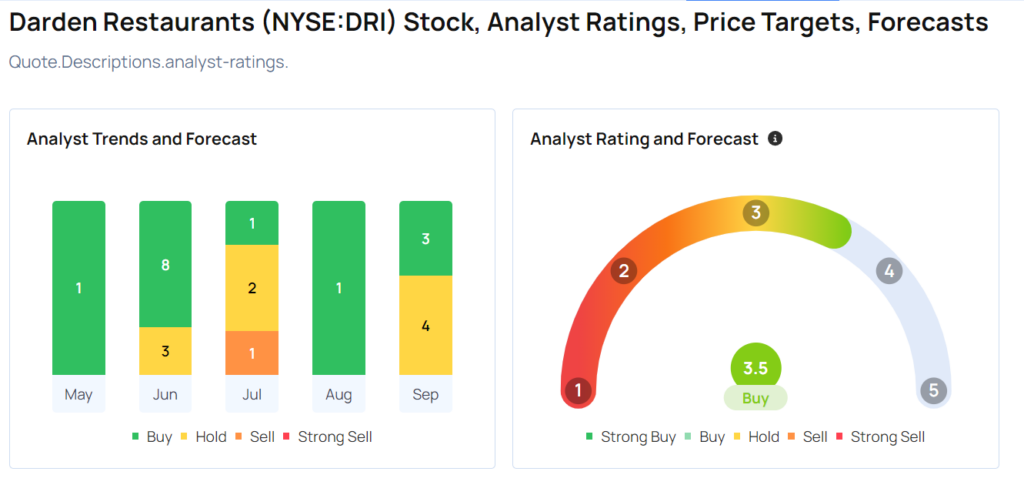

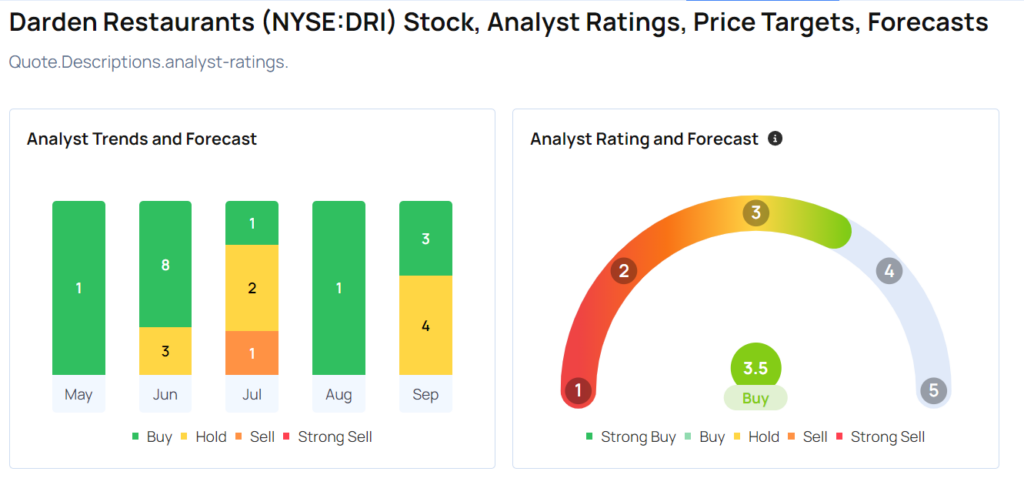

These analysts made changes to their price targets on Darden following earnings announcement.

- TD Cowen analyst Andrew Charles maintained Darden with a Hold and raised the price target from $150 to $165.

- Bernstein analyst Danilo Gargiulo downgraded the stock from Outperform to Market Perform and slashed the price target from $190 to $180.

- Stephens & Co. analyst Jim Salera maintained Darden with an Equal-Weight and raised the price target from $159 to $164.

- Wedbush analyst Nick Setyan maintained the stock with an Outperform and raised the price target from $170 to $200.

- Evercore ISI Group analyst David Palmer upgraded Darden Restaurants from In-Line to Outperform and raised the price target from $165 to $205.

Considering buying DRI stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.